Ing personal loan repayment calculator

This product is not currently available via Finder. Visit the provider's website directly, or compare other options.

Add origination fee. A personal loan calculator shows your monthly personal loan payments based on the loan amount, interest rate and repayment term. It also shows the total interest cost, with or without an origination fee. Use this calculator to help you decide whether a personal loan is the right financing option for your plans. Enter a loan amount. Borrowers with strong credit and income are more likely to qualify for large loan amounts.

Ing personal loan repayment calculator

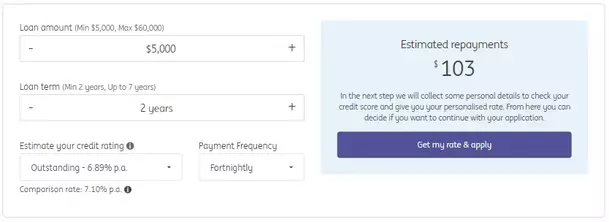

If you don't find your answer here, get in touch with our Australia-based customer care specialists. Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be. Have a play with our personal loan repayments calculator to find out the details. Loan term should be between 2 and years. Estimate your credit rating. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. In the next step we will collect some personal details to check your credit score and give you your personalised rate. From here you can decide if you want to continue with your application. An ING Personal Loan could help you to get the keys to those wheels, get started on your home renovation or jumping on that plane sooner.

What is your feedback about?

Work out how much you may be able to borrow with ING Personal Loan based on your income and expenses. Let's do the maths to estimate how much you could save if you were to switch to one of ING's variable rate home loans. See how much available equity you may be able to access as a deposit for a new property purchase. Use this calculator to get an estimate of the potential rental yield and income your property could give you. Knowing how much you will need for retirement and understanding how to make it happen can seem daunting. But you're not alone.

If you don't find your answer here, get in touch with our Australia-based customer care specialists. Whether you need a personal loan for a holiday, home renovations, a car loan or simply to consolidate debt, it's wise to know what your monthly repayments will be. Have a play with our personal loan repayments calculator to find out the details. Loan term should be between 2 and years. Estimate your credit rating. Different amounts and terms will result in different comparison rates.

Ing personal loan repayment calculator

Life is full of surprises, and knowing what's around the corner is important when it comes to your money. A personal loan from ING has a low personalised fixed interest rate, no ongoing fees and no early repayment fees, just what you'd expect from Australia's most recommended bank. Can't see this tool? Your ad blocker may be blocking it. Pause your ad blocker and refresh the page to view. A personalised fixed interest rate from 6. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Keep things simple and money in your pocket with no monthly or annual fees.

Terraria money farm

Fixed Rate Personal Loan. New customers can opt to pay the loan establishment fee or apply for an ING Orange Everyday account during the loan application process and have the establishment fee waived. Ask your question. Related personal loans articles. The repayment of credit cards is different from typically structured amortized loans. Secured By Deposit. Providers Type of lender Big 4 bank. Interest Rate p. We're independent We are independently owned and have a mission to help Australians make better financial decisions. When you apply for a personal loan, the lender will ask for information about your income, assets, expenses and liabilities. Rates are estimates only and not specific to any lender.

Add origination fee. A personal loan calculator shows your monthly personal loan payments based on the loan amount, interest rate and repayment term. It also shows the total interest cost, with or without an origination fee.

Here's how to save. Bad Credit Loans. Add a repayment start date. For instance, an emergency fund can come in handy when incidents like medical emergencies or car accidents happen. You can learn more about how we make money. No application fee. View more brands. Estimated APR. Secured By Property. Cost of living crisis: How much harder do parents have it? Regular savings calculator See just how far you could go with the help of a regular savings plan. Loan term 1 year.

I join. All above told the truth.