Is northwest healthcare reit a good buy

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular.

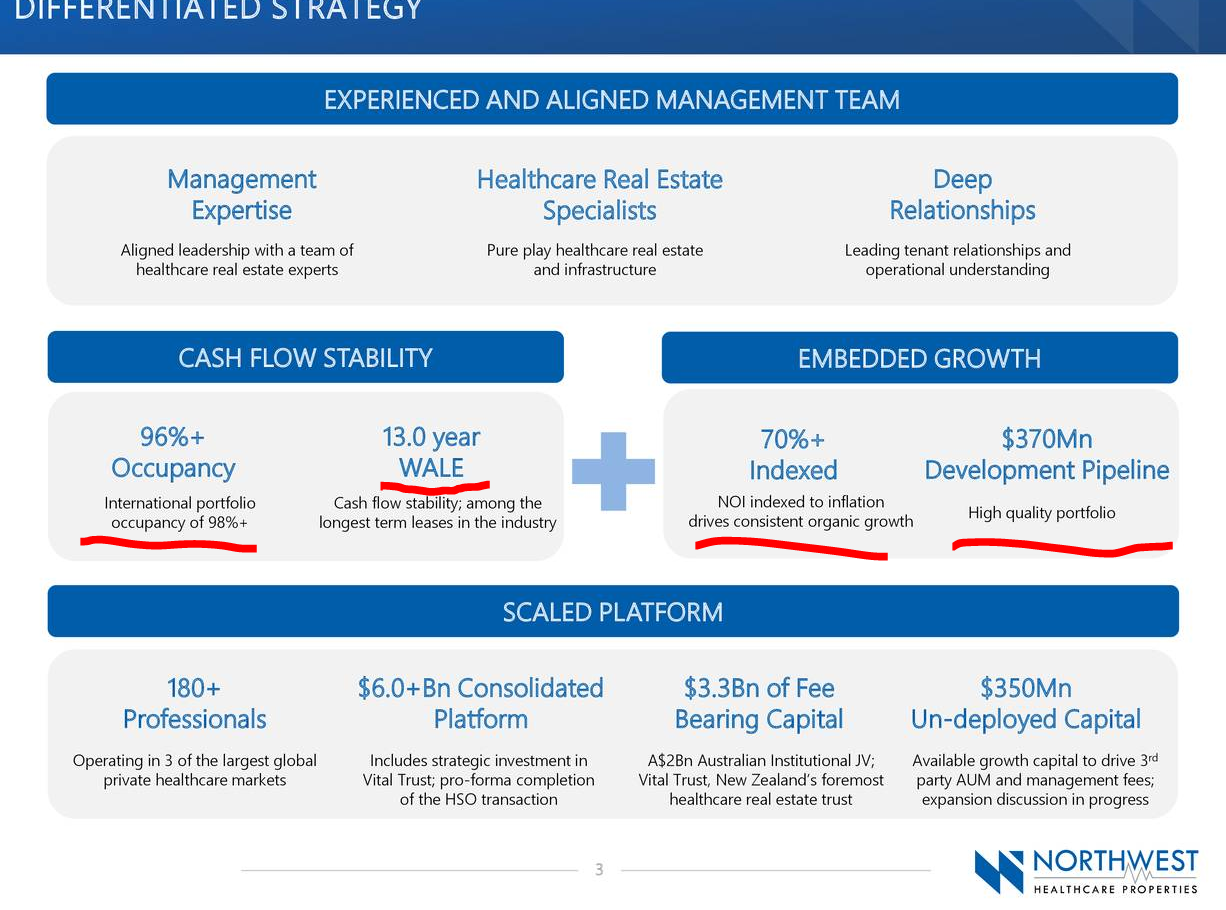

UN Northwest is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario. About the company. Return vs Industry: NWH. Return vs Market: NWH. UN underperformed the Canadian Market which returned 7. UN's share price has been volatile over the past 3 months. The REIT provides investors with access to a portfolio of high-quality international healthcare real estate infrastructure comprised as at September 30, , of interests in a diversified portfolio of income-producing properties and

Is northwest healthcare reit a good buy

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom. UN has become a favourite investment for many seeking passive income. Still, higher yields usually mean lower share prices and therefore lower returns. The company climbed during the pandemic, as the healthcare properties REIT continued its focus on healthcare properties. These properties will always remain essential but became even more of a focus during the pandemic. Lower interest rates and growth for the company led it to make some strategic acquisitions during this time. This, too, led share prices to grow higher. Stocks that climbed during the pandemic started to drop as investors saw inflation and interest rates rise. Wanting their returns to make up the difference, growth stocks such as NorthWest REIT stock started to fall lower and lower. First off, higher interest rates and expenses led to lower net income for the company. It also led to lower renewals from its tenants.

Invest in these three blue-chip TSX dividend stocks to create a passive-income stream in your self-directed investment portfolio. Capital structure and dividend policy not in a good position. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

This summary was created by AI, based on 17 opinions in the last 12 months. UN-T stock is that it is facing significant challenges due to its high floating debt and the impact of rising interest rates. The company has also experienced management changes, dividend cuts, and the need for asset sales to address its financial difficulties. Despite owning a large collection of healthcare real estate assets globally, the stock is currently experiencing a downturn and is viewed as a risky investment. Large collection of healthcare real estate around the world.

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom. UN has become a favourite investment for many seeking passive income. Still, higher yields usually mean lower share prices and therefore lower returns. The company climbed during the pandemic, as the healthcare properties REIT continued its focus on healthcare properties. These properties will always remain essential but became even more of a focus during the pandemic. Lower interest rates and growth for the company led it to make some strategic acquisitions during this time. This, too, led share prices to grow higher. Stocks that climbed during the pandemic started to drop as investors saw inflation and interest rates rise. Wanting their returns to make up the difference, growth stocks such as NorthWest REIT stock started to fall lower and lower.

Is northwest healthcare reit a good buy

Amidst the cuts in inflation during this week, there has been another company going through its own cuts. The real estate investment trust REIT continues to see its potential price target cut by analysts. First off, what happened to NorthWest stock? Shares of the monthly dividend stock hit double-digit status and looked like they would be staying there. However, the company has since lost over half of its share price. There were a few factors impacting the performance of NorthWest stock. First off, the major factor was rising interest rates. Those higher interest rates then led to higher borrowing costs, and this hurt profitability and investor confidence. However, this seriously disappointed investors who bought the stock for passive income. There continue to be more concerns for NorthWest stock, even as the market looks to improve and we get closer to rate cuts.

Electionbuddy login

Operating Expenses. Solvency Analysis Analysis of the financial position and solvency of the company. While we strive for accuracy, this text should be used as a supplementary resource and not as a sole basis for decision-making. Get More with TipRanks Premium. Top Hedge Fund Managers. Matt Kornack. UN stock price is 4. Compare ETFs. Shareholder Return NWH. Unusual Options Activity Popular. Long-Term Solvency.

This summary was created by AI, based on 17 opinions in the last 12 months. UN-T stock is that it is facing significant challenges due to its high floating debt and the impact of rising interest rates. The company has also experienced management changes, dividend cuts, and the need for asset sales to address its financial difficulties.

Scrutinize beyond numbers; assess long-term potential. Discount Rate NWH. Get in touch with us directly. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. What are valuation scenarios? Register here. Read More. Relative Value. Dividend Stocks. Help Center Contact Us. Image source: Getty Images. Market Cap.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

I agree with told all above.

Very good message