Ishares banks

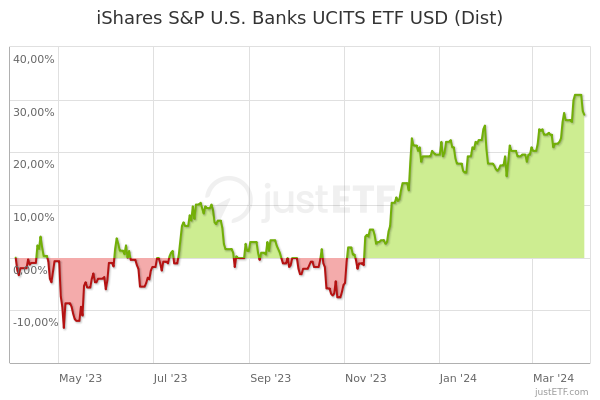

The figures shown relate to ishares banks performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Ishares banks

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor. Cancel Save. Download now. Savings plan ETF. Watchlist Watchlist Add to portfolio Portfolio Compare. Distribution policy.

BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above, ishares banks.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation.

Ishares banks

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Kfc 24 7 near me

Unfavourable What you might get back after costs Average return each year. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Our company Our company. The Fund seeks to track the performance of an index composed of Japanese companies Market developments in the future are uncertain and cannot be accurately predicted. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Change your settings. Show more Markets link Markets. Press centre. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Bonds are included in US bond indices when the securities are denominated in U. Funds participating in securities lending retain Growth of Hypothetical 10, Replication details. Total Expense Ratio 0.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Funds in Peer Group as of BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Factsheet EN. Skip to content Individual investor. At present, availability of input data varies across asset classes and markets. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Detailed Holdings and Analytics. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. To the extent that data becomes more readily available and more accurate over time, we expect that ITR metric methodologies will evolve and may result in different outputs. Asset Class Equity.

True phrase

Yes, I understand you. In it something is also to me it seems it is very excellent thought. Completely with you I will agree.