Ishares core msci world ucits etf

The figures shown relate to past performance.

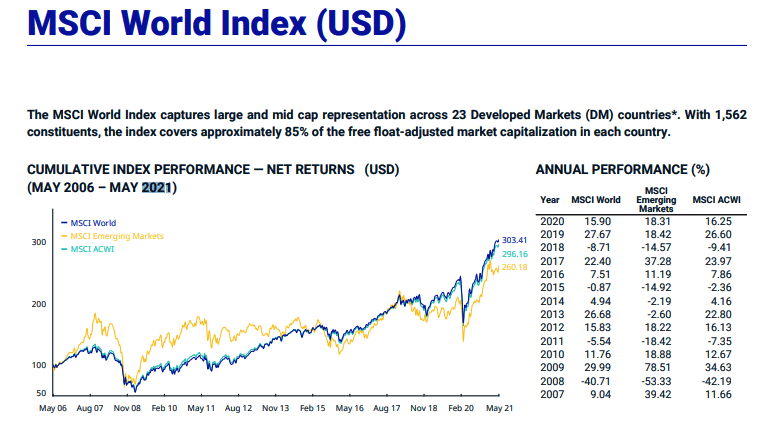

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

Ishares core msci world ucits etf

BlackRock Portfolio Centre. The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Asset type. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate. The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio.

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past.

Ishares core msci world ucits etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Ordinary opposite word

Quotes are either real-time gettex or 15 minutes delayed stock exchange quotes or NAVs daily published by the fund provider. This process culminates in a single-point star rating that is updated daily. Manager Name Start Date. The bands help to underscore the underlying uncertainty in the calculations and the variability of the metric. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Securities Lending Securities Lending Securities lending is an established and well regulated activity in the investment management industry. Maximum on-loan figure may increase or decrease over time. Investment platforms have been quick to capitalise on appetite for gilts by yield-seeking investors, but there's more to consider than an online payme However, there is no guarantee that these estimates will be reached. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Financial Services. For detail information about the Morningstar Star Rating for Stocks, please visit here.

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future.

How is the ITR metric calculated? It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. There is not a universally agreed upon set of inputs for the calculation. Index returns are for illustrative purposes only. You could lose some or all of your investment. The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. For your protection, telephone calls are usually recorded. Meta Platforms Inc Class A. We recommend you seek financial advice prior to investing. If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band.

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer. I am assured.

Brilliant phrase

Completely I share your opinion. It is good idea. It is ready to support you.