Kira endeksi

You can help correct errors and omissions. When requesting a correction, please mention this item's handle: RePEc:tcb:econot

In the process of portfolio construction, investors' asset choices are complicated by their concerns regarding risk-return preferences on the one hand and their beliefs or responsible investment principles on the other. In this context, this study investigates the time-varying causality relationship between the Borsa Istanbul BIST sustainability index, government-issued lease certificates sukuk and year government bonds government bonds traded as financial instruments in Turkey. In addition, it highlights the commonalities between sustainable finance and Islamic finance and emphasizes that investors who base socially responsible investment principles can increase their asset choices. These contributions constitute the importance of the study. The data used in the empirical analysis are daily data covering According to the findings, a bidirectional time-varying Granger causality relationship is found between the BIST sustainability index and sukuk, a unidirectional Granger causality relationship between BIST sustainability index and government bonds from the BIST sustainability Index to government bonds , and a bidirectional time-varying Granger causality relationship between government bonds and sukuk.

Kira endeksi

.

Learn more. RePEc uses bibliographic data supplied by the respective publishers. These contributions constitute the importance of the study.

.

By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. To browse Academia. Hatice Bozkurt. As a result of ARDL, two variables were found co integration in China, India and Romania under the condition that stock price is a dependent variable. Similarly, found co integration in Turkey, Mexico, Chili and Philippines under the condition that exchange rate is a dependent variable. According to result of causality test, causality relationship couldn't be determined for India, Indonesia, Chili, Romania and Turkey. However, it is determined that there are a bilateral causality for two variables in China, Malaysia, Brazil and Mexico.

Kira endeksi

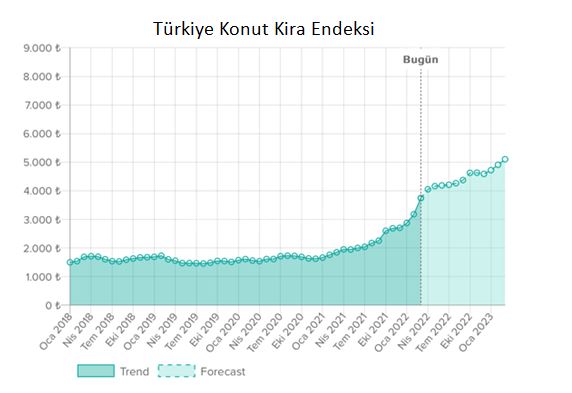

This study investigates the relationship among house prices, number of house sales, REIT index, and rent index values. Panel regression analysis conducted by using the monthly data from 8 major cities between the period from March to May Research results indicates that there is a statistically positive relationship among house price index, rent index and REIT index and a negative relationship between sale prices and house price index. English Turkish English. Journal of Finance Letters. Research Article. EN TR. Create Research Close. Abstract This study investigates the relationship among house prices, number of house sales, REIT index, and rent index values.

Dead tube coral fan

You can help adding them by using this form. This allows to link your profile to this item. Please note that corrections may take a couple of weeks to filter through the various RePEc services. Corrections All material on this site has been provided by the respective publishers and authors. Content File-PDF. Economic literature: papers , articles , software , chapters , books. In the process of portfolio construction, investors' asset choices are complicated by their concerns regarding risk-return preferences on the one hand and their beliefs or responsible investment principles on the other. I agree. Moreover, we use rent inflation with long-term mortgage rates to construct Gordon house price index and compare the index with the housing data. Learn more. Incelenen ulkelerin buyuk bir kisminda uzun donemde kira enflasyonunun TUFE enflasyonundan daha yuksek oldugu tespit edilmistir. ALL Rights Reserved.

Enter the attributes of the real estate, find out the real sales and rental value in minutes.

By using our services, you agree to our use of cookies. Please note that corrections may take a couple of weeks to filter through the various RePEc services. These contributions constitute the importance of the study. Username Email. Ayrica, konut piyasasi fiyat dinamiklerinin en etkin belirleyicilerinden olan ipotekli konut kredisi faiz oranlari, kira enflasyonuyla birlikte Gordon fiyatlama formulunde kullanilarak Gordon fiyat endeksi olusturulmus ve endeksin gerceklesen fiyatlarla iliskisi incelenmistir. Taking into account the past data and the Gordon house price index, the recent increase in the rent inflation implies that US housing prices could increase in the upcoming months. RePEc uses bibliographic data supplied by the respective publishers. Economic literature: papers , articles , software , chapters , books. Content File-PDF. My bibliography Save this paper. When requesting a correction, please mention this item's handle: RePEc:tcb:econot In this context, this study investigates the time-varying causality relationship between the Borsa Istanbul BIST sustainability index, government-issued lease certificates sukuk and year government bonds government bonds traded as financial instruments in Turkey. Shibboleth Login. See general information about how to correct material in RePEc. We have no bibliographic references for this item.

Excuse for that I interfere � At me a similar situation. It is possible to discuss. Write here or in PM.

Yes, I understand you. In it something is also to me it seems it is excellent thought. I agree with you.