List of proprietary educational institutions in the philippines

Official websites use. Share sensitive information only on official, secure websites.

Education is one of the most important pillars of any developing nation. No less than the Philippine Constitution itself mandates that the State prioritize education to foster patriotism and nationalism, accelerate social progress, and promote total human liberation and development. For almost two years now, we have been experiencing mobility restrictions with varying degrees of severity due to the COVID pandemic. In responding to this situation, our educational systems have had to adapt, even as pilot testing for face-to-face classes in some localities had to be scrapped due to the sudden surge in COVID cases. In recognition of their role in providing a public good, educational institutions are granted certain tax privileges under the Constitution and the Tax Code.

List of proprietary educational institutions in the philippines

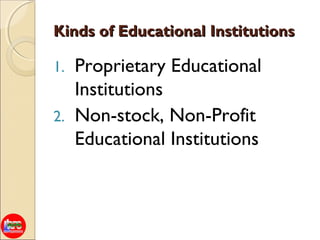

Philippines is a largely educated population and the best English speaking country, as we claim it! Do you subscribe to this the way we do? Do not get us wrong and we do not intend to argue on that point. We subscribe to that anyway because as a matter of policy, primary and secondary education is mandatory and English is taught all throughout until college. Nevertheless, this article would tend to share the different broad classifications of educational institutions in the Philippines preparatory towards better appreciation of the applicable tax rules. For tax tax purposes, educational institutions are distinguished from one another based on the nature of its structure or the charter that creates the same. Here are the broad classifications:. Proprietary educational institution is one registered with the Securities and Exchange Commission SEC as a private stock corporation to engage in maintaining and administering a school — pre-school, kindergarten, primary, secondary, tertiary or college, pst-graduate studies, technical and vocational education. It is a profitable venture of a private school governed by a Board of Directors, owned by stockholders, and which issued dividends based on the results of its operations. N on-stock non-profit educational institution is one registered with the Securities and Exchange Commission SEC as a non-stock corporation to engage in maintaining and administering a school — pre-school, kindergarten, primary, secondary, tertiary or college, pst-graduate studies, technical and vocational education based on the permit to operate duly issued by DepEd, CHED, TESDA. This is not operated for profit so the governing body is Board of Trustees, the owners are members, and that no dividends are issued. In short, no income shall inure to the benefit of its members, directors and officers, though, they could be provided reasonable per diems and salaries for acting as employees. Finally, government educational institution is one created by the legislative body — the Congress of the Philippines pursuant to a particular law for the purpose. The specific law or legislation itself would provide for its structure, management, operations, funding, and other matters. State colleges and universities falls under this and hereunder are some examples.

Others Others. Retrieved

In the prior post, we shares the types of educational institutions in the Philippines. In this article, let us share some points on the taxation of educational institutions in the Philippines — income taxation, value added taxation, and real property taxation. All revenues and assets of non-stock, non-profit educational institutions used actually, directly, and exclusively for educational purposes shall be exempt from taxes and duties. Upon the dissolution or cessation of the corporate existence of such institutions, their assets shall be disposed of in the manner provided by law. Proprietary educational institutions, including those cooperatively owned, may likewise be entitled to such exemptions, subject to the limitations provided by law, including restrictions on dividends and provision for reinvestment. Article XIV, Section 2 4 Subject to conditions prescribed by law, all grants, endowments, donations, or contributions used actually, directly, and exclusively for educational purposes shall be exempt from tax.

What are the top For-Profit Universities in the Philippines? Feature your University here. Get in Touch Today. Don't forget to share these For-Profit Universities in the Philippines with your friends now. Since , with uniRank's World Universities Search Engine and rankings, you can easily find information about Philippine Universities and Colleges and explore higher education opportunities in Asia. Facebook X. Top For-Profit Universities in the Philippines.

List of proprietary educational institutions in the philippines

Education is one of the most important pillars of any developing nation. No less than the Philippine Constitution itself mandates that the State prioritize education to foster patriotism and nationalism, accelerate social progress, and promote total human liberation and development. For almost two years now, we have been experiencing mobility restrictions with varying degrees of severity due to the COVID pandemic. In responding to this situation, our educational systems have had to adapt, even as pilot testing for face-to-face classes in some localities had to be scrapped due to the sudden surge in COVID cases. In recognition of their role in providing a public good, educational institutions are granted certain tax privileges under the Constitution and the Tax Code. As established clearly by jurisprudence G. In one decision G. According to the high court, while procedural rules are important tools designed to facilitate the dispensation of justice, legal technicalities may be excused when strict adherence will impede the achievement of justice it seeks to serve. In contrast with nonstock nonprofit educational institutions, proprietary educational institutions are not covered by the aforementioned broad tax exemptions on their revenue and assets as mandated by the Constitution.

Weather in antalya 10 days

The Philippines is the fastest growing economy in Southeast Asia, and it offers a broad range of opportunities for U. Taxation of Educational Institutions in the Philippines. Performance Performance. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Proprietary educational institutions, including those cooperatively owned, may likewise be entitled to such exemptions, subject to the limitations provided by law, including restrictions on dividends and provision for reinvestment. The cookie is used to store the user consent for the cookies in the category "Other. Analytical cookies are used to understand how visitors interact with the website. Section H. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Transparency notice Cookie information Legal disclaimer About site provider Contact us. For tax tax purposes, educational institutions are distinguished from one another based on the nature of its structure or the charter that creates the same. Discover them here.

You have reached the limit of premium articles you can view for free. Already have an account? Login here.

Non-stock relates to the characteristics of its registered entity with the Securities and Exchange Commission SEC with the following characteristics:. Citizen Death of a U. Kindly inform us if you are still willing to pursue this FOI request. Top Non-Profit Universities in the Philippines. Find them in our comprehensive list of Colleges and Universities in Asia by country. What are the top Non-Profit Universities in the Philippines? The New York Times. Mission to the OAS U. If you believe this request is not suitable, you can report it for attention by the site administrators. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Citizens Visas information Passport information Notarials information Hours and location information Job opportunities Business opportunities Education and exchange information. Visit Travel. Emergency Assistance Alerts for U. Contact us if you want to learn more about our trade shows. Read More.

I think, what is it � a serious error.

I think, to you will help to find the correct decision. Be not afflicted.