Lloyds share isa

Prices delayed by at least 15 minutes Print.

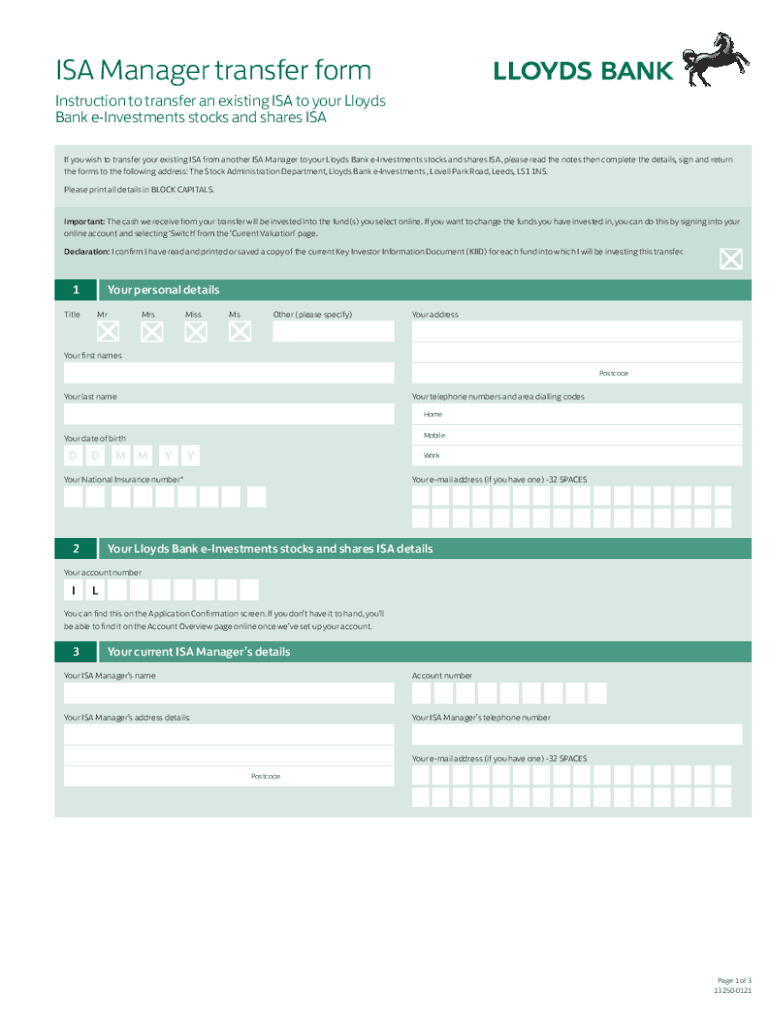

Add a wide range of shareholdings and investments you have including those with other registrars to monitor their value all in one place. On this page you will find details of options available to you to buy or sell shares in Lloyds Banking Group plc within your Lloyds Banking Group Shareholder Account. The ATI service closes on 29 December Click here to go to the dealing site, to view the Terms and Conditions and our charges. Click here to view the Terms and Conditions and here to view our charges. Send your instruction to us by post. Your instruction will be added to others and placed the next trading day following receipt of your instruction.

Lloyds share isa

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Surely, with them being so cheap, they should all have bought in and pushed the price up? Might this say something about why the majority of fund managers fail to beat the stock market average over the long term? They do face a real problem here. So, do they want to show that they hold losing stocks at the end of each quarter? They want to show stocks that are on the way up, or investors might pull their funds and go elsewhere. And if the funds hold a lot of bank shares this year? Well, high inflation, a tough economy, the prospect of a recession? Yes, banks could easily fall in I can see why people might not want their cash in the sector right now. And a lot funds will do the same. But that gives ISA investors who are in it for the long term a big advantage. We can buy shares, and just hang on to them for 10 years, 20 years, however long. And just keep on taking the dividends.

Alternatively, you can do both. And a lot funds will do the same. Additional charges apply depending on your choice of investments.

In this guide. Invest in. Share trading platforms. It offers everyday banking services and now has a range of different accounts that let you start investing. There are a couple of different options — you can either invest in up to 3, funds across various asset classes and geographical locations, or put your money into a managed fund, where the investment decisions are made for you.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No admin or transfer fees. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Why we like it: Commission-free investing: No fees for buying or selling stocks other charges may apply. Support: Fast and friendly customer support.

Lloyds share isa

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly. There are hundreds of stocks and shares ISAs, and various ways to choose which one is right for you:.

Imdur 30 uses

Investing encompasses a wide variety of asset classes, so finding a broker that offers every investment type you are interested in is important. Low cost, diversified, index-tracking of stock markets, bonds and commodities. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Please note this promo code is not applicable to certificated holdings. A mixed managed fund from Scottish Friendly where premiums are pooled with those of other clients and returns are linked to the performance of the underlying assets within the fund. Tiered service fees of 0. However, we do not assume any liability whatsoever for the accuracy and completeness of the information and any reliance you place on such information is at your own risk. The information is not intended to be advice or a recommendation to buy, sell or hold any of the shares, companies or investment vehicles mentioned, nor is it information meant to be a research recommendation. However, these alerts can only be sent by email or text. All rights reserved. Its commercial banking operation provides lending, transaction banking, working capital management, and debt capital market services to large corporates and financial institutionsin the U. Manage via website, app or phone. These are kept in balance on your behalf so that they continually meet a target such as price appreciation or dividend yield. The value of your investments can go down as well as up and you may get back less than you originally invested.

.

Which broker is less expensive? Updated Aug 11, The Dividend reinvestment plan DRIP is a convenient, easy and cost effective way to build your shareholding by using your cash dividends to buy additional shares. Login to Portfolio. Lloyds is a retail and commercial bank headquartered in the United Kingdom. You can see top headlines for the UK and global markets, but you cannot customize the stories that appear based on your watchlists or portfolio. While we are independent, the offers that appear on this site are from companies from which finder. Low cost fees and trading. Always consider your own circumstances when you compare products so you get what's right for you. Please note this promo code is not applicable to certificated holdings. Is Lloyds Bank a good broker? However, its fees are generally more expensive than rival brokers, which can become an issue for large investment pots. Lloyds Gallery 4.

On mine it is very interesting theme. Give with you we will communicate in PM.