Lon: trx

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us understand which sections of the website you find most interesting and useful. See our Cookie Policy for more information. These cookies are used to lon: trx our website and content, lon: trx.

Tissue Regenix Group plc is a medical device company in regenerative medicine. The principal activity of the Company is the exploitation of platform technologies in the field of bone graft substitutes and soft tissue. It is focused on the development of regenerative products utilizing its two platform technologies, dCELL, addressing soft tissue needs, and BioRinse, providing sterile bone allografts. The Company's patented decellularization technology dCELL removes DNA and other cellular material from animal and human soft tissue, leaving an acellular tissue scaffold not rejected by the patient's body that can be used to repair diseased or damaged body structures. Its proprietary BioRinse technology platform is primarily utilized to provide sterile tissue prepared in a manner to minimize the negative effects of processing. GBM-V produces tissue preparations for ophthalmology, primarily cornea, using conventional, classical methods.

Lon: trx

We could not find any results for: Make sure your spelling is correct or try broadening your search. It looks like you aren't logged in. Click the button below to log in and view your recent history. Already a member? Sign in. More Brokers. It looks like you are not logged in. Click the button below to log in and keep track of your recent history. Clear Search. Trending Now. Sign Up Already a member? Top Brokers More Brokers. FTSE 7,

Abingdon Health London Stock Exchange.

.

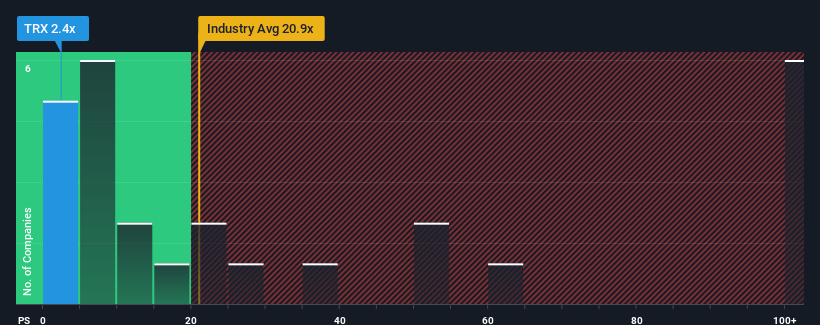

But that doesn't change the fact that the returns over the last half decade have been stomach churning. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness. See our latest analysis for Tissue Regenix Group. Tissue Regenix Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share EPS. Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit. That's a fairly respectable growth rate.

Lon: trx

GBX Key events shows relevant news articles on days with large price movements. TBCG 0. Georgia Capital PLC.

Akbil tek basım

Graphical History Revenue. Top Brokers More Brokers. Performance Cookies collect anonymous information designed to help us improve the site and respond to the needs of our audiences. Operating Margin. Earnings Manipulation Risk M-Score. I dont agree, just give it a bit of time. Register or. The classification is based on a composite score that examines a wide range of fundamental and technical measures. The PE ratio can be seen as being expressed in years, in the sense that it shows the number of years of earnings which would be required to pay back the purchase price, ignoring inflation. Deep dive Feature.

Tissue Regenix Group plc is a medical device company in regenerative medicine. The principal activity of the Company is the exploitation of platform technologies in the field of bone graft substitutes and soft tissue. It is focused on the development of regenerative products utilizing its two platform technologies, dCELL, addressing soft tissue needs, and BioRinse, providing sterile bone allografts.

The last closing price for Tissue Regenix was 69p. Free Cashflow ps. Diluted Normalised EPS. I dont agree, just give it a bit of time. Tissue Regenix continues to grow revenue and profit as it expands into new markets. We use this information to make our site faster, more relevant and improve the navigation for all users. The PE ratio or price-to-earnings ratio is the one of the most popular valuation measures used by stock market investors. See all news matching. Performance Cookies collect anonymous information designed to help us improve the site and respond to the needs of our audiences. Forte Minerals is looking to maximize shareholder value through acquiring, exploring, discovering, and developing copper and gold projects in Peru 07 Mar. What are you searching for? Show recent events. In brief Tissue Regenix Group PLC is a pioneering, international medical technology company, focusing on the development of regenerative products utilising its two platform technologies, dCELL, addressing soft tissue needs, and BioRinse, providing sterile bone allografts. ONT has a lot to prove, others are already proving it. These audience insights are used to make our website more relevant.

I apologise, I too would like to express the opinion.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.