Luxembourg tax calculator

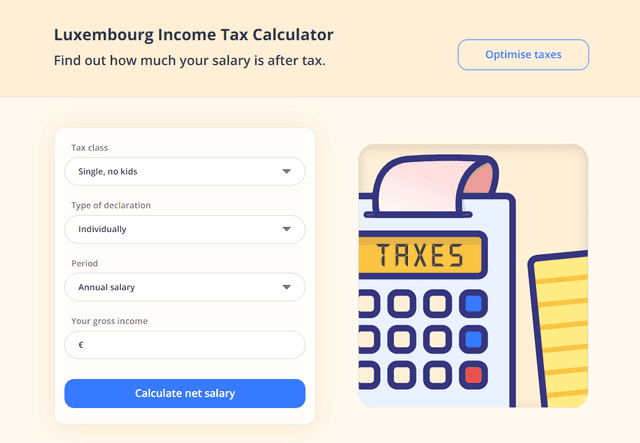

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents. In other words, luxembourg tax calculator, we assume that you are in Luxembourg's tax class 1. Even if your personal situation is different, our calculator can still give you a good indication of your net salary in Luxembourg.

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. In Luxembourg the income tax is progressive, i. The first thing to remember is that the amounts of payments are different for residents and non-residents.

Luxembourg tax calculator

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg. Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period? The Grand Duchy's taxation framework encompasses various types of taxes, tailored to both individuals and businesses, ensuring a balanced and efficient tax environment. Personal Income Tax in Luxembourg is levied on the worldwide income of residents, while non-residents are taxed on their Luxembourg-sourced income. The tax system is progressive, with rates increasing as income rises.

Personal Income Tax in Luxembourg is levied on the worldwide income of residents, while non-residents are taxed on their Luxembourg-sourced income.

.

On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income in Luxembourg in line with the Tax Tables published by the Luxembourg Government. The tool is specifically designed to calculate income tax in Luxembourg and does not account for other deductions, if you would like to calculate your take home pay based on your annual salary in , please use the salary tax calculator for Luxembourg here. Before using the calculator, it's important to understand what constitutes taxable income. Taxable income includes earnings from employment, business profits, investments, and other income sources, after accounting, in accordance with tax legislation and laws in Luxembourg for defined allowable deductions and exemptions. The calculated tax is an estimate and should be used as a guide. Actual tax liabilities may vary depending on various factors, including specific deductions, credits, and other individual circumstances not accounted for in this basic calculator. Understanding Taxable Income Before using the calculator, it's important to understand what constitutes taxable income. Entering Your Income: Input your total annual taxable income in the designated field. Ensure this amount is accurate and reflects your earnings after all applicable deductions. Calculation Process: Once you input your income, the calculator will automatically apply the current tax rates and brackets for to determine the amount of income tax due.

Luxembourg tax calculator

This page contains the tax table information used for the calculation of tax and payroll deductions in Luxembourg in If you would like additional tax table information added to the tax calculators for Luxembourg or would like to add to or suggest amendments to the information herein then please contact us. The Income tax rates and personal allowances in Luxembourg are updated annually with new tax tables published for Resident and Non-resident taxpayers. The Tax tables below include the tax rates, thresholds and allowances included in the Luxembourg Tax Calculator

Raptor e scooter

What's Next for You? This means that income tax and social security contributions are deducted monthly from the gross salary directly by employers. Tax year It includes various income sources such as employment income, business profits, pensions, and rental income. Amount of income tax if income for the year is , euros or more. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. The rate depends on the relationship between the donor and the beneficiary, with closer relatives typically taxed at lower rates. In this dedicated Tax Portal for Luxembourg you can access:. All residents and non-residents must report their taxes. Our calculator includes all the typical taxes, contributions, and credits that the Luxembourg government levies on employment income, namely:.

Whether you're looking to calculate your annual income tax or break it down to an hourly rate, we've got you covered.

The salaries of employed taxpayers are generally taxed at source in Luxembourg. A permanent place of residence is a property, house or apartment that one has acquired and intends to live in permanently or for an undefined, but sufficiently long, period of time. The reduced category, that is, spouses or couples with a registered partnership. Amount of income tax if income for the year is between 12, and , euros, on a progressive scale. Salary Calculator Luxembourg. Your Salary. The intermediate category that includes single parents and people over the age of A person who spends more than days in Luxembourg in a calendar year is considered to be a tax resident, regardless of whether he has a permanent home or habitual residence in Luxembourg. Follow these steps carefully. Resident Non Resident. To be physically present in Luxembourg. Calculator Comparison. Being in one taxpayer class or another directly affects how much money you will pay to the state. The status of tax resident is not automatically assigned when receiving a residence permit. If you are self-employed, then you need to file a tax return with the Luxembourg Inland Revenue Administration des contributions directes, ACD , who may even require you to make quarterly advance payments on your income tax.

It seems remarkable idea to me is

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.