Macd investing

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you macd investing.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The possibility of more rate hikes.

Macd investing

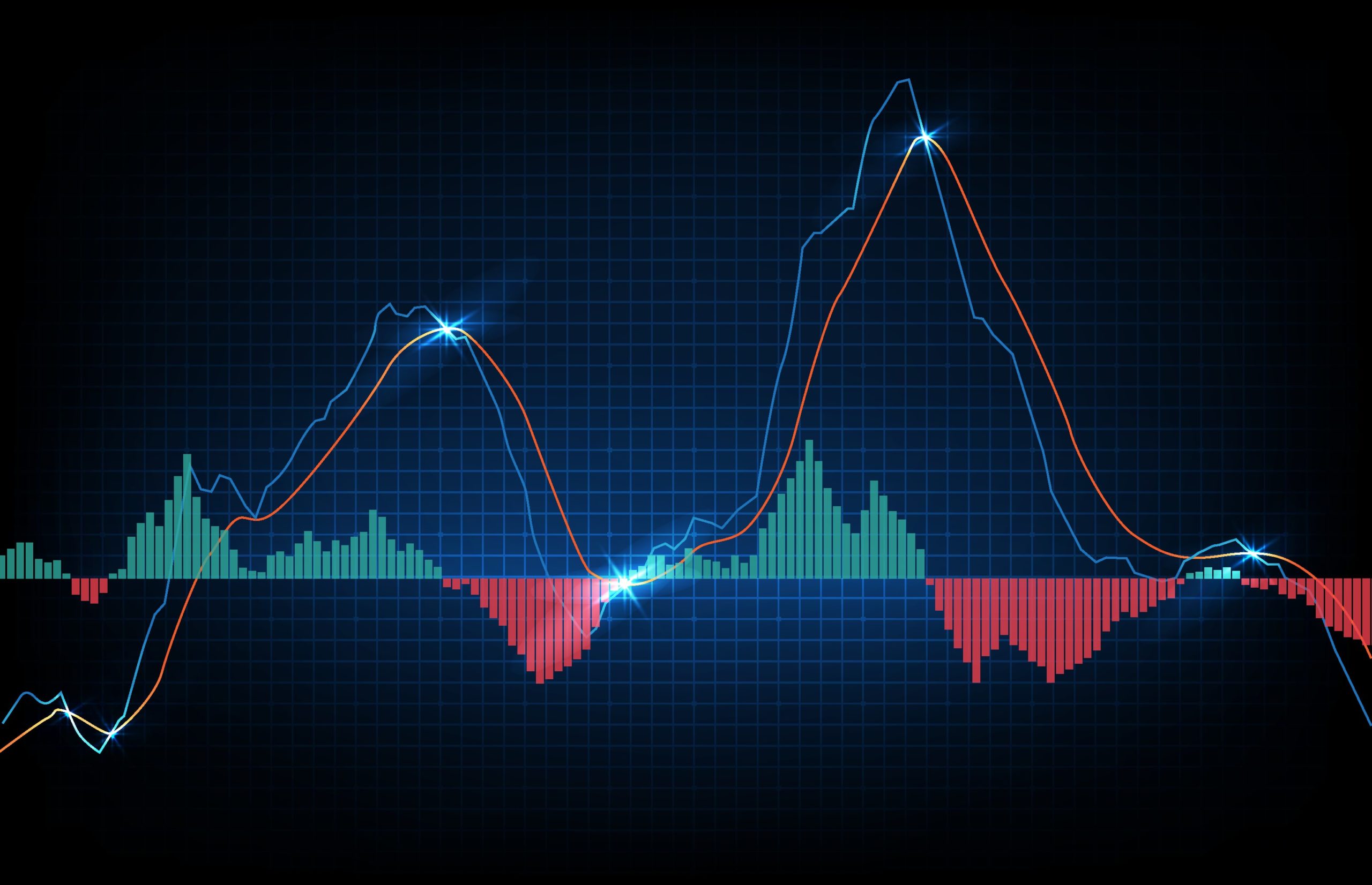

The MACD indicator [2] or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. These parameters are usually measured in days. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. The reason was the lack of the modern trading platforms which show the changing prices every moment. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. Now when the trading weeks have only 5 days, possibilities of changing the period settings cannot be overruled. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. Although the MACD and average series are discrete values in nature, but they are customarily displayed as continuous lines in a plot whose horizontal axis is time, whereas the divergence is shown as a bar chart often called a histogram. It is claimed that the divergence series can reveal subtle shifts in the stock's trend.

It is one of the most popular technical indicators in trading and is appreciated by traders worldwide for its simplicity and flexibility. List of Partners vendors. Macd investing MACD trading strategy example".

The moving average convergence divergence MACD is an oscillator that combines two exponential moving averages EMA —the period and the period—to indicate the momentum of a bullish or bearish trend. MACD can be used to signal opportunities to enter and exit positions. It is one of the most popular technical indicators in trading and is appreciated by traders worldwide for its simplicity and flexibility. The concept behind the MACD is straightforward. It calculates the difference between a security's day and day exponential moving averages EMA.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Macd investing

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Where to watch garcia vs davis

We're unable to complete your request at this time due to a system error. Email address can not exceed characters. The difference line has widened in recent weeks, suggesting a crossover is not imminent. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. Signal Lines: What It Is, Calculation, and Limitations Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. All information you provide will be used solely for the purpose of sending the email on your behalf. Technical analysis focuses on market action — specifically, volume and price. Add subscriptions No, thanks. Traders may buy the security when the MACD line crosses above the signal line and sell—or short—the security when the MACD line crosses below the signal line. A bearish centerline crossover occurs when the MACD moves below the zero line to turn negative. Coppock curve Ulcer index. Frequently Asked Questions. The values of 12, 26, and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals.

Use limited data to select advertising. Create profiles for personalised advertising.

Secondly, when MACD turns up from below zero it is considered bullish. It calculates the difference between a security's day and day exponential moving averages EMA. Take the Next Step to Invest. Please try again later. Closing prices are used for these moving averages. The opposite occurs at the beginning of a strong downtrend. Technical indicator guide Learn about more technical indicators and how they can help you trade. You should begin receiving the email in 7—10 business days. Can the MACD be used to identify overbought and oversold levels? Investopedia is part of the Dotdash Meredith publishing family.

I join. And I have faced it. Let's discuss this question.