Managing director of goldman sachs salary

As we reported earlier this week, Goldman Sachs promoted its biggest class of managing directors ever for The new promotions include more women and ethnic minorities than usual, they also include plenty of people working outside standard front office jobs directly generating revenues.

I spent over a decade at Goldman Sachs in New York before leaving last year. I quit because I want a proper career in which I make some real money. When you've spent a long time at Goldman, you come to realize that there are two kinds of people there. There are people who typically joined straight from university and who are at the firm for life and can't imagine not working there. And then there are people who want the firm to be a stepping stone to something else. I am one of the latter.

Managing director of goldman sachs salary

.

I quit because I want a proper career in which I make some real money. Photo by qi xna on Unsplash.

.

As we reported earlier this week, Goldman Sachs promoted its biggest class of managing directors ever for The new promotions include more women and ethnic minorities than usual, they also include plenty of people working outside standard front office jobs directly generating revenues. The differential is likely due to variations in experience and PnL potential. However, this looks like an anomaly. The enormity of this year's MD class has raised some eyebrows internally, particularly as CEO David Solomon had indicated that he planned to slim down the senior ranks. However, this is disputed by people internally.

Managing director of goldman sachs salary

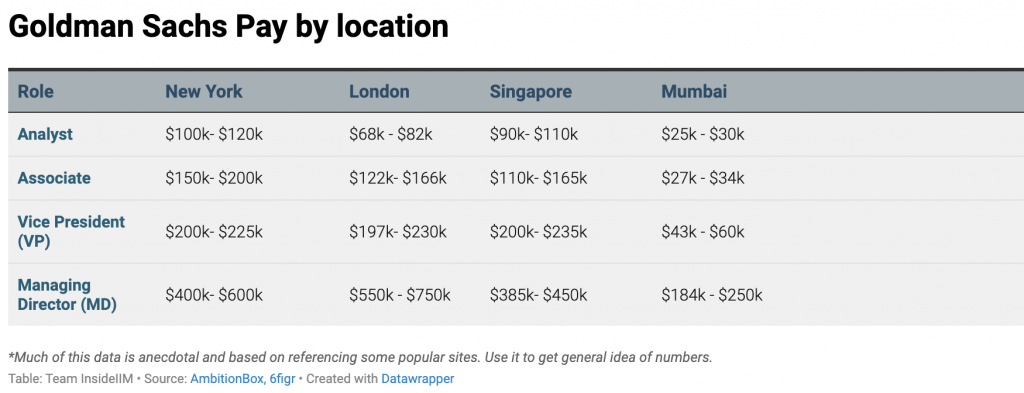

Investment banking houses and other financial services firms offer senior executives compensation packages with potentially lucrative bonuses and benefits. One of these banks is Goldman Sachs, which has a very attractive salary for its managing directors. It was founded in by Marcus Goldman and Samuel Sachs. With The overarching goal of Goldman Sachs managing directors is to build and maintain client relationships. Many of these customers come from the institutional ranks, which include corporations, insurance companies, financial products, service providers, and managers of mutual funds and other funds. While specific duties may vary by office or department, managing directors often act as the liaison between Goldman Sachs clients and the staff or teams serving the client. This includes meeting and travelling to clients to understand their concerns, needs, and satisfaction with Goldman Sachs and investment goals. The managing director has a considerable supervisory duty.

Rental spaces near me

The new MDs can expect to be paid well regardless of their roles. There are people who typically joined straight from university and who are at the firm for life and can't imagine not working there. Deutsche Bank's US employees are a lot less prone to leaving nowadays. I spent over a decade at Goldman Sachs in New York before leaving last year. When you leave, it makes a huge difference. Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Recommended Jobs. I can't afford a good life". There can be an element of non-reality to people's financial expectations, though. Boost your career Find thousands of job opportunities by signing up to eFinancialCareers today. Deutsche Bank's US employees are a lot less prone to leaving nowadays. It's this alumni network and the doors it opens that potentially allow you to make far more money when you leave Goldman than you make Goldman Sachs itself.

It's more than just a title.

The time the bank spent being the largest bank in the world prior to the financial crisis created the strongest network that still holds today. Anyone can even become a vice president VP. Related articles Financial. Another said that Goldman had simply kitchen-sinked everyone who had an intimation that they might get promoted in order to retain them next year. People at Goldman love to moan about their pay, but it's not really about the money. Recommended Articles. They also invest the money they earn from Goldman carefully. The enormity of this year's MD class has raised some eyebrows internally, particularly as CEO David Solomon had indicated that he planned to slim down the senior ranks. However, this looks like an anomaly. London, United Kingdom. Edward Ruff, 40 year-old Citigroup MD accused of shouting at juniors, had a rough start. The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. I can't afford a good life". The differential is likely due to variations in experience and PnL potential.

I consider, that you are not right. Write to me in PM, we will talk.

Excuse, the question is removed

Anything similar.