Maximum withdrawal from td atm

Phone banking. Drop by a branch to take care of your everyday banking needs or book an appointment to chat with an advisor.

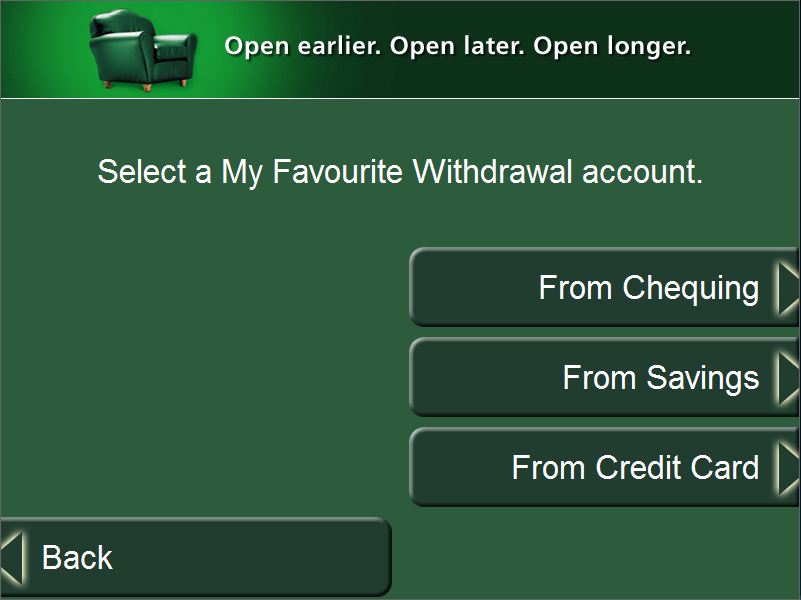

Follow these steps to set up a Favourite Withdrawal as a fast and convenient, one-step way to save time at each Green Machine ATM visit. Select a pre-set dollar amount as your Favourite Withdrawal amount, or select Another Amount to type in a different amount using the ATM keypad. Select which of your accounts you would like to set as the My Favourite Withdrawal account. Set your preference for whether or not you would like a printed receipt each time you use the My Favourite Withdrawal feature. This screen summarizes your settings for My Favourite Withdrawal.

Maximum withdrawal from td atm

Picture this: you lose your wallet with your TD Access Card tucked inside. You panic, worried that someone could be using it for unauthorized purchases, draining your bank account by the minute. You think about heading to your TD branch to report the incident and immediately request a replacement card. But before you leave, you feel a sense of relief as you remember that your debit card has safety features — safety features that are designed to help protect you in the event of a misplaced, lost or stolen card. Here are the top five security features included with a TD Access Card, which are designed to help keep your account safe. Daily spending limits can help stop the wrong people from spending or withdrawing money over your spending limit. TD Access Cards have three different daily spending limits — one for ATM withdrawals, one for point-of-sale purchases and one for card-not-present transactions, like when you buy something online or over the phone — which can be managed separately in-branch or via EasyLine. You can request a limit increase or decrease in each of these categories at a TD branch or by calling EasyLine. Once you request a limit change, it remains at this new level until you request to change it again. When your card is locked, only pre-authorized charges, like bill payments and transfers, will be processed. No new transactions will go through. Once you locate your TD Access Card, you can simply go back into the TD app and unlock it so you can continue using it as usual.

Service is currently unavailable. How do I locate my closest branch? Contact us and speak with a TD advisor to learn how.

For your protection, daily withdrawal and spending limits are applied to your TD Access Card. Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary. In case of discrepancy, the documentation prevails. How can we help you? Ask Us.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate banking products to write unbiased product reviews. ATMs provide an easy way to access your money quickly if you don't want to step into a bank. But, if you're planning to take out money for a trip or to make a big purchase, you may want to double-check your bank's ATM withdrawal limit so you don't end up with a last-minute problem. Below you'll see the ATM withdrawal limits from 25 banks and credit unions. We also walk through your options if you need to withdraw more than the ATM withdrawal limit. Institutions that have a range in maximum daily ATM withdrawal amounts have different limits for savings, checking, and money market accounts. Checking accounts typically have a higher withdrawal limit, especially if it's a premier account. You'll have to log in to mobile or online banking to see your ATM withdrawal limit.

Maximum withdrawal from td atm

Just about every bank puts a limit on how much cash you can withdraw each day. In part, this is a security feature to prevent thieves from cleaning out unauthorized accounts. In other part, this helps banks and ATMs to stabilize liquidity. A daily withdrawal limit is the maximum amount of money you can withdraw from your bank account in a single day. These limits largely exist for two reasons. The first is to manage cash flow and liquidity. Banks keep a limited amount of cash on hand at any given time, as do ATMs. By setting withdrawal limits, the bank can control how much they have to distribute at any given time.

Utah driver education handbook

Bank and Wells Fargo. Once you locate your TD Access Card, you can simply go back into the TD app and unlock it so you can continue using it as usual. Sorry this didn't help. Canada Search. We maintain a firewall between our advertisers and our editorial team. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Brian Beers is the managing editor for the Wealth team at Bankrate. While there's usually no requirement to call our contact centre, there are two instances in which a call to TD EasyLine may still be required. Should your TD Access Card become compromised, you will not be held liable as long as you have met your obligations as outlined in the Access Agreement, including your responsibility to protect your PIN. Some individual ATMs might have their own limits on cash withdrawals. Your Welcome screen will now reflect My Favourite Withdrawal, showing your account, amount and receipt preference. Access Card withdrawal limits For your protection, daily withdrawal and spending limits are applied to your TD Access Card. Default daily ATM limits might not cut it for some emergencies. Drop by a branch to take care of your everyday banking needs or book an appointment to chat with an advisor.

E ven people who pride themselves on being cashless might need to withdraw money once in a while.

How can we help you? We maintain a firewall between our advertisers and our editorial team. Please note that the answers to the questions are for information purposes only for the products discussed. Some individual ATMs might have their own limits on cash withdrawals. For your protection, daily withdrawal and spending limits are applied to your TD Access Card. Plus, the ATM will automatically tally your total deposit amount for you. Drop by a branch to take care of your everyday banking needs or book an appointment to chat with an advisor. Daily debit and withdrawal limits Daily spending limits can help stop the wrong people from spending or withdrawing money over your spending limit. Obtaining a cash advance from your credit card is another way to get cash, but this works best as a last resort, since cash advances often come with fees and high interest rates. Service is currently unavailable. Find answers here. Banking Do money market accounts have withdrawal limits? In Canada. Step 2.

Between us speaking, in my opinion, it is obvious. I recommend to look for the answer to your question in google.com

Thanks for support.

It seems excellent phrase to me is