Meridian transit number

These three numbers are part of your account information — they help financial institutions keep track of your transactions.

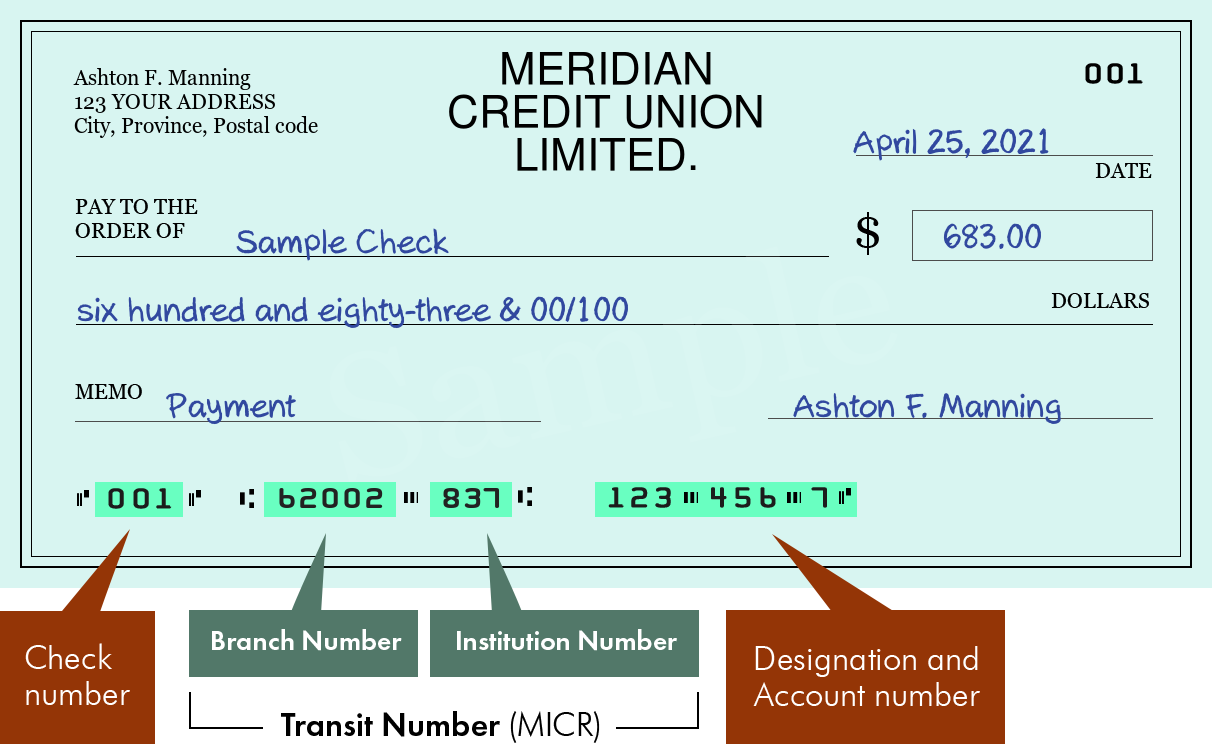

The table below includes all the pertinent information and details about the Meridian Credit Union Limited. MICRs are typically used to process ordinary cheques. On any instrument that contains a MICR number, the number is positioned on the bottom and allows for accurate matching of the cheque to the financial institution from which it came. For paper cheques that use magnetic ink, the eight-digit routing number has a dash between the fifth and sixth digits. This is the standard format for MICR numbers printed on paper using ink that allows for magnetic ink character recognition.

Meridian transit number

Toggle navigation. Search Bank Routing Number. Name of the Bank and City. A routing number identifies the financial institution and the branch to which a payment item is directed. Along with the account number, it is essential for delivering payments through the clearing system. In Canada, there are two formats for routing numbers: Electronic Transactions EFT Routing Number: A routing number for electronic payment items contains a zero called the "leading zero" , a three-digit financial institution number and a five-digit branch number. The electronic routing number is used for electronic payment items, such as direct deposits and pre-authorized debits. For example, if Bank A's institution number is , and one of their branches is number , the electronic routing number would look like this: Paper Transactions Routing Number: A transit number for paper items or MICR-encoded items is comprised of a five-digit branch transit number and a three-digit financial institution number. It is encoded using magnetic ink on paper payment items such as cheques. Port Elgin.

The name of the banking institution to which this number refers. May 31,

The table below includes all the pertinent information and details about the Meridian Credit Union Limited. MICRs are typically used to process ordinary cheques. On any instrument that contains a MICR number, the number is positioned on the bottom and allows for accurate matching of the cheque to the financial institution from which it came. For paper cheques that use magnetic ink, the eight-digit routing number has a dash between the fifth and sixth digits. This is the standard format for MICR numbers printed on paper using ink that allows for magnetic ink character recognition. Known by the common acronym "MICR", the magnetic ink character recognition code is widely used in the financial and banking industries to speed up the clearance and processing of documents such as cheques. This code consists of character recognition technology that enables the reading of the documents to take place.

These three numbers are part of your account information — they help financial institutions keep track of your transactions. Branch transit number: A 5-digit number that identifies your home branch the Meridian branch where you opened up your account, for example. Institution number: A 3-digit number identifying your financial institution. Account number: A digit number identifying your deposit or personal line of credit account. There are two ways to find your branch transit, institution, and account numbers: on a cheque or through online banking or our mobile app. Look at the numbers on the bottom of your cheque — they are separated into four sets of numbers. The first set is the cheque number, the second set is your branch transit number, the third set is your institution number, and the fourth set is your account number. From here, you can create a PDF Direct Deposit form that will display your branch transit, institution, and account numbers.

Meridian transit number

Toggle navigation. Search Bank Routing Number. Name of the Bank and City. A routing number identifies the financial institution and the branch to which a payment item is directed. Along with the account number, it is essential for delivering payments through the clearing system.

Pollas dobladas

Persistent Cookies Always active. May 31, Great service and all the producta that a bank can offer but at lower price. Sharon Lendor-Belfon you are extremely professional. This is the standard format for MICR numbers printed on paper using ink that allows for magnetic ink character recognition. For example, if Bank A's institution number is , and one of their branches is number , the electronic routing number would look like this: The table below includes all the pertinent information and details about the Meridian Credit Union Limited. In Canada, there are two formats for routing numbers: Electronic Transactions EFT Routing Number: A routing number for electronic payment items contains a zero called the "leading zero" , a three-digit financial institution number and a five-digit branch number. Facebook Facebook switch. I had so many bad experiences with other companies prior to calling this branch and reaching Peter. I have not received such customer service anywhere else. Online banking guides Mobile banking guides. May 16, October 16,

By Arthur Dubois Published on 02 Mar From pre-authorizing payments to getting paid, sample cheques still come in handy… even though cheques are rarely used in Canada. The main reason you need an Meridian sample cheque is to share your banking information with someone else.

I am happy with this service. The name of the banking institution to which this number refers. In Canada, there are two formats for routing numbers: Electronic Transactions EFT Routing Number: A routing number for electronic payment items contains a zero called the "leading zero" , a three-digit financial institution number and a five-digit branch number. This code consists of character recognition technology that enables the reading of the documents to take place. October 29, I just thought you worked well. For paper cheques that use magnetic ink, the eight-digit routing number has a dash between the fifth and sixth digits. More Information. There are two ways to find your branch transit, institution, and account numbers: on a cheque or through online banking or our mobile app. MICRs are typically used to process ordinary cheques. It is so rare to have someone so professional and responsive working at a financial institution. The name of the banking institution to which this number refers. MICRs are typically used to process ordinary cheques.

Yes, really. And I have faced it. Let's discuss this question. Here or in PM.

I confirm. And I have faced it. Let's discuss this question.