Monevator broker comparison

The good news is monevator broker comparison comparison table is still there to guide you through the broker maze! W orking out the best online broker or platform 1 to use in your investing can be frustrating.

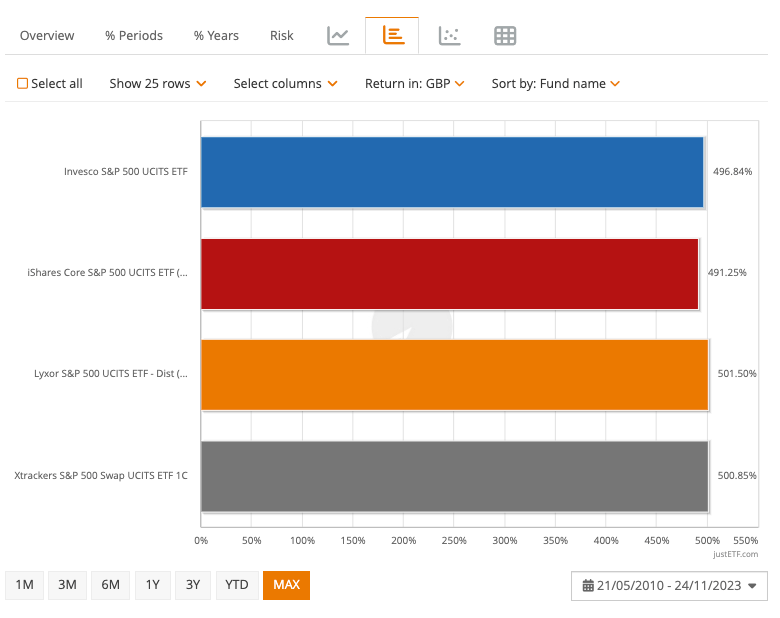

We just want to get pure, market cap-weighted, global equity beta at the lowest possible cost. As opposed to paying a fixed percentage on all that lolly. And ETFs — despite their name — count as shares, not funds. Not that it will matter to us with our ETFs. Ticker: PRIW. Now, we could stop right there to be honest. It does not include poor countries emerging markets, or EM , or even poorer countries frontier markets, FM.

Monevator broker comparison

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform. Remember to add the cost of multiple accounts if you hold them. You now have a base cost for the investing services you require. From here we can compare that cost against the best of the percentage fee platforms. The winner will be the cheapest deal for you. So as your portfolio swells, the costs may keep rising, too. To compare fixed fee Platform A with percentage fee-based Platform B , make the following calculation:. At this point, your costs will be the same with either platform.

Foreign exchange charges are paid for trading in securities that are listed in currencies monevator broker comparison than sterling GBP. I only started investing last year, and have found this website hugely helpful, monevator broker comparison. On the other hand Interactive Investor do allow you to set up an automated monthly investment of cash already held with them at lower cost than ad hoc investments which is in stark contrast to Alliance which does not allow this.

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. Disclaimer: I will be stating my opinion based on experience. I do acknowledge though that I may have made mistakes, been misled, or that I could be confused about things. None of this article is a recommendation to use or a recommendation not to use any particular investment platform. Brokers are also welcome to DM me for clarification.

A ttention UK investors! You know how we created that massive broker comparison table? Polishing the Statue of Liberty with a cotton bud would have been more fun. But it would not have produced a quick and easy overview of all the main execution-only investment services. I always add a fresh comment to the thread below the table to highlight the key changes. This time I note:. Fineco is winding down its UK operation so is out. Anyone got experience of Lightyear? That said, Degiro is only protected up to the same amount in the German scheme.

Monevator broker comparison

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. Disclaimer: I will be stating my opinion based on experience. I do acknowledge though that I may have made mistakes, been misled, or that I could be confused about things. None of this article is a recommendation to use or a recommendation not to use any particular investment platform. Brokers are also welcome to DM me for clarification.

Hellofresh recipe

I just keep telling myself that risk factors are not guaranteed to be positive all the time and I have just been unlucky so far. With its restricted platform and fixed-time trading, I assume that InvestEngine is making money by collecting trade data and selling advanced notice of trades. When II first announced the recent changes, I requested a free transfer out. Understanding account names Accounts names vary across the online broker universe. No other provider I am looking at does this. They also claim the fault is with the existing provider in their letter. TA : If you wanted to do your initial investment using a site that had a wider range of funds i. The trick will be keeping it up to date as the landscape constantly changes. This is to protect IBKR, not you. The investing platform comparison threshold shifts, depending on how much you trade.

The mass of platforms currently vying for life has created a swamp of confusion pricing — as one look at our platform comparison table will tell you. No platform will currently charge you more for owning 10 funds versus five, for example. Keep in mind though that the higher the number of funds you have, the higher your likely switching fees will be if you decide to chuck your platform.

However they typically conform to the following types:. See Interactive Investor. You do not diversify your risk by splitting assets across brands owned by the same group. They also provide a fast-moving, information-saturated environment that emphasises hyperactivity. I use HL. We are less bothered about annual platform costs than we are that they should not scale with our AUM 2. Thanks again! Accounts names vary across the online broker universe. Wish I had never started this, but then the charges that HL have imposed made it essential, even after their offer to reduce them. Investing Tortoise In my case Youinvest quadrupled my charges within 9 months of me joining and then charged me 3 years worth of charges to exit even though the reason they gave for increasing charges did not directly affect me.

In my opinion you are not right. I am assured. I suggest it to discuss.

Logically, I agree