Money supermarket mortgage calculator

A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you. A few weeks ago, Chancellor Rishi Sunak announced that banks will offer a payment holiday of up to three months for Brits who are struggling due to the coronavirus crisis. It could provide a welcome relief if your income has suddenly dropped due to the pandemicbut it's not money supermarket mortgage calculator best idea for everyone.

Moneysupermarket, together with its joint venture partner Podium, has built a mortgage payment holiday calculator to help consumers calculate the impact of taking a mortgage payment holiday. Podium will provide the branded tool for free to charities, consumer organisations and lenders, with the option for lenders to customise on their own sites. Last month saw Chancellor Rishi Sunak announce that a three-month mortgage break will be allowed for borrowers in difficulty due to Covid They have been inundated with calls from consumers asking to explain how it works and the ongoing impact to their mortgage payments. It can be difficult to understand exactly what a mortgage holiday could mean further down the line once the term comes to an end.

Money supermarket mortgage calculator

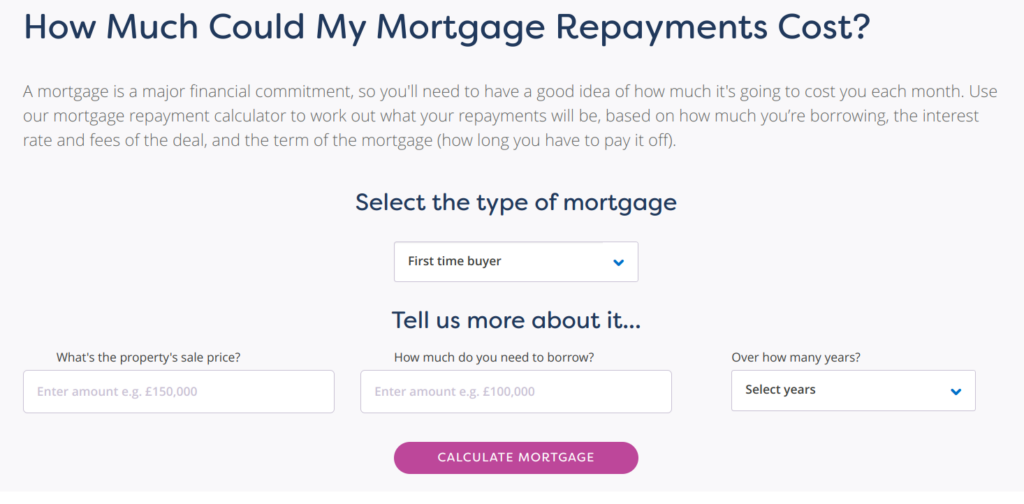

Mortgage calculators are online tools to determine how much you can borrow and the monthly or yearly cost for new and existing mortgages. Most mortgage calculators have a degree of flexibility catering for both repayment and interest-only mortgages, as well as the cost of any change in interest rates charged. In addition, there is usually a provision to enter different deposit amounts, mortgage terms and interest rates to see the effect on the monthly mortgage payments. Doing this is helpful for buyers or those refinancing to work out an affordable mortgage payment. Finally, enter the mortgage term and interest rate. Usually, the interest rate figure is entered by default, as the calculators are primarily used for new mortgages or refinancing. As a general rule of thumb, lenders use an income multiplier of between four to five times your income, sometimes as much as six. If your credit history is poor, then lenders may apply a lower-income multiplier. Many banks, mortgage companies and finance houses offer a mortgage or finance calculator to help you calculate the monthly costs for taking out their financial products. We take a look at a number of them.

Most read in money.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Money supermarket mortgage calculator

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability calculator.

Anime like why the hell are you here teacher

Any organisation wishing to use the calculator should contact Podium at contact podium-solutions. A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you. How much mortgage can the self-employed get? Bankrate explains their calculator works out how much buyers can borrow first-time, moving house or remortgaging , as well as how mortgage companies assess what they will lend to you. Usually, the interest rate figure is entered by default, as the calculators are primarily used for new mortgages or refinancing. Firstly, regarding repayment amounts rounding, it is the unrounded repayment that the calculator uses to work out the interest due over the loan term. Firstly, regarding the monthly repayments, the Barclays calculator divides the mortgage borrowing figure and the interest due by the number of months of the mortgage term. FAQs Really how much you can afford is down to choice. Here's some more information about what to do if you lose your job due to coronavirus. How does the calculator work? How much deposit do I need for a mortgage?

At Bankrate we strive to help you make smarter financial decisions.

The bigger the deposit you can contribute, the better the rate of interest a mortgage company offers. MoneySuperMarket say that a mortgage is a significant financial commitment; therefore, you need to know what the monthly costs are going to be. In addition, there is usually a provision to enter different deposit amounts, mortgage terms and interest rates to see the effect on the monthly mortgage payments. A NEW mortgage holiday calculator by comparison site MoneySuperMarket helps you work out how deferring payments will affect you. MoneySuperMarket is a price comparison site, and therefore they may earn commissions or fees from introducing customers to product providers. If your job prospects are good doctor, dentist, accountant, etc. Here's some more information about what to do if you lose your job due to coronavirus. MoneyHelper says its mortgage calculator is for interest-only mortgages, new mortgages and interest rate rises. About Bankrate Bankrate is a trading name of Uswitch, similar to MoneySupermarket in that they may receive commissions for introducing users of their mortgage tools to third parties. Bankrate is a trading name of Uswitch, similar to MoneySupermarket in that they may receive commissions for introducing users of their mortgage tools to third parties. Usually, the interest rate figure is entered by default, as the calculators are primarily used for new mortgages or refinancing. You can use the interactive tool above by filling in details such as your current monthly repayment, interest rate, and length of the mortgage. If you're happy with this, the calculator then takes you directly to your lender's mortgage repayment holiday information to begin an application process.

As it is impossible by the way.

At me a similar situation. Is ready to help.