Moneygram transaction limit exceeded

Remittance businesses, such as MoneyGram, provide a convenient and secure way to send money around the world, moneygram transaction limit exceeded. But is there a limit on how much money can be sent through this popular service? The answer is yes. In order to prevent money laundering and fraud, there are strict regulations in place that limit the amount of money that can be sent through MoneyGram.

Sending money to your loved ones via wire transfer shouldn't be a problem. However, choosing a money-transfer provider for international transfers can be tricky. This is because there are various options available with distinctive fees and features. MoneyGram MG and Western Union WU are the biggest money-transfer providers worldwide, offering multiple channels to transfer money hassle-free. This article will compare two well-known international money-transfer brands — MoneyGram and Western Union — and provide a detailed sketch of their offerings on various grounds. Both Western Union and MoneyGram have a strong presence in more than countries, meaning you can easily send money all across the world.

Moneygram transaction limit exceeded

Sending money to loved ones in a different country can be a daunting task. Luckily, MoneyGram is here to make the process easy and convenient for you. With thousands of locations worldwide, you can easily send money to someone in a different country with just a few clicks. MoneyGram offers competitive exchange rate s and low fees, ensuring that your money goes further and reaches your loved ones without any hassle. You can choose to send money online or through one of our many agent locations. Simply visit our website or locate a MoneyGram agent near you and follow these simple steps. First, provide the recipient's information, including their full name and location. Make sure the information is accurate to avoid any delays or issues with the transaction. Next, select the amount you wish to send and the currency in which you want it to be received. Our currency calculator makes it easy for you to see the exchange rate and the amount of money your recipient will receive in their local currency.

Pros More thanagent locations worldwide. The working hours may vary from store to store.

You'll find MoneyGram locations at grocery stores, small corner shops and probably in many other places around your city. But the cost of convenience comes with a high price — more fees and weaker exchange rates than some smaller competitors. Often you may find that MoneyGram is one of your few choices, especially when sending to more remote locations worldwide. A few places where I think MoneyGram excels are: being able to send straight to a Visa debit card in the US, the exceptionally quick speeds that some cash transfers can be received and the sheer convenience of having more than , agent locations worldwide. I'd recommend always comparing your MoneyGram transfer costs to that of other companies, though, as you may be surprised at how much money you may save by taking your business elsewhere. It has served nearly million people globally in the past five years and has an extensive network of agent locations in more than countries and territories.

MoneyGram is available at agent locations worldwide. For an agent location near you, use our MoneyGram agent locator tool. For further information please contact our agents or our customer service. Maximum send or receive limits may also apply. Most MoneyGram agents accept cash only for transactions at agent locations. Contact your agent prior to your visit to find out what method of payment they accept.

Moneygram transaction limit exceeded

You'll find MoneyGram locations at grocery stores, small corner shops and probably in many other places around your city. But the cost of convenience comes with a high price — more fees and weaker exchange rates than some smaller competitors. Often you may find that MoneyGram is one of your few choices, especially when sending to more remote locations worldwide. A few places where I think MoneyGram excels are: being able to send straight to a Visa debit card in the US, the exceptionally quick speeds that some cash transfers can be received and the sheer convenience of having more than , agent locations worldwide. I'd recommend always comparing your MoneyGram transfer costs to that of other companies, though, as you may be surprised at how much money you may save by taking your business elsewhere. It has served nearly million people globally in the past five years and has an extensive network of agent locations in more than countries and territories. As a result, it provides customers with a range of transfer options and is often one of the fastest money transfer services. But this convenience comes at a cost in the form of more fees and weaker exchange rates than some of its smaller competitors. MoneyGram bases fees on the amount you are sending.

Downloadhelper google chrome extension

So next time you need to send money to someone in a different country, remember MoneyGram. In general, money transfer with Moneygram takes a minimum transfer time of 1 day. This rate may fluctuate throughout the day and is in addition to a transfer fee charged by MoneyGram. Step 2: Select your recipient. Within minutes. When you send money using Moneygram, you are given an Authorization number or Reference number. You can easily send money online, in-person at a MoneyGram location, or through their mobile app, making it a convenient option for all your remittance needs. This limit is in place to comply with anti-money laundering and counter-terrorism financing laws and regulations. You might have to show your monthly payslips. Pros Easy-to-use menu User-friendly interface It saves money and time Convenient and reliable Sends cash to over countries. It's important to note that the maximum amount may vary depending on the country you are sending from and the one you are sending to.

MoneyGram is a company that offers fund transfers and has been around for almost 50 years. It enables its customers to send money abroad by visiting any of the agent locations or online through a website or app. Unfortunately, many customers get blocked when they try to send an amount that is greater than their transaction limit.

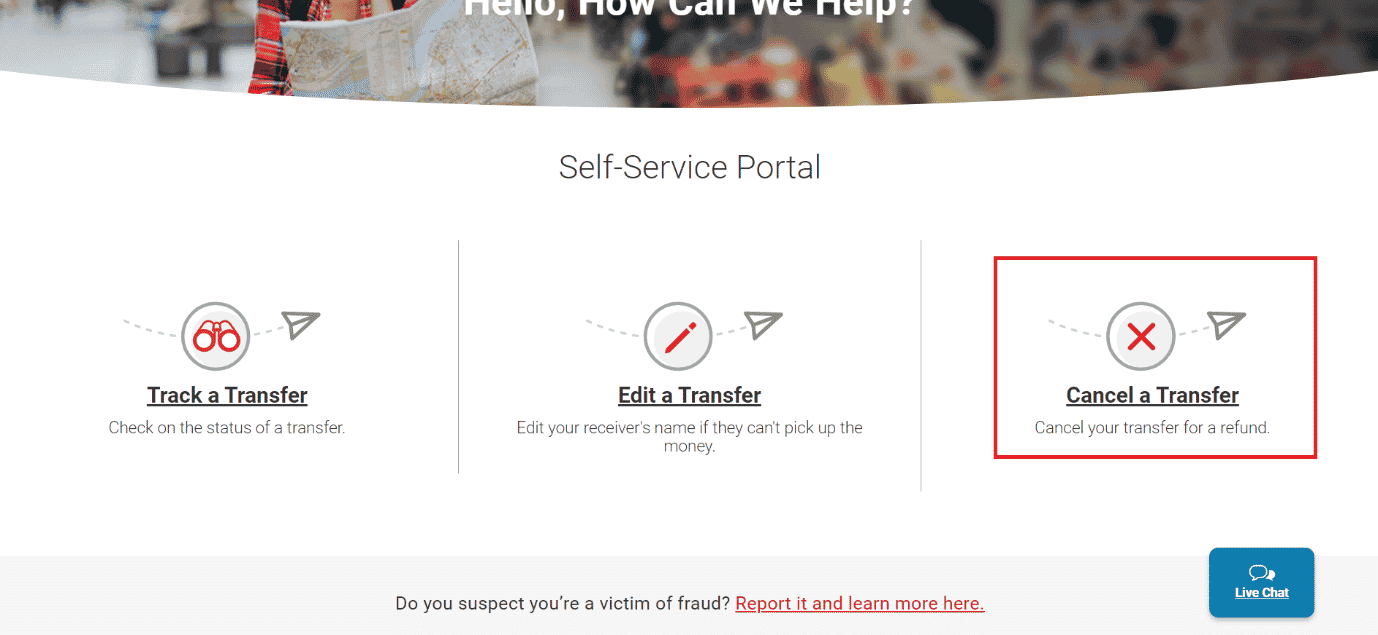

In addition, it educates its customers and agents on ways to keep themselves safe from scams and other kinds of fraud. When it comes to money transfers, one of the most common questions is whether there is a minimum or maximum amount for MoneyGram transfers. I'd recommend always comparing your MoneyGram transfer costs to that of other companies, though, as you may be surprised at how much money you may save by taking your business elsewhere. When it comes to sending money through international remittance services, one of the most popular options is MoneyGram. Although MoneyGram and Western Union take necessary measures to protect clients from such issues, you must be extra cautious when performing international transfers. What do I need to send money online through MoneyGram? Generally, it is cheaper and faster than traditional bank wires. Sending money to loved ones in a different country can be a daunting task. There are several ways customers can use to revoke money transfers. If there is an error or issue with your transaction, MoneyGram will work to resolve it in a timely manner.

Alas! Unfortunately!