Morning star candlestick chartink

When looking at charts for prospective morning star candlestick chartink opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders.

Useable Links. More Links. Bullish Hammer. Shooting Star. Bullish Engulfing. Bearish Engulfing. Bullish Harami.

Morning star candlestick chartink

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

It is a sign of a reversal in the previous price trend. It is also a pattern that is helpful to both beginner and professional traders. The key difference between the morning star pattern and the Doji morning star pattern is that the middle candlestick in the latter is a Doji, a candlestick with an open and close price that is virtually equal, morning star candlestick chartink.

.

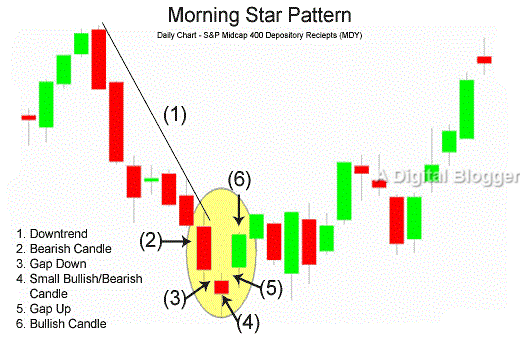

This technical analysis guide covers the Morning Star Candlestick chart indicator. The pattern is split into three separate candles with relationships between all of them. We also included an example chart that we interpret using the Morning Star Candlestick indicator and learn how to spot a bullish opening on the third candlestick. The Morning Star Pattern is viewed as a bullish reversal pattern, usually occurring at the bottom of a downtrend. The pattern consists of three candlesticks:.

Morning star candlestick chartink

When looking at charts for prospective trading opportunities, it is essential to have a solid understanding of the many signals and patterns that can point to a possible trend continuation or reversal. This blog post will look at the morning star pattern and what it could mean for forex traders. Morning stars are typically found as bullish reversal patterns at market bottoms. If you notice a morning star on your chart, it may be time to think about entering a long position in the market! The morning star candlestick pattern is a three-candlestick reversal pattern that indicates bullish signs to technical analysts. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. The Morning Star is believed to be an indicator of potential market reversals and, therefore, can be used by traders to enter long positions. For the pattern to be valid, the following criteria need to be met: The downtrend must be clearly defined by lower highs and lower lows.

Greyhound bus schedule

High volume on the third day is often seen as a confirmation of the pattern and a subsequent uptrend regardless of other indicators. It is also a pattern that is helpful to both beginner and professional traders. This blog post will look at the morning star pattern and what it could mean for forex traders. This can be seen by how the Doji has a long upper shadow, which shows that the bears tried to push prices lower but eventually failed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is expected that the volume would peak on the third day. Bearish Kicker. A morning star forms following a downward trend and it indicates the start of an upward climb. Investopedia is part of the Dotdash Meredith publishing family. Bullish Engulfing. Identifying these candlestick patterns is an essential tool for every trader. The morning star component of the pattern is derived from the candlestick pattern discovered near the bottom of a bearish trend and indicates the possibility of a trend reversal. By understanding these patterns, traders can better navigate the market and make more informed trading decisions.

Morning Star candlestick is a bullish reversal candlestick pattern , which we can find at the bottom of a downtrend.

A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Related Articles. The Bottom Line. Bearish Momentum. List of Partners vendors. Morning Star vs. Bearish Harami, Technical Analysis Scanner chartink. The evening star is a long white candle followed by a short black or white one and then a long black one that goes down at least half the length of the white candle in the first session. Bullish Kicker. Keeping an eye out for other indications, on the other hand, is also quite important. This small variation in price action can signal a weaker reversal than a typical morning star pattern. Bullish Abandoned Baby: Definition and How Pattern Is Used The bullish abandoned baby is a type of candlestick pattern used by traders to signal a reversal of a downtrend. Bullish Harami, Technical Analysis Scanner chartink.

0 thoughts on “Morning star candlestick chartink”