Mortage calculator bmo

Get a sense for your mortgage payments, the cash you'll need to close and the monthly carrying costs with Ratehub.

You may get a different rate if you have a low credit score or a conventional mortgage. This can create peace of mind for homeowners, which makes it a fundamentally appealing program for home buyers. If you are arranging a new mortgage for a future or current home, your fixed interest rate can be guaranteed up to days before the closing date of your home. If interest rates go up during that time, you will be guaranteed the lower rate. BMO Variable Rate Mortgages provide you with fixed payments over the term; however, the interest rate will fluctuate with any changes in the prime interest rate. If their prime rate goes down, more of your payment will go towards paying off your principal; if their prime rate goes up, more of your payment will go towards interest costs. As a result, this can be a great financial tool for those expecting rates to fall in the upcoming year.

Mortage calculator bmo

.

Mortgage Term:.

.

You may get a different rate if you have a low credit score or a conventional mortgage. This can create peace of mind for homeowners, which makes it a fundamentally appealing program for home buyers. If you are arranging a new mortgage for a future or current home, your fixed interest rate can be guaranteed up to days before the closing date of your home. If interest rates go up during that time, you will be guaranteed the lower rate. BMO Variable Rate Mortgages provide you with fixed payments over the term; however, the interest rate will fluctuate with any changes in the prime interest rate. If their prime rate goes down, more of your payment will go towards paying off your principal; if their prime rate goes up, more of your payment will go towards interest costs. As a result, this can be a great financial tool for those expecting rates to fall in the upcoming year. A convertible mortgage allows you to convert to another term at any time. This feature provides security and flexibility, as it enables you to convert to a longer closed term should your variable rate mortgage no longer meet your needs.

Mortage calculator bmo

If you plan to live in your home for many years, a fixed rate mortgage may be best for you. The stability of a fixed rate makes it easier to plan and budget for the long term. Speak with a Mortgage Banker. Share general information about your employment history, income, savings, investments, debts and property you wish to purchase or refinance.

Lori poling nude

Longer amortization periods allow homeowners to make smaller monthly payments, but equate to more interest paid over the life of the mortgage. You can also change to an accelerated weekly or bi-weekly payment schedule. You can re-borrow your prepayments from this account with the amount added back to your mortgage principal. Those receiving mortgage disability benefits are also not eligible. Mortgage amount. If you have an insured mortgage, you can only use these options if you have previously made a mortgage prepayment equivalent to the amount to be skipped. WOWA does not guarantee the accuracy of the information shown and is not responsible for any consequence that arise from the use of the calculator and its results. More Ratehub. The knowledge bank A wealth of knowledge delivered right to your inbox. Even though BMO has some of the lowest posted rates among the big banks, you might be able to get a better mortgage rate by using a mortgage broker. If interest rates go up during that time, you will be guaranteed the lower rate.

Whether you want to apply for a home loan or refinance your mortgage , BMO Mortgage Bankers can guide you through the process. If you're looking for consistent monthly payments of principal and interest during the life of your loan, a fixed rate mortgage is easier to budget and plan. If you're planning to stay in your home for a relatively short period of time, consider an adjustable rate mortgage.

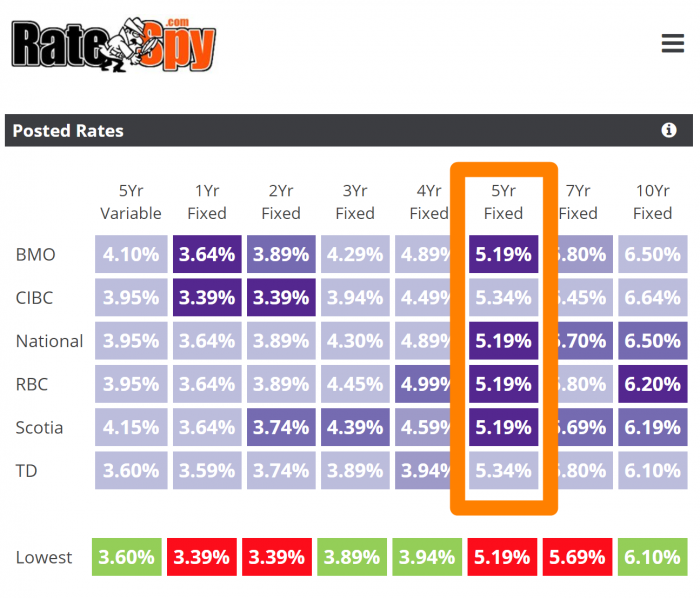

See today's best mortgage rates. This feature provides security and flexibility, as it enables you to convert to a longer closed term should your variable rate mortgage no longer meet your needs. Take 2 minutes to answer a few questions and discover the lowest rates available to you. You may get a different rate if you have a low credit score or a conventional mortgage. If your home qualifies for the ECO Smart Mortgage, you should still compare rates with other lenders as they may provide you with a lower rate. Press Press Centre Team Bios. If interest rates go up during that time, you will be guaranteed the lower rate. Enter email. You can re-borrow your prepayments from this account with the amount added back to your mortgage principal. If you are arranging a new mortgage for a future or current home, your fixed interest rate can be guaranteed up to days before the closing date of your home. You can always make a prepayment in the future to cover skipped payments without any prepayment penalties. Compare current mortgage rates across the Big 5 Banks and top Canadian lenders. If their prime rate goes down, more of your payment will go towards paying off your principal; if their prime rate goes up, more of your payment will go towards interest costs. This is determined by the mortgage type and mortgage provider. Real Estate.

Did not hear such