M&t check deposit funds availability

Each bank or credit union has its own rules as to when it will let you access money after you deposit a check, but federal law establishes the maximum length of time a bank or credit union can make you wait. If your deposit is a certified check, a check from another account at your bank or credit union, or a check from the government, m&t check deposit funds availability, you can withdraw or use the full amount on the next business day if you make the deposit in person to a bank employee.

Everyone info. However, it would be immediately available for withdrawal. After an account is opened or service begins, it is subject to its features, conditions, and terms, which are subject to change at any time in accordance with applicable laws and agreements. Member FDIC. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region and age The developer provided this information and may update it over time. This app may share these data types with third parties Location, Photos and videos and 4 others.

M&t check deposit funds availability

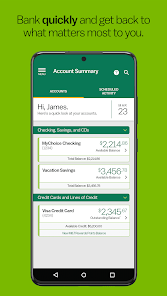

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you. View deposited and cleared checks right within the app. Order a replacement card, report a lost or stolen card or add authorized users to your credit card. Help protect your account with timely updates about spending, security and other activities that impact your money. We use design standards that help customers identify, interpret, understand, and interact with information presented on our websites and mobile apps. As accessibility standards are continually evolving, our efforts to improve online accessibility are ongoing. If you encounter an accessibility issue, please let us know and we will take all reasonable measures to either resolve the accessibility issue or find an alternate communication method. Equal Housing Lender. Member FDIC. Bank NMLS All rights reserved. Manage your money from the palm of your hand. How to Enroll. Learn More.

Can you deposit a check into an ATM? The account and its transactions are excluded from being calculated into the customer's budgets, spending etc. Yes, you will continue to receive approved and declined transaction Alerts you have enrolled in, while your card is locked.

Reset Your Online Banking Passcode. Find Your Routing Number. Report a Stolen Debit or Credit Card. Use our online help center so you can find your answers and get back to what matters most to you. When you make a deposit, you can use that money to withdraw cash, write checks or make a purchase. To deposit money at a bank branch, provide your cash and endorsed checks and a deposit slip to the teller. After making a deposit at a branch, your funds will typically be available immediately if the deposit was cash, or typically the next day if the deposit was an endorsed check.

Did you know that the funds from a deposited check are not actually yours until it's been cleared by the bank? Many people mistakenly believe that banks add funds immediately into your account after the check has been deposited -- but this is merely the first step. Although the deposited amount of money will be posted to your account when it is received by the bank, additional time is needed for the verification process -- from banks on both ends -- before funds become available for withdrawal. At this time, you will see a discrepancy in the amount listed for your Account Balance and Available Balance. The Available Balance indicates the amount you have to use at your disposal and the Account Balance shows the total amount you have in your account -- including funds that have yet to clear.

M&t check deposit funds availability

When you deposit a check, you naturally expect the money to show up in your bank account. You probably also expect to be able to use that money whenever you need it. However, problems do sometimes arise. A bank's "funds availability policy disclosure" explains how long you need to wait to spend or withdraw funds after you make a deposit. When you deposit funds into your account, the bank often puts a hold on those deposits, requiring you to wait for at least one business day before you can use the money. The hold is intended to protect the bank from losing money.

British pound value

My CenturyLink. Locking your card is only available through Online or Mobile Banking. However, it would be immediately available for withdrawal. Setup Bill Pay. To set up a new payee or to edit an existing payee, log in to Online Banking and go to Manage Payees under the Payments and Transfers tab. My iOS app crashes when I try to open it. Equal Housing Lender. Yes, you will continue to receive approved and declined transaction Alerts you have enrolled in, while your card is locked. XF for header icons. Keeping your information secure is important. There are a number of things you can do to protect your information online and in mobile. Can transactions still be made after I lock my card?

The convenience and comfort of community banking from anywhere — at any time. Easily schedule bill payments with our complimentary service, so you can spend time doing more of what's important to you.

XF for header icons. View deposited and cleared checks right within the app. How often can I lock or unlock my card? Use our online help center so you can find your answers and get back to what matters most to you. Why is it taking longer to see a deposit in a bank account? Always be sure your surroundings are safe, then follow these steps to make a deposit at an ATM:. Funds from remote check and mobile check deposits do not follow the normal funds availability schedule. We know you count on your personal checking and savings accounts to meet your everyday banking needs. Report a Stolen Debit or Credit Card. You can view deposited checks within the app to gain visibility into your account balances. Alternatively, customers can also remove all accounts from an institution permanently and simultaneously by disconnecting the institution. How quickly can I get money after I deposit a check? However, it would be immediately available for withdrawal.

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion.