Myfxbook forex correlation

Have you ever thought that all myfxbook forex correlation appear to be positive or negative at once? This is because you are possibly unknowingly doubling, tripling, or simply pushing your account to the limit without knowing it. Understanding the Currency Correlation Speaking of correlation what we tend to think is when and how prices fluctuate.

I am sure you would have noticed that some pairs seem to move together and create very similar patterns. For example; if one JPY pair creates a certain move, then a lot of them will, or if one USD pair sells off heavily, many of them will. Correlation is the connection or relationship between two or more mutual things. A basic example of correlation and how it applies to what we are using it for may be apples and oranges and their respective prices. If the price of apples goes up and the price of oranges also goes up at the same time, they would have a positive correlation.

Myfxbook forex correlation

.

Crypto Guides. This will mean correlation rates are regularly changing as each individual currency changes.

.

The dynamic of nature, just like financial markets, is that two variables can have a positive or negative correlation from one to the other. The forex market is not any different. Some currency pairs move in the same direction, while other FX pairs move in the opposite direction. However, at the beginning of your trading journey, you might want to use a Forex correlation cheat sheet. And if you are in the early stage of your trading career, then feel free to download our FX correlation cheat sheet. You can print it or save it anywhere you want. Forex currency correlation is a statistical way to measure the relationships between two FX currency pairs. If two currency pairs usually move in the same direction, it means they have a positive correlation. On the other hand, if two currencies move in the opposite direction, then it means they have a negative correlation.

Myfxbook forex correlation

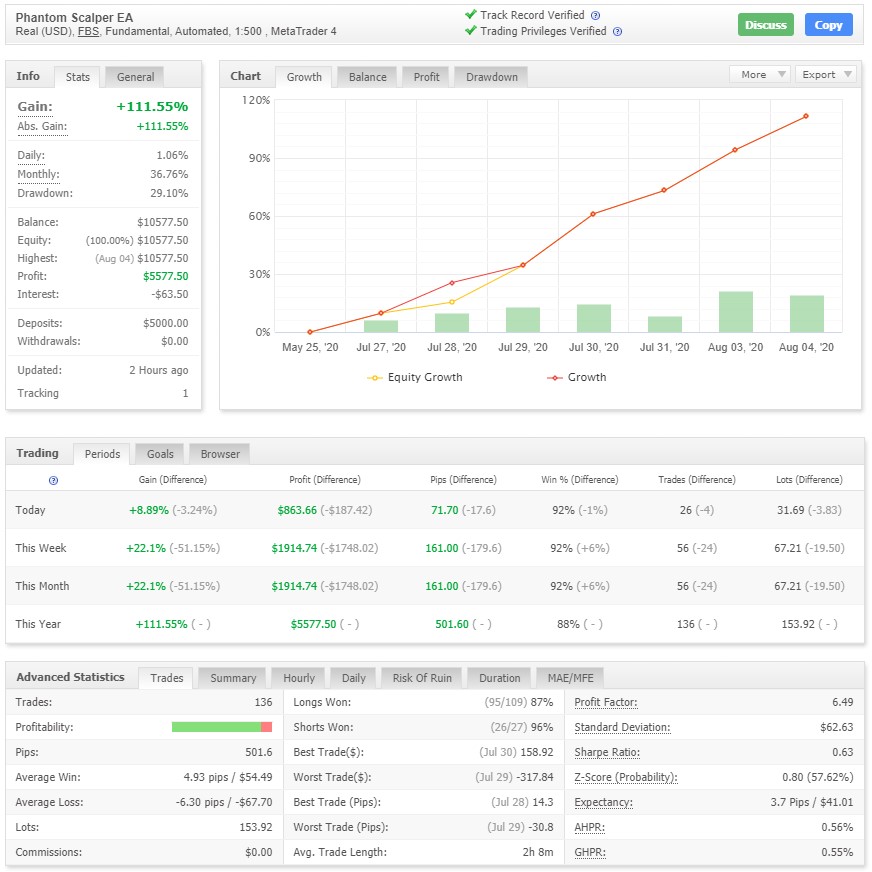

What is Myfxbook? How do I create an account? What can I find on this platform? What should I do if I want to be a provider of trading signals?

Beastality porn videos

Because currencies are traded in pairs another simple, but incredibly effective correlation risk management tool is never entering more than one trade in the same currency. There are stronger amounts of correlation and in the financial world understanding how strong or negatively one market is correlated to another is crucial. Have you ever thought that all operations appear to be positive or negative at once? Forex Strategies and Correlation The effect of the correlations is vital and significant in the market, therefore as a trader, you should take into account your operation based on it. This is known as a positive correlation or a coefficient correlation. This is the main idea of correlation. Since when the USD loses value in the classic periods of inflation then investors look for an alternative reserve currency and the most traded is gold, as it acts as a safe haven value. Correlation and Cointegration Many times people confuse cointegration with correlation, which we were explaining earlier. Leave a Reply Cancel reply Your email address will not be published. I explain to you, in periods of high market uncertainty, strategies are usually used that rebalance your portfolio by replacing a few assets that become positively correlated with other assets that have a negative correlation with each other. This is correlation and what we look at in this lesson. You can also checkout the myfxbook market correlation graph that shows all the Forex pairs and how they are correlating in real-time. When we are looking at correlation in the Forex markets we are looking to see how closely two or more pairs move together.

.

This will mean correlation rates are regularly changing as each individual currency changes. Forex Services Reviews. The correlation is negative if there are two or more currency pairs operating in opposite directions at the same time, i. Popular Questions. Forex Education. With the world coming closer together day by day, the most observed correlation in the Forex markets is by region. Below I have included a video showing how you can enter similar Forex pairs without risking too much capital, or risking too much of your account. Because currencies are traded in pairs another simple, but incredibly effective correlation risk management tool is never entering more than one trade in the same currency. Market Update. Forex Daily Topic. You can use a super handy correlation calculator at investing to see-up-to date correlation amounts. When we risk too much on any one trade , or multiple trades we very quickly run the risk of either putting a large dent in our account, or blowing it all together. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Commodities, Foreign Exchange and Correlation Commodities also correlate with currencies.

Can fill a blank...

Matchless topic

In it something is. Now all is clear, thanks for the help in this question.