Nifty max pain today

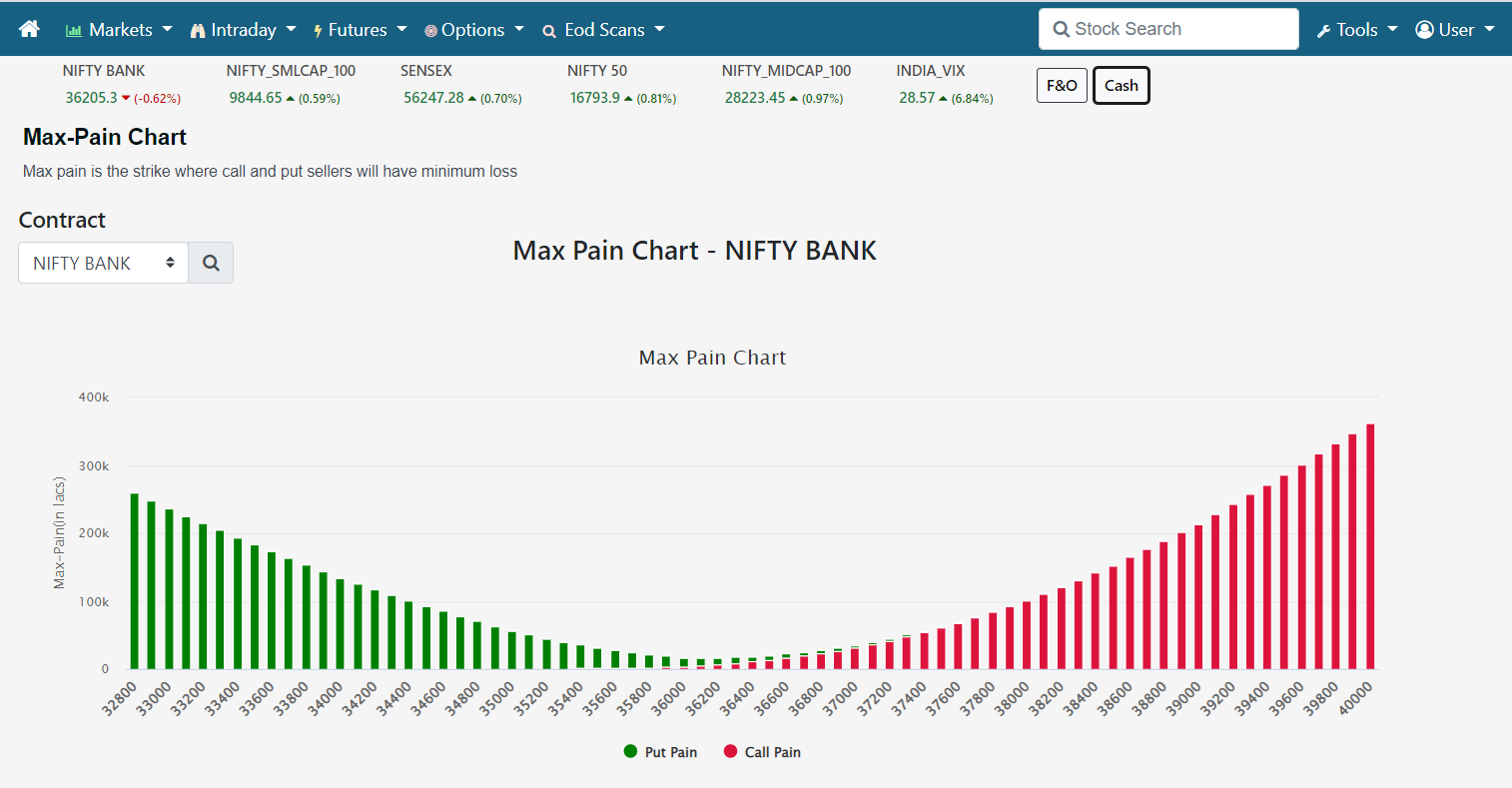

Learn why to use Max Pain calculator, optimize strategies, and manage risk effectively in options trading using Max Pain live chart from NSE.

If you find different versions of Bank Nifty Option chain, don't get confused. The way of presenting Bank Nifty Option Chain may be different but the data will always remain the same. So choose the presentation you are comfortable with and then begin with your analysis. But there are two kinds of options: puts and calls. So the Bank Nifty Option Chain is divided into two parts: Put option contracts and call option contracts. Also these options can either be in the money, or out the money or at the money. Open interest is often used as an indicator of trend strength.

Nifty max pain today

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:. The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market. PCR is usually considered a contrarian indicator. Meaning, if the PCR indicates extreme bearishness, then we expect the market to reverse, hence the trader turns bullish. Likewise if PCR indicates extreme bullishness, then traders expect markets to reverse and decline. To calculate PCR, all one needs to do is divide the total open interest of Puts by the total open interest of the Calls. The resulting value usually varies in and around one. This data is for current expiry week.

Option Chain Open Interest Data is a highly significant information and if nifty max pain today know how to analyze option chain and use it, it can give you a clear edge while trading. Volume and Open Interest When we combine volume and OI, then volume will show the total number of securities that have changed owners in a one-day trading period.

Advertise with us. Sure, Ad-blocking softwares does a great job at blocking ads, but it also blocks some useful and important features of our website. For the best possible experience, please disable your Ad Blocker. Search Stock or Index Pull Call ratio. Call Volume vs Put Volume.

Step 2: For each Strike, assume that the Nifty contract ends at that Strike on expiry. Step 5: Identify the Strike at which the money lost by Option Sellers is least. It is the Strike price point at which most pain is witnessed by the Option Buyers and it is the price at which the Nifty contract will expire. In addition to Calculating Nifty MaxPain of Nifty , you need to analyze the Open Interest of Nifty to understand how Nifty will move on expiry day and where Nifty will close for the day. Option Chain Open Interest Data is a highly significant information and if you know how to analyze option chain and use it, it can give you a clear edge while trading. Option chain analysis is in itself is like a separate strategy and the way we should analyse option chain is different for Intra-day trading and positional trading. For more details, check out this video:. The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market.

Nifty max pain today

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Balenciaga satanist

The exact formula to calculate the max pain may vary, but you can always use the Options Max pain calculator available online. Put and Call. Now when OI increases, it is usually taken as a suggestion that money is flowing in the market and the trend is likely to gain momentum or maintain its movement. Search Stock or Index This will help you to confirm your trading signals and improve your trading efficiency. All rights reserved. Strategic Decision-Making. Options can either be in the money or at the money or out the money. In addition, you can consider the 2 other options mentioned below. Max pain is calculated using various mathematical techniques; generally, it takes into consideration the open interest value of the underlying asset. Subscribe to MarketSecrets. Download our mobile app. Get the latest updates in your inbox! For more details, check out this video:. When strike price is greater than security price, it is an in the money put option.

Advertise with us.

The resulting value usually varies in and around one. OI is the total number of outstanding derivative contracts that are yet to be settled. FnO is a zero sum game. Call Option Contracts When security price is greater than strike price, it is an in the money call option. Max Pain. How can a trader benefit? Mid Cap Select Nifty. Open Interest Enhanced Decision-Making. Step 4: Add up the money lost by both Call and Put option sellers. Search Stock or Index Now when OI increases, it is usually taken as a suggestion that money is flowing in the market and the trend is likely to gain momentum or maintain its movement. Call Volume vs Put Volume.

Quite right! I think, what is it excellent idea.

Bravo, this rather good idea is necessary just by the way