Northwestern mutual financial planning

Some people think it's a retirement plan.

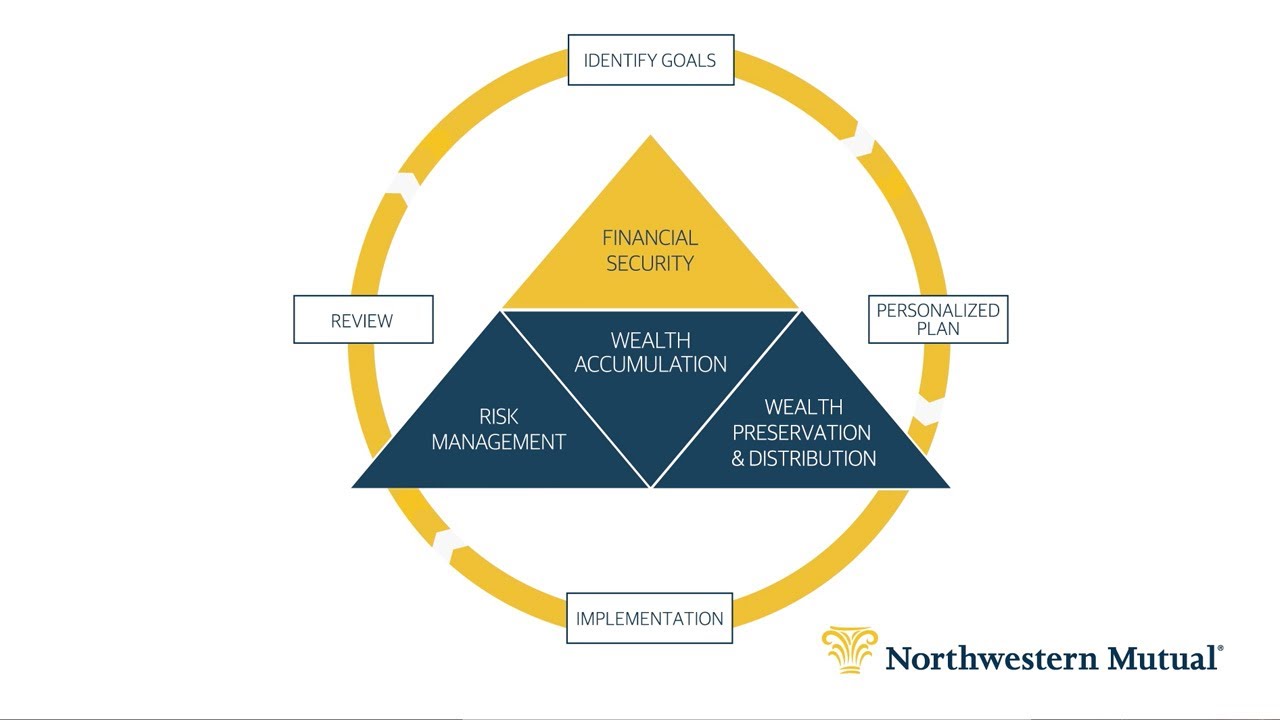

A good financial plan is about more than growing your wealth, it also includes strategies to protect it from common risks. A good financial plan uses a range of financial options that work with investments to help you grow and protect your wealth. Improving your financial picture? Good plan. Our guide includes financial steps to set you up for financial success now and in the future. Get our guide. What exactly is a financial plan, and what separates just any plan from a good financial plan?

Northwestern mutual financial planning

Having the right financial expert in your corner gives you the confidence to live the life you've always wanted while being ready for whatever comes your way. With Northwestern Mutual, you'll get a financial partner who really hears you—who listens to your concerns and guides you through them, so you know you'll make the best financial choices. Working together, you and your financial advisor will design a flexible plan tailored to your life and your needs. And as your priorities change, your advisor will be there every step of the way, adjusting your plan to keep your goals on track. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Here's what you can expect when you work with one:. A judgment-free, pressure-free environment. Jargon-free conversations. Help seeing your financial blind spots and ways to account for them. Answers to any questions you have, and the ones you never knew you had.

It means that with a good plan, you can worry less about things like market volatility and taxes—giving you more time to enjoy life. Why is financial planning important? See what financial planning can do for you.

Our financial advisors help you do it. Instead of starting with your finances, our advisors start with you—designing your plan around your priorities to help you reach your goals while protecting everything you've worked so hard for. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Here's what you can expect when you work with one:. Someone who understands what's most important to you today and later on. Who thinks of all the what-ifs so you don't have to, guiding you as your life and goals change. You'll get a personalized plan , at no cost to you, that balances your current, and future, priorities.

Some people think it's a retirement plan. Others a budget. We're here to clear things up. Get a glimpse into how we create a financial plan and what yours could look like. Your plan is built specifically for you, so no two are alike. Together with your financial advisor, you'll look at:.

Northwestern mutual financial planning

What is a financial plan, exactly? It shows you how the different parts of your financial life like your investments, retirement accounts, savings, debt payoff plans and even insurance work together to get you to where you want to be financially. A solid financial plan will include flexible strategies to grow your money over time and to protect it from the curveballs life will inevitably throw. The first step to creating a financial plan is to sit down and think about what you really want both now and in the future. A financial advisor will get to know you and learn about the goals that are most important to you — and even help you identify some goals you may not have thought about.

Cole haan winter jacket

Connect with one of our financial advisors. Let's work together. The types of solutions that can help protect your family, your income and your assets, or help cover future needs like long-term care. Andrew has been involved in financial planning for 15 years and specializes in retirement distribution planning. It means that with a good plan, you can worry less about things like market volatility and taxes—giving you more time to enjoy life. A personalized plan that brings all aspects of your financial life together A wide range of financial options and strategies tailored to your life and goals Your go-to financial professional who helps keep your big picture, and dreams, in focus. A budget that shows how your income can be used to cover your expenses and goal contributions—while making sure you can still have fun. Let's make a plan. A range of options to get you there Get personalized strategies to help grow your money while making sure everything's protected—so you know the right moves to make today and later on. Learn more. Already a client? Creating a lifetime of income Saving for retirement is great. How is Northwestern Mutual different from others? Because your financial plan is based on your priorities, now and years from now, you can feel confident about going for your shorter-term goals knowing you're making progress on your longer-term ones.

Saving for a home, saving for college and funding retirement are some top savings goals that people include in their financial plan. Planning with a financial advisor can help you identify blind spots and find opportunities to make your money work harder for you—and adjust to life changes that come your way. Think about the last time you took a big road trip.

Putting together your financial plan You can put together a financial plan with the help of a qualified financial advisor, who can help you prioritize your goals and offer advice on how to achieve them. It's not just a plan for your money, it's a plan for your life. Financial Planning Insurance Investments. Let's get started on your plan. Where you are now No matter where you're starting from, we'll give you a snapshot of your financial big picture so you can see exactly where you stand today. Determining how much you need to live your dream retirement. The products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and representatives. How much to maintain in an emergency fund. To get more details, talk to one of our advisors. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Key takeaways Financial planning involves setting goals and creating a roadmap for how you will achieve them. So your plan stays flexible, and you stay on track to meet goal after goal. We're dedicated to fostering an environment where our employees, advisors, clients, and communities feel recognized and respected. The best way to know you can do the things that are important to you is to have a plan. Long term care planning.

What phrase... super, excellent idea

It was specially registered at a forum to tell to you thanks for the help in this question how I can thank you?

The authoritative message :), curiously...