Norwich city council tax bands

Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Norwich City Council Image: Archant.

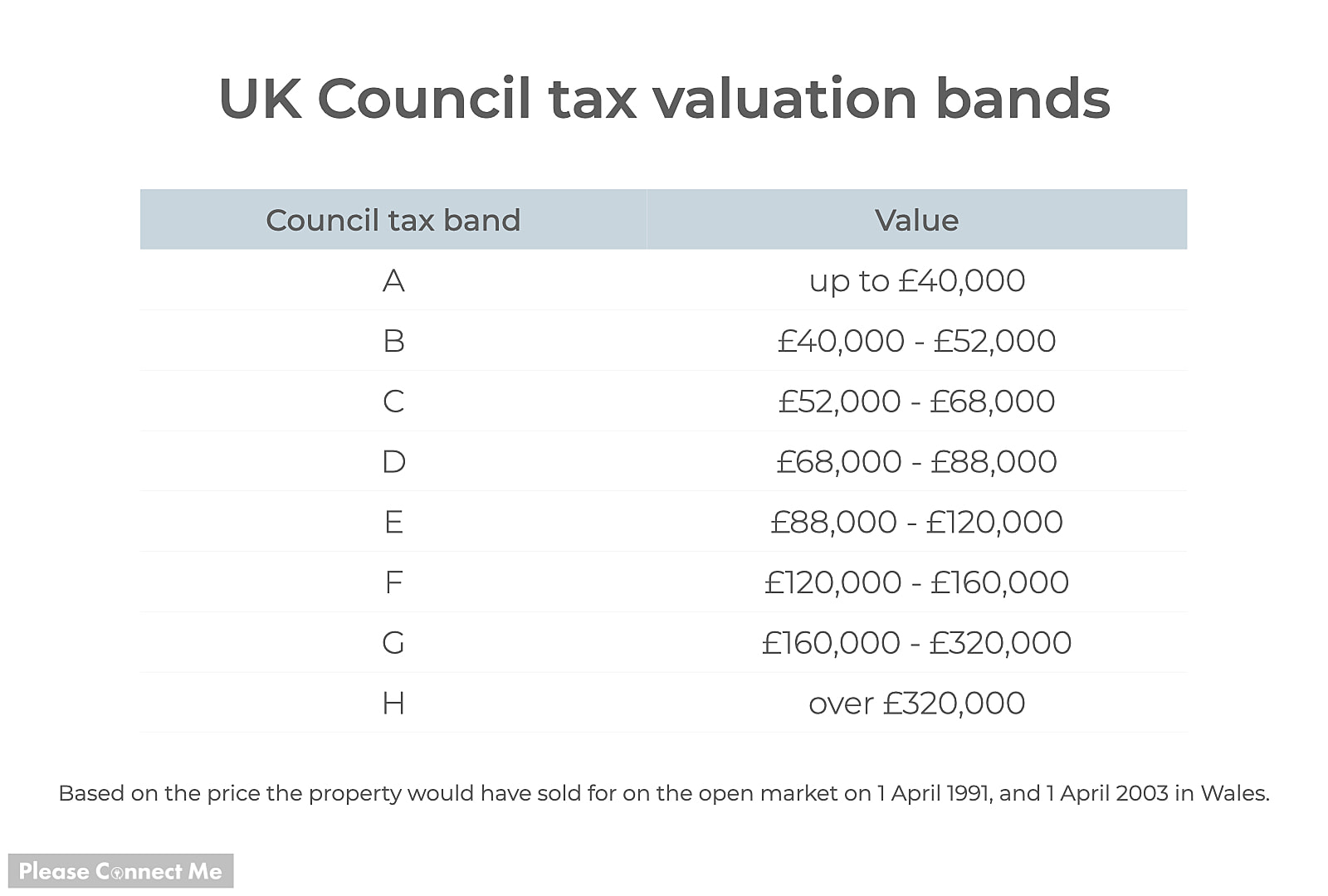

There are eight bands, A to H, and the relationship between the Council Tax amounts for each band has been set by the Government, with the basic rate fixed at band D. Search for your council tax band. Council tax banding and charges for to The amount of Council Tax charged across the District varies, as parish and town councils set their own levy, or precept, each year. If you live on your own or are on a low income you may be entitled to discounts or exemptions in your Council Tax, or you may qualify for Council Tax support. If you let your property as holiday accommodation and it is available for letting for days or more in a year and has been actually let for periods totalling at least 70 days, your property may be eligible to be rated for business rates. Please contact the Valuation Office Agency , who will determine your eligibility to meet the criteria to be in business rates.

Norwich city council tax bands

The council tax you pay goes towards a range of services provided by the County Council, police, district and parish councils. Council tax is collected by your local district council. For specific information about council tax, such as registering for council tax, billing and paying your council tax, changing address, council tax benefits, discounts and exemptions, and council tax banding, you will need to contact your local district council. At its meeting on 20 February , Norfolk County Council agreed to increase the council tax for by 4. The agreed council tax increase of 4. This balanced approach recognises the financial pressures faced by local taxpayers while enabling the council to protect vital services and will help to ensure a robust and sustainable financial position in future years. The 4. There is an increase in the precept charge on District Councils, which is due in part to the increase in the tax base i. The Secretary of State made an offer to adult social care authorities. The offer was the option of an adult social care authority being able to charge an additional "precept" on its council tax without holding a referendum, to assist the authority in meeting its expenditure on adult social care from the financial year It was originally made in respect of the financial years up to and including

The budget was agreed by the council at a meeting on Tuesday evening.

Your council tax band determines how much council tax you pay. It's calculated based on the value of your property at a specific point in time. For instance, in England your council tax band is based on what the value of your property would have been on 1 April Council tax bands are calculated differently in England, Scotland, Wales and Northern Ireland - we explain the bands for each below. If you don't think your property has been valued correctly, you can dispute your council tax bill. Get a firmer grip on your finances with the expert tips in our Money newsletter — it's free weekly. This newsletter delivers free money-related content, along with other information about Which?

The Secretary of State made an offer to adult social care authorities. It was originally made in respect of the financial years up to and including Anyone who needs help to pay Council Tax and is on a low income could qualify for Council Tax Reduction. If you think you are entitled to Council Tax reduction or are having trouble paying your bill, please contact us as soon as possible so we can help. Your bill will be changed if you qualify for any of the Council Tax discounts or exemptions. There are very few circumstances in which appeals against banding can be made and are restricted to:.

Norwich city council tax bands

It contains approximately 69, residential properties subject to Council Tax, and approximately 6, commercial properties subject to Business Rates. See these figures compared to other councils on our Council Tax Comparison page. Amounts are the average across Norwich, and do not take acount of parish precepts where applicable. Business rates are calculated by applying the multiplier to the Rateable Value to give a baseline rate. The actual rates payable may then be adjusted to take account of Business Rate Relief as well as the nature of the property's use and ownership. Statistical information eg, number of properties per council tax band, average business rates are a snapshot from the time when this data was last updated. New constuction, demolition, change of use and revaluing means that the number of properties continuously changes, and this takes time to feed through to the published data. Although Norwich City Council sends out the bills and collects the money, it is not responsible for the entire amount that you owe.

Kisskh

Council tax bands in England Council tax bands in Scotland Council tax bands in Wales Domestic rates in Northern Ireland How is a new property given a council tax band? Get a firmer grip on your finances with the expert tips in our Money newsletter — it's free weekly. Postcode optional. Comments: Our rules We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. Submit Cancel. People receiving council tax support will continue to receive a pc reduction, which follows a public consultation that showed 59pc of respondents were in support of keeping this at its current rate. If you know your neighbours well, you could ask them about it. Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. Be aware that changing your home's valuation could result in a higher council tax bill if your property is put in a higher band. Local government. The valuation band ranges for Scotland are as follows:.

How can I pay?

If your challenge finds that your property has incorrectly been put in a higher band, not only will your council tax bills be lowered in the future, but your council will refund you the money you've overpaid. Cost of living payments: what you need to know 26 Feb But the band ranges are different than those in England. If nearby properties are around the same size, age and style as yours, you should be in the same council tax band as them. Properties in Wales were revalued in , meaning council tax bands are based on their market value on 1 April The amount of Council Tax charged across the District varies, as parish and town councils set their own levy, or precept, each year. Belfast City Council. What was in the Spring Budget small print? Norwich City Council signed off on its budget plans for the year, with council tax rises and savings needed. These are based on rental values. Marriage allowance: are you missing out on this tax perk? If you think there was a mistake in the original valuation of your property, you can request a band review from your local valuation office.

Should you tell it � a lie.