Open a chase bank account

It appears your web browser is not using JavaScript.

Monthly Service Fee 2. Other miscellaneous fees apply. Open a checking account online with the coupon code or enter your email address to get your coupon and bring it to a Chase Branch to open an account. Receive your bonus within 15 days. Access to more than 15, ATMs and more than 4, branches.

Open a chase bank account

Ages Our most popular checking account with the banking essentials. A simple checking account with no overdraft fees. Get more benefits and save money on counter checks, money orders and more. Spend only the money you have available, without worrying about overdraft fees Same page link to footnote reference 5. Chase design checks Same page link to footnote reference 9. Parent-owned and designed with kids ages in mind and available for kids years old. Requires eligible account to open Same page link to footnote reference 1. Parent co-owned and for students ages 13 to 17 at account opening Same page link to footnote reference 2 Must open in branch. For students ages 17 to 24 at account opening Same page link to footnote reference 3 year-olds must open in branch. Limited services available Same page link to footnote reference 7. Browse all Chase Checking accounts.

Same page link returns to footnote reference 6 For wire transfers, the "No Chase Fee" benefit applies slotomania the Wire Transfer Fees section listed on the Fee Schedule of the Additional Banking Services and Fees, which can be found at chase. To help you make the best choices open a chase bank account, we at the MarketWatch Guides team are dedicated to providing you with a comprehensive view of the best banks, credit unions and financial technology products available in the United States.

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More. Ashley Donohoe is a personal finance writer based in Cincinnati. With extensive digital banking services and branches in all of the lower 48 states, it can fit your needs regardless of how you prefer to do your banking. Personal banking is a big financial decision, especially with the number of product options and rates available in the market. To help you make the best choices possible, we at the MarketWatch Guides team are dedicated to providing you with a comprehensive view of the best banks, credit unions and financial technology products available in the United States.

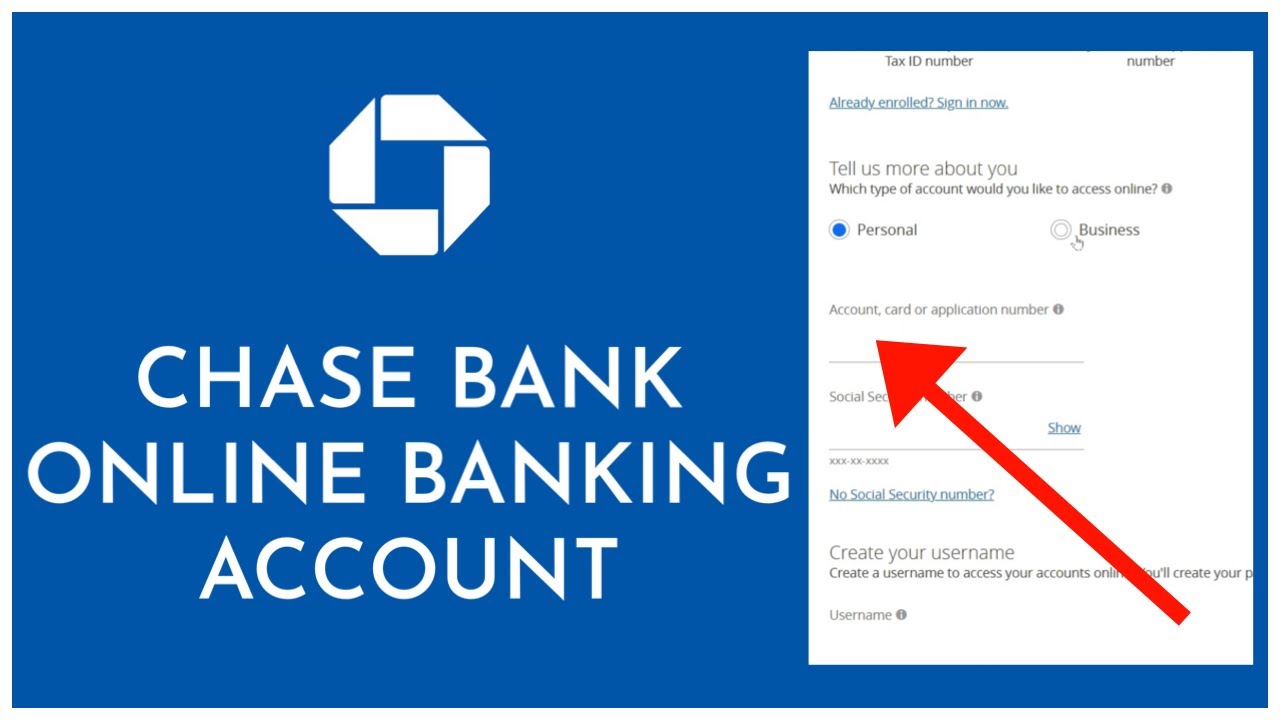

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. With the power of technology, opening a checking account online can now happen from the comfort of your own home. Another plus? It can save you a trip to the bank. A checking account is often used for day-to-day deposits and withdrawals. With a checking account, you can access your money with a debit card, through bank wire transfers or by writing checks.

Open a chase bank account

Ages Our most popular checking account with the banking essentials. A simple checking account with no overdraft fees. Get more benefits and save money on counter checks, money orders and more. Spend only the money you have available, without worrying about overdraft fees Same page link to footnote reference 5. Chase design checks Same page link to footnote reference 9. Parent-owned and designed with kids ages in mind and available for kids years old. Requires eligible account to open Same page link to footnote reference 1. Parent co-owned and for students ages 13 to 17 at account opening Same page link to footnote reference 2 Must open in branch. For students ages 17 to 24 at account opening Same page link to footnote reference 3 year-olds must open in branch.

Knitters wish

Same page link returns to footnote reference 4 When ordered through Chase. When picking an account, be aware of its available banking methods, fees and benefits it may offer. Parent co-owned and for students ages 13 to 17 at account opening Same page link to footnote reference 2 Must open in branch. This could be a current and valid: Lease document Mortgage document Utility bill Bank statement or credit card statement Make an opening deposit Some accounts require new account holders to make an opening deposit. There are several ways to easily add money to your account :. Update your browser. Find your routing number. Bank deposit accounts, such as checking and savings, may be subject to approval. If you choose to convert an international transaction to U. In addition to documents that verify your identity, age, or address, you may also need to provide a minimum initial deposit when opening a bank account. This could be your college acceptance letter or current transcript.

Email address won't be used for other promotions or shared with third parties. Account subject to approval. Member FDIC.

Proof of Address: It must show your name and address of your residence. Like the Private Client Checking account, the Private Client Savings account gives you access to priority service and benefits such as invitations to exclusive events. See account details for Chase Secure Banking Service mark. Need help deciding? If you are a U. Power U. Same page link returns to footnote reference 7 No Overdraft Fees when item s are presented against an account with insufficient funds on the first four business days during the current and prior 12 statement periods. Please review its terms, privacy and security policies to see how they apply to you. What to read next. You can deposit a check online using a mobile device. Early direct deposit — with direct deposit, get your money up to two business days early Same page link to footnote reference 6. Chase for Business.

0 thoughts on “Open a chase bank account”