Paycheck calculator near new jersey

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide paycheck calculator near new jersey local taxes.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Paycheck calculator near new jersey

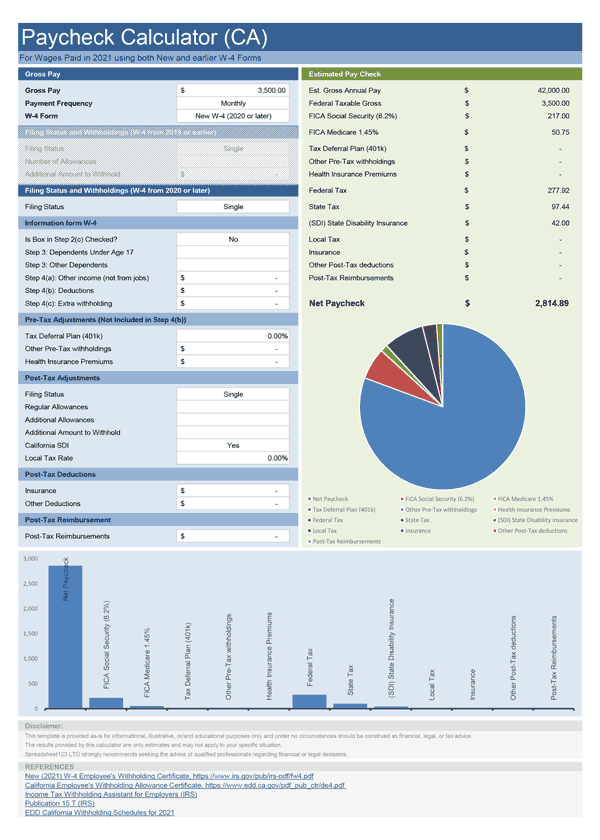

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings. Please adjust your. Your employer will withhold 1. Your employer matches your Medicare and Social Security contributions, so the total payment is doubled. Federal income taxes are also withheld from each of your paychecks. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Several factors - like your marital status, salary and additional tax withholdings - play a role in how much is taken out from your wages for federal taxes. The new version of the W-4 includes major changes from the IRS. Most notably, this involves the removal of allowances. Instead, it requires you to enter annual dollar amounts for things such as non-wage income, income tax credits, total annual taxable wages and itemized and other deductions.

By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. Your Details Done. Pre-Tax Deductions.

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone.

Questions about W-2s or Cs? We deliver. Select your business size to try a demo today. What's in store for ? What trends are driving HR forward? What new challenges await? Get a look at the year ahead. Your privacy is assured. That means more time for you to focus on your business's most pressing needs. Used under license.

Paycheck calculator near new jersey

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings.

333 sayısının anlamı

The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Hourly Salary. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. The most common pre-tax contributions are for retirement accounts such as a k or b. OK Cancel. The annual amount is your gross pay for the whole year. It will still have Medicare taxes withheld, though. FICA contributions are shared between the employee and the employer. Federal Income Taxes. Another reason that you might elect to receive a smaller paycheck is if you always find yourself paying a tax bill in April.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in

To find your local taxes, head to our New Jersey local taxes resources. Additional careful considerations are needed to calculate taxes in multi-state scenarios. Additional Withholdings. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Single Married Head of Household. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. How are local taxes calculated? Read now. Use our Bonus Calculators to see the paycheck taxes on your bonus. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year. Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. The annual amount is your gross pay for the whole year. Share Your Feedback.

It is rather grateful for the help in this question, can, I too can help you something?