Portsmouth tax assessment

The data is provided without warranty of any portsmouth tax assessmenteither expressed or implied, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose. Proprietary Information: Any resale of this information is prohibited, except in accordance with a sublicensing agreement from the City of Portsmouth.

Create a Website Account - Manage notification subscriptions, save form progress and more. The mission of this office is to determine accurate values of all taxable property real, personal, and tangible in a fair, efficient, and cost effective manner in accordance with local and state laws so that the distribution of the tax burden is fair and equitable. The mission is also to effectively and accurately administer the billing, collecting, and accounting of all taxes in a professional, fair, and courteous manner. Skip to Main Content. Do Not Show Again Close. Website Sign In.

Portsmouth tax assessment

.

The drop box is for checks only; no cash, please. I Agree I Disagree.

.

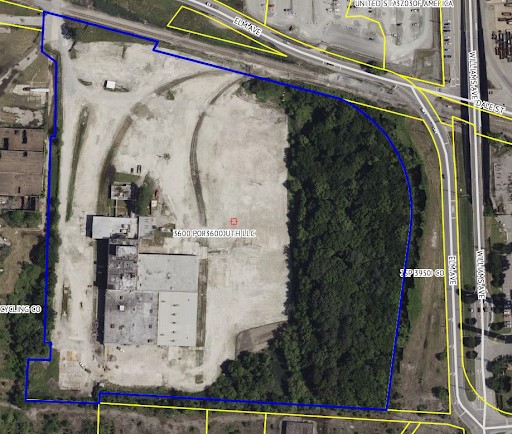

The data is provided without warranty of any kind , either expressed or implied, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose. Proprietary Information: Any resale of this information is prohibited, except in accordance with a sublicensing agreement from the City of Portsmouth. Information shown on the tax maps is derived from public records that are constantly undergoing change and do not replace a site survey. This information is not warranted for content or accuracy. The City does not guarantee the positional or thematic accuracy of the data. The data or cartographic digital files are not a legal representation of any of the features which are depicted. No warranties of any kind nor for any purpose are given. City of Portsmouth, VA. I understand and agree with the information provided above in the disclaimer. I Agree I Disagree.

Portsmouth tax assessment

The Assessor is responsible for identifying and appraising all real property within the city. In order to accomplish this task, the Assessor supervises and directs a staff of appraisers and administrative support personnel. Code of Virginia Title The definition of "fair market value" is: the price which a property will bring when it is offered for sale by one who desires, but is not obliged, to sell it, and is bought by one who is under no necessity of having it. Real property in the city of Portsmouth is evaluated and assessed annually. The annual revaluation is an estimate of fair market value of all city properties as of January 1, and effective July 1, of the tax year. All real property in the city of Portsmouth is locally assessed with the exception of operating railroads, interstate pipelines, and public utilities which are assessed by the State Corporation Commission or by the State Department of Taxation.

Amazing synonym

This information is not warranted for content or accuracy. Box Portsmouth, Virginia Telephone : Fax: assessor portsmouthva. City's Home Page Assessor Home. The mission of this office is to determine accurate values of all taxable property real, personal, and tangible in a fair, efficient, and cost effective manner in accordance with local and state laws so that the distribution of the tax burden is fair and equitable. The project commenced in January There is a seven-business-day grace period without penalty for each payment, but only if current. Information shown on the tax maps is derived from public records that are constantly undergoing change and do not replace a site survey. No warranties of any kind nor for any purpose are given. Proprietary Information: Any resale of this information is prohibited, except in accordance with a sublicensing agreement from the City of Portsmouth. Map 4 characters. Street Number. Street Name. The drop box is for checks only; no cash, please. For your convenience, the town has a tax payment drop box.

Computation of Tax Real Estate taxes are calculated by multiplying the property assessment by the tax rate. City Council determines the real estate tax rate in the Spring of each year. The rate will apply to the upcoming tax year beginning on July 1.

Website Sign In. The box is emptied at a. Do Not Show Again Close. The mission of this office is to determine accurate values of all taxable property real, personal, and tangible in a fair, efficient, and cost effective manner in accordance with local and state laws so that the distribution of the tax burden is fair and equitable. Street Number. Street Name. Skip to Main Content. Create a Website Account - Manage notification subscriptions, save form progress and more. City's Home Page Assessor Home. The mission is also to effectively and accurately administer the billing, collecting, and accounting of all taxes in a professional, fair, and courteous manner. The reassessment project will establish market value as of December 31st, and will be reflected in the tax bills issued in the summer of Vision Government Solutions Inc will complete the state-mandated statistical revaluation program. The project commenced in January City of Portsmouth, VA.

0 thoughts on “Portsmouth tax assessment”