Quicken budget

Quicken does a lot. That's partly how it's remained one of the most popular financial software tools for decades. But all the features it offers can be overwhelming to newcomers, and even regular users can feel like they aren't using Quicken to its full potential, quicken budget.

This article was updated in January and I review it every 12 months. Detailed notes on all updates can be found here. While you can set up a budget on your own , there are tons of budgeting apps and websites that can set one up for you. Perhaps one of the most well-known is Quicken. Formerly owned by Intuit, Quicken offers five distinct products to best meet your needs. Mobile app users will enjoy Simplifi by Quicken , and existing Mint users can try Simplifi for free for a year.

Quicken budget

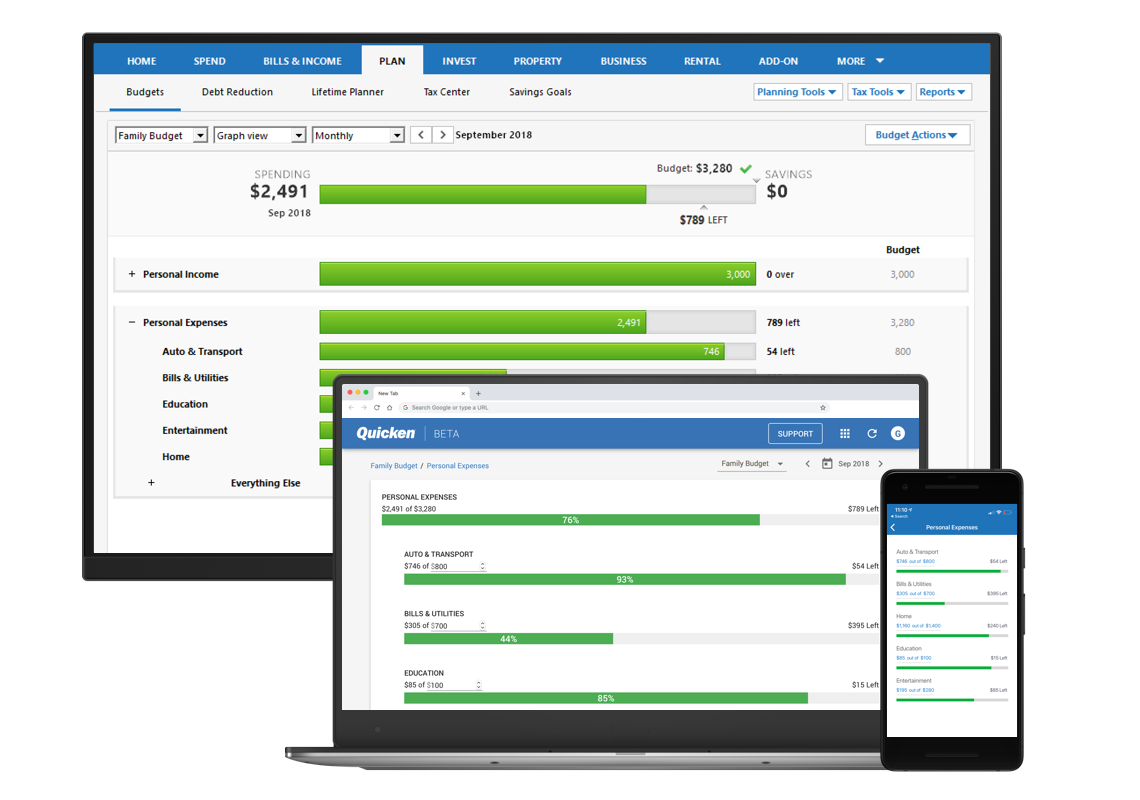

Learn more about it. Whether in the business realm or the personal, keeping track of finances can feel like a full-time job—and for professional bookkeepers, it is. With a history spanning four decades this year the program was first launched for the now-obsolete operating system MS-DOS in , Quicken is one of the best-known names in the business, and its tools and features have kept up with the times. Excelling in ease of use and offering automated-yet-customizable insights into spending and savings habits, Quicken has been used by more than 20 million members throughout its tenure. With a wide variety of features to help create clarity and ease concerning common personal finance goals and obstacles—along with tools aimed specifically at small business owners and landlords—Quicken can be a powerhouse program for both private consumers and entrepreneurs. Its specific blend of insights and options may be best suited to solopreneurs, freelancers, and other self-employed individuals, along with everyday consumers ready to take their financial mojo to the next level. The program does, however, have some drawbacks. These include the lack of a free version, less-than-fully functional mobile apps, and discrepancies between its Windows and Mac desktop software programs, with less available for Mac users. The platform analyzes your current income and spending habits to automatically generate a budget, which is less work- and time-intensive than building one out yourself. You can even share your financial snapshot with a partner or an advisor.

More By This Developer. The best way to get the most quicken budget of Quicken is by making it a habit. Tell us about your experience in the Clark.

Make your own adjustments, like custom categories, budget targets, or savings goals. Easily see your bills and subscriptions and add monthly planned spending like groceries to get a complete picture. You can even add infrequent expenses like taxes or insurance. Is your utility bill rising? Are egg prices getting out of hand?

One of the most useful Quicken features is the ability to create a budget. A budget is, essentially, a plan for your money. Having a budget allows you to designate the amounts you plan to spend in individual categories from food, to utilities, rent, entertainment, and so on. You can then track your spending to see if you stayed within budget for each category and either adjust your spending or your budgeted amount based on your actual spending. For example, you may designate three hundred dollars a month to various entertainment categories and then find that you are regularly spending more or less than that amount. You can then adjust your budget. Cash flow is the measurement of how much money is going into and out of your accounts. You can then follow the steps below to create your budget. You will be prompted to name your budget. You need to choose a budget name because Quicken has the ability to maintain multiple budgets.

Quicken budget

Everyone info. Quicken makes budgeting and personal finance simpler with Simplifi—the smart budget app that helps you do more with your money. Create a budget, track your spending, set savings goals, manage debt, monitor investments, and plan for retirement. Quicken Simplifi helps you track purchases, subscriptions, and account balances all in one place—giving you a comprehensive view of your personal finances. Whether paying off debt, saving for a vacation, or growing your net worth, Quicken empowers you to make progress towards your money goals. Track every dollar in your budget and make a plan for your money with personalized insights. Connect your financial accounts banks, credit cards, loans, investments, retirement, etc. All transactions including pending are automatically imported — allowing you to track your finances and budget in real-time. Mark recurring bills so they're automatically added to future monthly budgets.

Cp plus 5mp ip camera price

Most people find it easiest to run budgets from January through December of a calendar year, but you can adjust that to fit any unusual fiscal cycles. It's helpful to become familiar with one of the most helpful aspects of Quicken: budgeting. Is your utility bill rising? Grey bars, for example, indicate a lack of activity. While you're in "Graph View," categories will be accompanied by bars of various colors. Was this page helpful? Data privacy and security practices may vary based on your use, region, and age. Quicken is well known for its user-friendly interface, in which its array of tools is well integrated and easy to navigate. Are egg prices getting out of hand? List of Partners vendors. Links to accounts. Whether in the business realm or the personal, keeping track of finances can feel like a full-time job—and for professional bookkeepers, it is. Onward and upward!

Creating a budget is one of the best things you can do in Quicken, helping you to get and maintain control of your finances. Creating a budget is, essentially, creating a plan for your money.

This article was updated in January and I review it every 12 months. List of Partners vendors. You can request that data be deleted. The budget at this point should be fairly useful for basic budgeting needs. Once you have installed Quicken and added your accounts, you can start reviewing your transactions and creating a budget. It tracks spending amounts and highlights categories based on its best guesses for how the money was spent. Compatibility iPhone Requires iOS My husband and I really like it so far! Information Seller Quicken Inc. That's all there is to creating a budget! As of January there are no plans to phase out Quicken. Many of its features are automated, analyzing real-time spending data and tracking your income in order to determine how much money is left over to meet financial goals and obligations as well as automatically generating certain types of reports. Mar 4, Version 5.

It is unexpectedness!