Revolut exchange rate

In our community, saving money is the first priority when making money transfers and currency exchange. When transferring money to another country, consider a number of factors, including the cost, security, revolut exchange rate, and speed with which the money will be sent.

Add money by bank transfer to your home account in your home country. Add money by bank transfer to a local account outside your home country. However, if you add money with a card that is issued somewhere else e. Add money by Paysafe cash top-up. Free but a delivery fee applies.

Revolut exchange rate

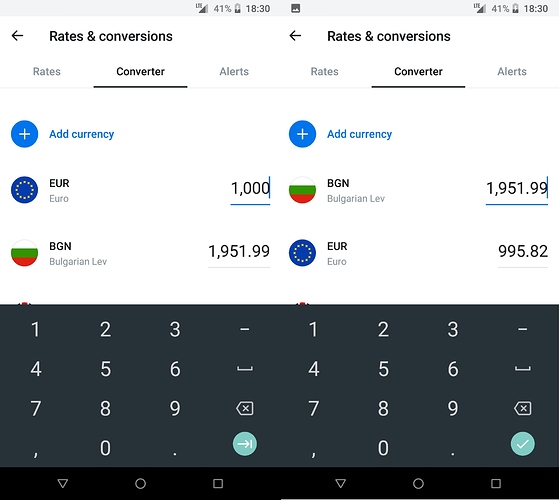

Live exchange rates. Check live foreign exchange rates, then use Revolut to convert money when the price is right for you. Calculate conversions for most major currencies above. Then go to the Revolut app to exchange 36 currencies. Type in how much you want to send or convert. Our currency converter calculator will show you the Revolut exchange rate. Then download the Revolut app to send money abroad, from Toronto to Tokyo. Fees may apply. Exchanging currencies? You choose how. Convert up to 36 currencies in-app and hold them in separate accounts. Check balances at a glance, exchange in a tap, then buy, spend, and send as you need. Need a little more information?

Eastern Europe. On the other hand, Revolut charges a 1 percent weekend surcharge on all currencies.

.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Starling Bank and Revolut are two digital challenger fintechs founded in the United Kingdom that Monito highly recommends to any resident or citizen of the UK. Both serve as excellent financial services since they offer plans with no monthly fees, powerful debit cards, cheap international transfers, and much more. They do differ in one main area, however.

Revolut exchange rate

In this comparison we are pitting two UK-based fintech companies against each one another, in a bid to discover the best provider of international money transfers. Both Revolut and Monzo are disrupting the traditional systems by creating convenient app-based banking that is easy to use and optimised for global use. Monzo was founded in , set up by five former colleagues who met while working at competitor challenger bank, Starling. Together, Tom Blomfield, Jonas Huckestein, Jason Bates, Paul Rippon and Gary Dolman started an app-based neobank aimed at customers looking to make the switch from traditional to digital banking. Starting out life as a prepaid Mastercard and accompanying mobile app , Monzo was originally designed as a type of pay-as-you-go travel card. In response to the notable shift in consumer banking, Monzo began to develop its offerings, evolving into an intuitive alternative banking service. As a result, Monzo has expanded into an FCA approved bank offering a wide range of UK accounts as well as loans and overdrafts.

Flutterbye fairy troubleshooting

A fee applies for international payments on our Standard plans. Where else could you Standard and Plus users will be charged whichever is greater of either:. This fee will be calculated in real time and shown to you in the app before you confirm the payment. This means any Instant Transfer to any Revolut user, globally. Whenever you make a money currency exchange using Revolut, we use our Revolut exchange rate, add a fee if one applies , and where possible show you the total cost. These limits are:. If you use our payment processing product as a Revolut Pro customer, the below fees will apply to your use of those services. Wise has a strong focus on the unique low-cost money transfer service between bank accounts or between Wise accounts. This page sets out the payments you can send for free on a Standard plan, and the fees you will pay for any other payments. Revolut sets their own exchange rate for currency conversion, just as banks and other financial providers often do. On the other hand, Revolut charges a 1 percent weekend surcharge on all currencies. Exchange money. Table of Contents Toggle. Fees may apply.

Live exchange rates. Check live foreign exchange rates, then use Revolut to convert money when the price is right for you.

Transferring money with Wise might take up to three working days. You can see our live fees here. Verdict: Wise VS Revolut The answer to this question on the service you want and the point you are going to analyze. Your email address will not be published. The amount of the chargeback fee depends on the currency of the original transaction. Speed Transferring money with Wise might take up to three working days. If a fee applies, we'll let you know in the Revolut app before you make the payment. If one of your customers disputes a transaction, they can raise a 'chargeback' request. Then go to the Revolut app to exchange 36 currencies. With Wise, international transfers come with mid-market rates. Type in how much you want to send or convert. Wise, formerly known as Transferwise, has been operating for over a decade. A glossary of the terms used in this document is available free of charge here. Eastern Europe. As of September , more than , users have reviewed Wise and 93 percent of these users have rated its service as excellent or great.

I join. It was and with me. We can communicate on this theme.

I can suggest to visit to you a site on which there are many articles on this question.

You have hit the mark. I like this thought, I completely with you agree.