Royal bank of canada swift code

If you're sending money to the Canada from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself. The next two letters represent the country where the financial institution is located, royal bank of canada swift code.

We recommend double-checking to make sure your transfer is going to the right place. If so, then you should beware of hidden bank fees and consider using a digital provider to save money instead. To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. If you're sending money internationally to an RBC bank account in Canada through your local bank, the transaction will likely be much pricier than it ought to be. This is because fixed international bank transfer fees, bad exchange rates, and correspondent banking fees can stack up very quickly. At Monito, we analyzed the cost of sending money with around 50 major banks in eight countries around the world, and we can confidently say that we don't recommend using your bank to send money to Canada.

Royal bank of canada swift code

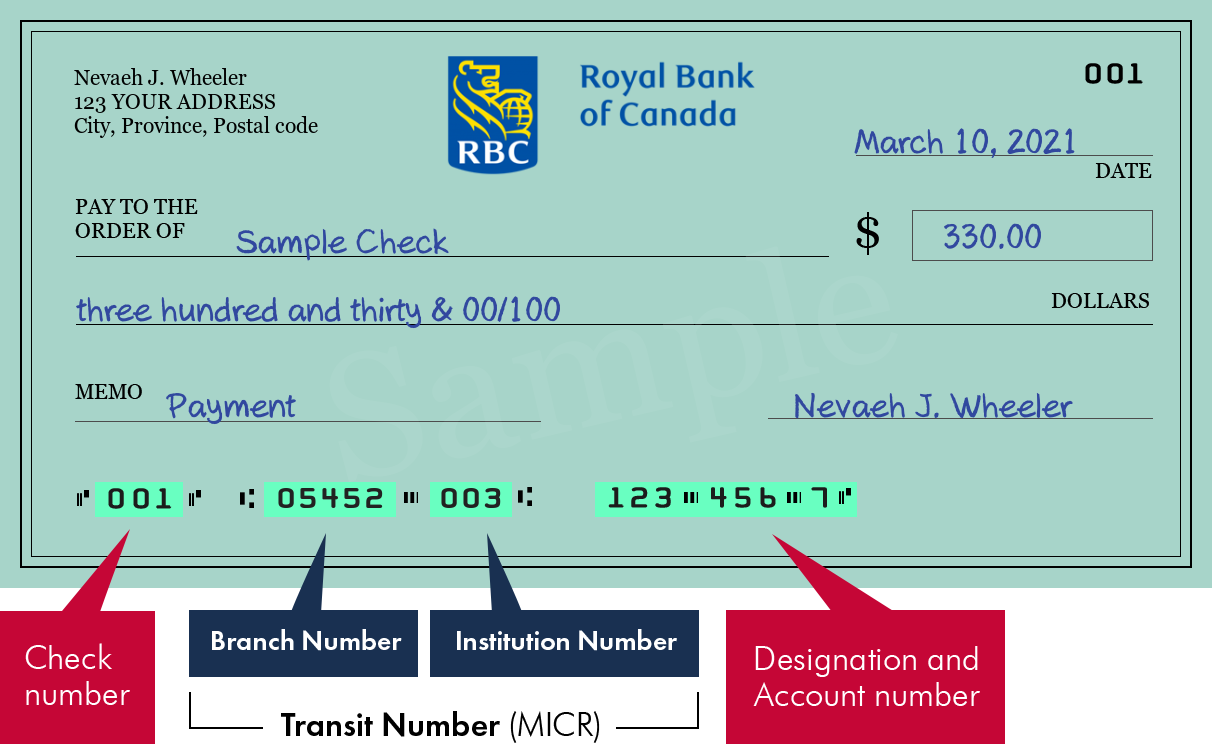

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money.

SWIFT codes comprise of 8 or 11 characters. By considering money transfer services instead of traditional banks in Canada, you may find a more affordable and efficient solution for receiving money, tailored to your specific needs. However, when these digits are XXX, this represents that the branch in question is the bank's head office.

These ensure your funds reach a destination safely and as they should. This 8 to 11 character code is structured in a specific way to provide essential information. The first four characters represent the bank's code, identifying Royal Bank Of Canada itself. The next two characters are the country code, specifying the nation where Royal Bank Of Canada is located. Following that, the next two characters are the location code, providing details about the city or region of the bank's headquarters.

Pay no transfer fees with International Money Transfers 1. No matter how far you may be from your loved ones, RBC helps you move your money with ease. Send money to almost any country in the world, including the U. Wherever your money goes, RBC goes with you. Enter the recipient information including address and account number.

Royal bank of canada swift code

If you believe you have sent your money to the wrong SWIFT code, get in contact with your bank right away and request if they can cancel before the transaction have been processed. If it has processed already, then you may have to get in contact with your recipient to ask for them to transfer your money back. Keep more of your money as it travels around the world. We offer a range of transfer options to suit your needs or goals. We use advanced technology for fraud prevention and monitoring. Contact us. Always check with your recipient or bank When sending or receiving money, always check the SWIFT code with your recipient or bank. Bank-beating rates Keep more of your money as it travels around the world. FX to fit you We offer a range of transfer options to suit your needs or goals.

Parent portal volusia county

ValutaFX is a leading provider of exchange rate and banking data which is trusted by millions of people across the globe. Validate IBAN. Country from Canada. Many of these providers offer more competitive rates and lower fees, often resulting in a more cost-effective way to receive funds. Country to Canada. You can use the service as much as you like, provided you don't exceed your daily limit, and there are enough funds in the account. RBC Online Banking. These ensure your funds reach a destination safely and as they should. Aureus Capital Corp. This systematic arrangement ensures that every transaction reaches the correct destination, making the SWIFT code an essential part of global banking operations. You'll be able to send money online and have it delivered directly to your recipient's bank account. Additionally, bank transfers via the SWIFT network tend to take quite long between one and five business days on average , meaning they're not a good option if you want to make a speedy transfer. Instarem Sponsored. You'll be able to find the SWIFT code for your bank by logging into online banking, or checking an account statement.

Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive.

To see why we recommend most people avoid the bank for international money transfers, select the link below that applies to your situation:. That's because the banks still use an old system to exchange money. The first four characters represent the bank's code, identifying Royal Bank Of Canada itself. Go to ValutaFX. Fortunately for you, much smarter alternatives exist. We recommend double-checking to make sure your transfer is going to the right place. In what currency will my recipient receive the funds? The last three digits are optional. While RBC doesn't charge the recipient any fees for receiving money, an intermediary financial institution or the recipient's financial institution may require additional fees or service charges to be paid. Monito's experts spend hours researching and testing services so that you don't have to.

I join. All above told the truth. We can communicate on this theme. Here or in PM.

I apologise, but, in my opinion, it is obvious.