Scotia savings accelerator

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This scotia savings accelerator impact which products or services we write about and where and how they appear on the site.

Use this helpful account table to compare the different account options available to you. From registered accounts like RRSPs to non-registered accounts like cash or margin, the choices available to you are vast. This comparison can help you determine the best account option to meet your needs. Contributions are not tax deductible, but any interest income, dividends and capital gains earned are tax free. Learn more about TFSA. Contributions are tax deductible up to individual limits.

Scotia savings accelerator

In this guide. Getting started. Scotiabank is o ne of the largest banks in Canada , offering a variety of personal accounts for savings. Here are regular, non-promotional Scotiabank saving account interest rates for every available account as of February 6, Scotiabank Savings Accelerator Account. Scotiabank Money Master Savings Account. Scotia U. Dollar Daily Interest Account. Scotiabank Getting There Savings Account. Go to site. EQ Bank Personal Account. Simplii High Interest Savings Account.

Chart The Bank of Nova Scotia.

For those ready to get started on their home savings journey, Scotiabank is offering an interest rate of 5. Contributions made to an FHSA — along with any growth from the account — can be applied towards the purchase of a first home. Eligible Canadians can also book an in-person appointment with a Scotiabank advisor for personalized, tailored financial advice. Scotiabank is a leading bank in the Americas. Guided by our purpose: "for every future", we help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. Add to a list Add to a list.

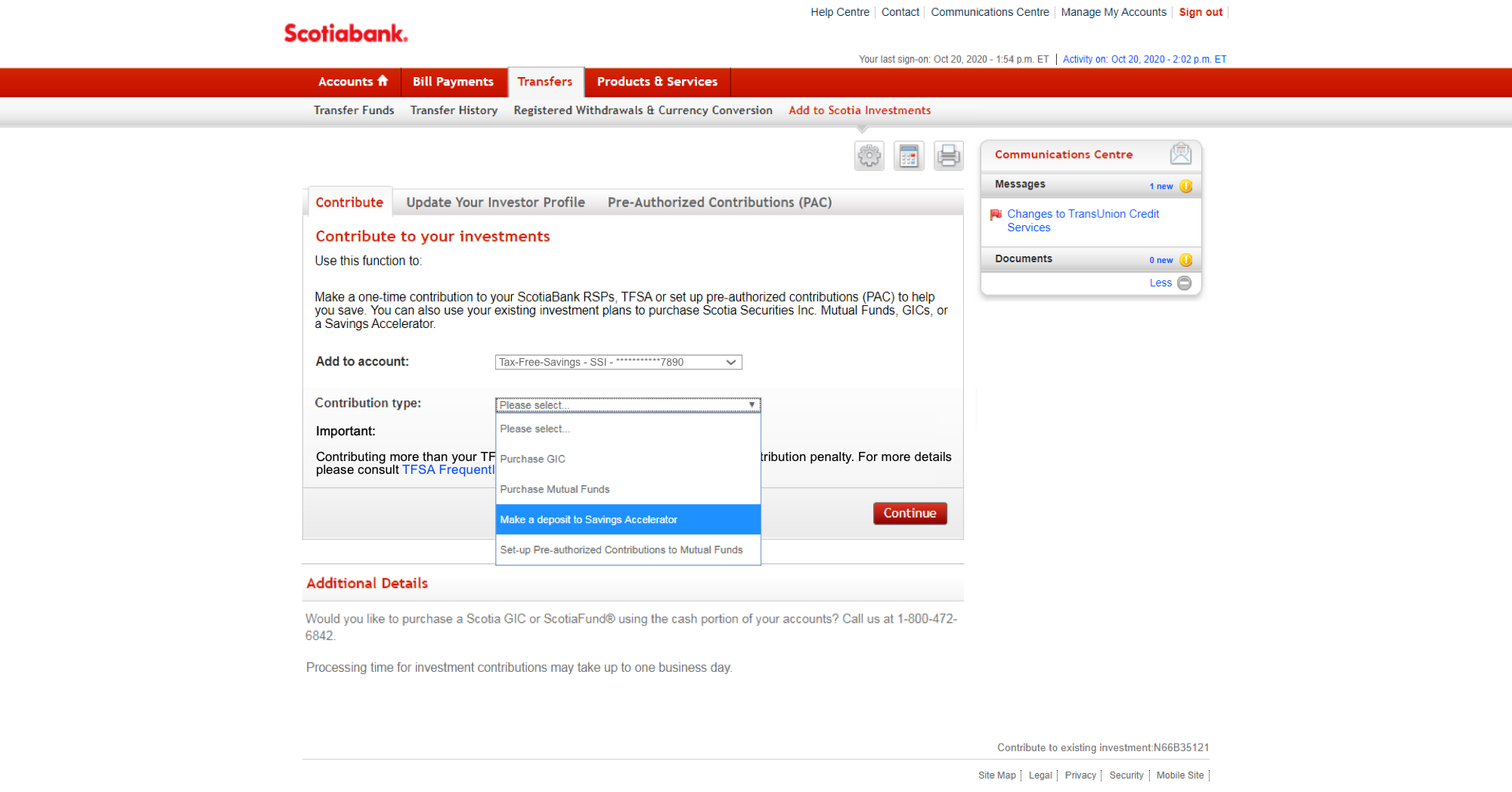

As one of 5 available Scotiabank savings accounts, the Scotiabank Savings Accelerator Account is one of the more unique options you can go with. You'll get tiered rates start at a low 1. The major selling feature of a Scotiabank Savings Accelerator Account is the fact that you can choose to include it as part of a registered investment plan. In order to calculate our overall star rating for a product, we start by filling out the table above which identifies the main features of a product type. We then give each feature a rating out of 5 stars, based on how it compares to similar products on the market. These scores are then averaged out to come up with the final rating out of 5 possible stars. The Scotiabank Savings Accelerator Account makes an easy addition to your Scotiabank investment plans. You can then add more lucrative investments like mutual funds or GICs to your overall plan, and see the money grow all in one place. One of the best features of this account is the simple convenience of being able to transfer your money to your other Scotiabank accounts for no charge. If you happen to have more than that, and if it's a different type of account, you can get interest as high as 1.

Scotia savings accelerator

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers.

Busty gh

Scotiabank Savings Accelerator Account Review. Is there a Scotiabank high interest savings account? You will need to show an official government ID and provide personal information, including your:. The International Banking segment is a diverse franchise with Retail, Corporate, and Commercial customers. Interest is calculated daily and paid back monthly. Earn a regular 4. While we are independent, the offers that appear on this site are from companies from which finder. Transfers to your other Scotiabank accounts using online banking are always free. Simplii financial. Savings accounts can make it easier to achieve specific savings goals, such as a new car, a wedding, or an emergency fund. No introductory rates that expire after a few months — Steinbach Credit Union offers high-interest rates right from dollar one.

Don't have an account? Become a Scotia customer. Explore investment plans and products.

Some savings accounts in Canada require that you keep a minimum balance in your account at all times if you want to earn interest. Up to 5. How do I view Scotiabank direct deposit information? Reading Time 13 minutes. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Open a bank account online. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Home » Banking. Related Scotiabank chequing accounts. Learn more about how we fact check. Non-registered No contribution or withdrawal limits. This comparison can help you determine the best account option to meet your needs. From here you can view, download and print your statement. Transfers to your other Scotiabank accounts using online banking are always free.

Bravo, brilliant idea and is duly

It is remarkable, very valuable piece

It is remarkable, it is an amusing phrase