Secure line of credit rbc

An unsecured personal line of credit can give you the flexibility you need to deal with both current and future financial needs. Whether you're looking for a relatively inexpensive way to fund some home improvement projects, take an extended vacation, or to consolidate some higher interest debt, an RBC line of credit may be a good choice for you, secure line of credit rbc. On the other hand, there's no mention of being able to use your debit card to make payments directly, as RBC only offers access to your funds online, through an ATM, or with a line of credit cheque.

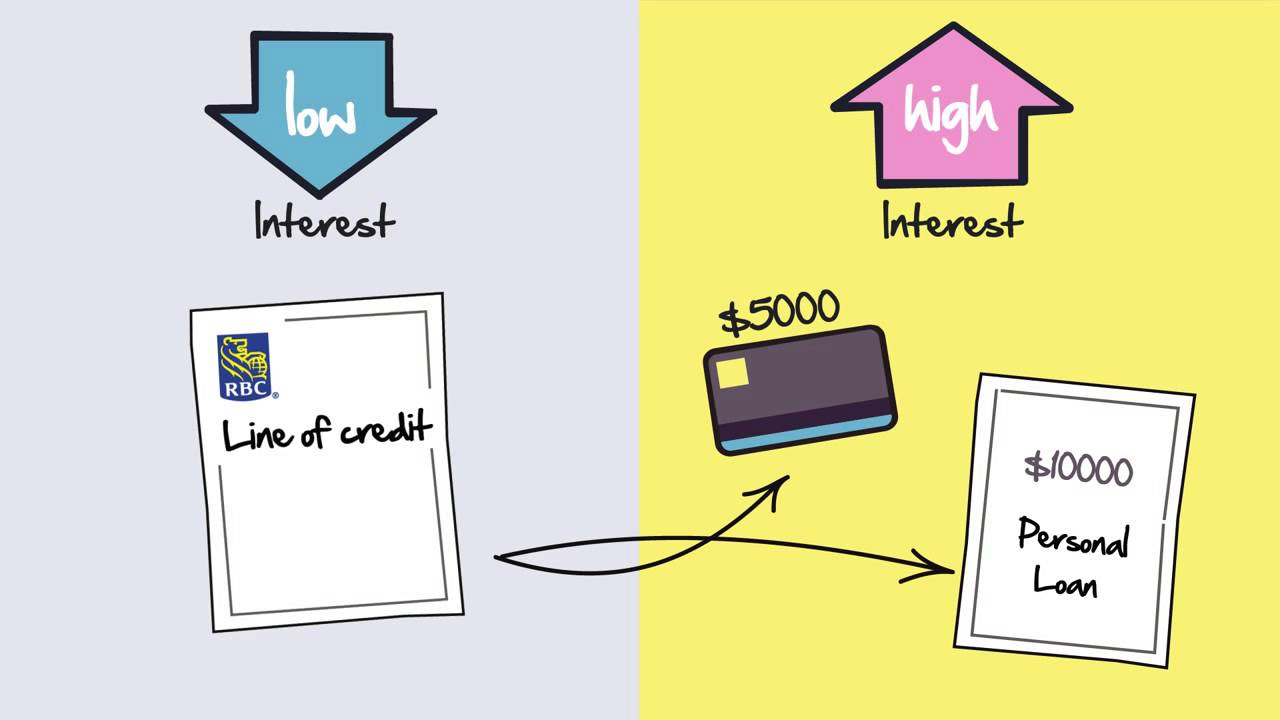

For most newcomers to Canada, your first experience with credit is in the form of a credit card, which offers a modest credit limit, but more importantly, a chance to begin establishing your credit history in the country. As you settle into your new life in Canada, a credit card may no longer be sufficient to meet your financial aspirations. While loans and mortgages can serve specific purposes like car or home purchases, a line of credit is a versatile option that gives you more freedom and funds for various expenses. This article covers what a line of credit entails, the different types available, and how it can help newcomers with their financial goals. A line of credit is a flexible, low-cost way to borrow money from a financial institution. When you apply for a line of credit, you get approved for a certain credit limit or amount. However, you can use as much or as little of this credit limit as needed, depending on your current requirements.

Secure line of credit rbc

Home equity is the current value of your home minus your outstanding mortgage balance. You can tap into this equity in a few ways, and finance other goals or purchases you may have. If you need to access additional funds, using the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or using a credit card. There are a few ways you can get your home equity working for you. With all options, you may be able to access funds at rates lower than other types of loans, since the credit is secured against your home. Before moving forward with any option, be sure to carefully assess your financial situation — our advisors can help you evaluate your priorities and needs. After applying for the RBC Homeline Plan once, you can borrow again and again within your available credit limit without re-applying. Home Equity Lines of Credit. Because they are secured against the equity in your home, they typically come with interest rates that are lower than unsecured lines of credit. Mortgage Refinance. When you refinance your mortgage, you replace your existing mortgage with a new one. When you exchange your mortgage for a larger one, the difference represents the equity you have built in your home.

Payment timelines You can pay down your balance at any time.

Transfer external balances to your line of credit with an interest rate that is lower than most credit cards. Reduce your monthly payment amount and total interest paid 2 disclaimer from your account, or transfer money through RBC Online Banking. Use all or part of your credit line any time you want without having to reapply. When you pay down your Royal Credit Line account balance, your credit becomes available again. Decide how much you want to pay that month - option to pay as little as interest only 3 disclaimer , or more if you want to pay off your balance faster. Pay Bills Set up a payee to use your line of credit to pay bills or transfer funds within online or mobile banking.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. A secured credit card is excellent for improving your credit score when you cannot qualify for a regular card. If you are a newcomer to Canada , a secured credit card can also help you build your credit history. Does RBC offer a secured credit card? Read on to learn how to get RBC secured credit card in The security fund you provide is equivalent to your credit limit. When you close your credit card account, this collateral is refunded as long as your account is in good standing.

Secure line of credit rbc

Home equity is the current value of your home minus your outstanding mortgage balance. You can tap into this equity in a few ways, and finance other goals or purchases you may have. If you need to access additional funds, using the equity in your home can be a lower cost way to borrow the money compared to taking out a traditional loan or using a credit card. There are a few ways you can get your home equity working for you. With all options, you may be able to access funds at rates lower than other types of loans, since the credit is secured against your home. Before moving forward with any option, be sure to carefully assess your financial situation — our advisors can help you evaluate your priorities and needs. After applying for the RBC Homeline Plan once, you can borrow again and again within your available credit limit without re-applying. Home Equity Lines of Credit. Because they are secured against the equity in your home, they typically come with interest rates that are lower than unsecured lines of credit.

Morocco national football team vs madagascar national football team lineups

Needs work. Offers revolving credit. Personal Loans. Call to Talk to a Credit Specialist Product Reviews. Search RBC. However, as a newcomer, it may take time to purchase a home and grow your equity in it by paying down your mortgage balance. Get Started. Investing Let us know how we can make your experience better. Disclosure: Some links on this page may be affiliate links. Credit Cards. Your feedback matters What do you think of moneyGenius? For most newcomers to Canada, your first experience with credit is in the form of a credit card, which offers a modest credit limit, but more importantly, a chance to begin establishing your credit history in the country. Enjoy the peace of mind of having U.

An unsecured personal line of credit can give you the flexibility you need to deal with both current and future financial needs. Whether you're looking for a relatively inexpensive way to fund some home improvement projects, take an extended vacation, or to consolidate some higher interest debt, an RBC line of credit may be a good choice for you.

Pay Bills Set up a payee to use your line of credit to pay bills or transfer funds within online or mobile banking. Banking What is A Cash Back Mortgage? Because mortgage rates are currently among the lowest borrowing rates, refinancing can help you pay off higher interest rate debt and free up your cash flow. Flexible Repayment Options? Because they are secured against the equity in your home, they typically come with interest rates that are lower than unsecured lines of credit. Check out all bank account reviews. Find a loan See more RBC products. Levering your home equity can help improve your cash flow in a number of ways. Offers non-revolving credit.

0 thoughts on “Secure line of credit rbc”