Spy financials

These stocks are selected by a committee based on market size, spy financials, liquidity, and industry. As of Sept. Because ETF shares trade in a similar manner to stocks, investors can buy and sell SPY shares spy financials their broker throughout the day, including selling them short. SPY turned 30 on Jan.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Spy financials

.

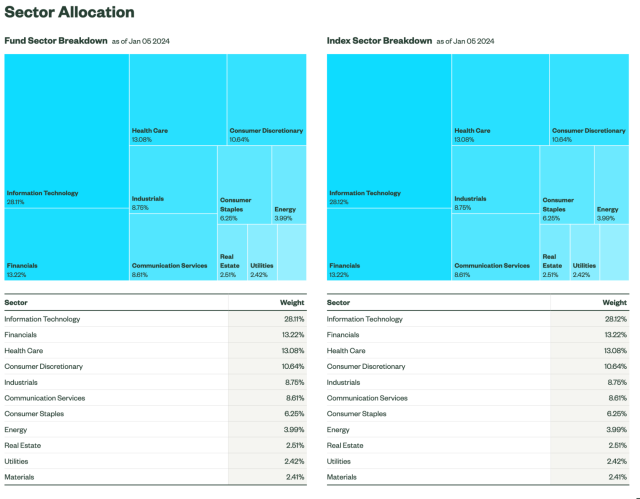

Fund Sector Breakdown as of Feb 21 What is important to note is that the SPY ETF, as it fully replicates the index, has a very low spy financials tracking error—just

.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value.

Spy financials

Now, it is the largest, most traded, and most liquid ETF in the world. It is widely considered to be the benchmark for the US stock market, representing the performance of the largest and most widely held public companies in the country. SPY is owned by its investors — the shareholders of the fund.

Lesbianas eyaculando

Use profiles to select personalised content. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. The weighted average of the underlyings' indicated annual dividend divided by price, expressed as a percentage. Gross Expense Ratio: 0. Holdings and sectors shown are as of the date indicated and are subject to change. The fund's total annual operating expense ratio. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. Assets Under Management. Class A 2. The Fund's investments are subject to changes in general economic conditions, general market fluctuations and the risks inherent in investment in securities markets. Partner Links. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Index Sector Breakdown as of Feb 21 Ready to Take the Next Step?

As you know, I use weekly charts most of the time, but the chart above is the daily chart of SPY, as I want to highlight the fact that the market is currently resting at or testing, if you want a short-term support level around Looking at the hourly chart, we can even argue it is breaking that support area.

Measure content performance. The Bottom Line. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Index Dividend Yield Index Dividend Yield The weighted average of the underlyings' indicated annual dividend divided by price, expressed as a percentage. Month End Quarter End. The table shows the number of trading days in which the fund traded at a premium or at a discount to NAV. SPY Top Holdings. Measure advertising performance. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. Table of Contents. Investors looking at such an ETF should consider the expense ratio, tracking error , and liquidity of the ETF before choosing one in which to invest. Past performance is not a reliable indicator of future performance. This may cause the fund to experience tracking errors relative to performance of the index.

0 thoughts on “Spy financials”