Standard deviation investopedia

Call Us: Course Info Enroll. The most frequently used measurement of investment risk is standard deviation. The measurement is used in math and science; it is calculated using a series of numbers, standard deviation investopedia.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Standard deviation investopedia

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Standard deviation SD measures the amount of variability, or dispersion , from the individual data values to the mean.

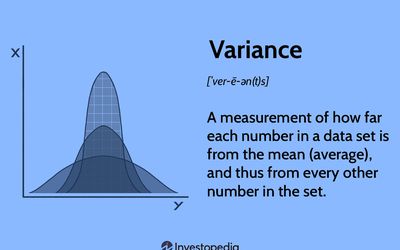

The variance is determined by subtracting the mean's value from each data point, resulting in

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Standard deviation investopedia

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Gym in al nahda dubai

The variance of an asset may not be a reliable metric. Investment firms report the standard deviation of their mutual funds and other products. Some argue that average deviation, or mean absolute deviation, is a better gauge of variability when there are distant outliers or the data is not well distributed. It is also used to gauge volatility in markets and financial instruments, but it is used less frequently than standard deviation. You can calculate the variance by taking the difference between each point and the mean. In addition, and unlike other means of observation, the standard deviation can be used in further algebraic computations. Compare Accounts. Investors use variance to assess the risk or volatility associated with assets by comparing their performance within a portfolio to the mean. This compensation may impact how and where listings appear. Use limited data to select content. These choices will be signaled to our partners and will not affect browsing data. For a given data set, standard deviation measures how spread out the numbers are from an average value. Variance is a statistical measurement used to determine how far each number is from the mean and from every other number in the set.

Use limited data to select advertising. Create profiles for personalised advertising.

The standard error of the mean is the standard deviation of the sampling distribution of the mean. However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset. Table of Contents. Now we have to figure out the average or mean of these squared values to get the variance. Partner Links. Variance is derived by taking the mean of the data points, subtracting the mean from each data point individually, squaring each of these results, and then taking another mean of these squares. Standard deviation is calculated by first subtracting the mean from each value, and then squaring, adding, and averaging the differences to produce the variance. Create profiles to personalise content. What Is Variance in Statistics? Measure content performance. On the other hand, one can expect aggressive growth funds to have a high standard deviation from relative stock indices, as their portfolio managers make aggressive bets to generate higher-than-average returns. Discover more about risk measures here. SEM is calculated simply by taking the standard deviation and dividing it by the square root of the sample size. Consider leveraging Excel when calculating standard deviation. Then square and average the results.

0 thoughts on “Standard deviation investopedia”