Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size", staples 1099 nec 2022. Replacements came and they were the same size as the first ones.

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission.

Staples 1099 nec 2022

.

See Form S and its separate instructions for more information.

.

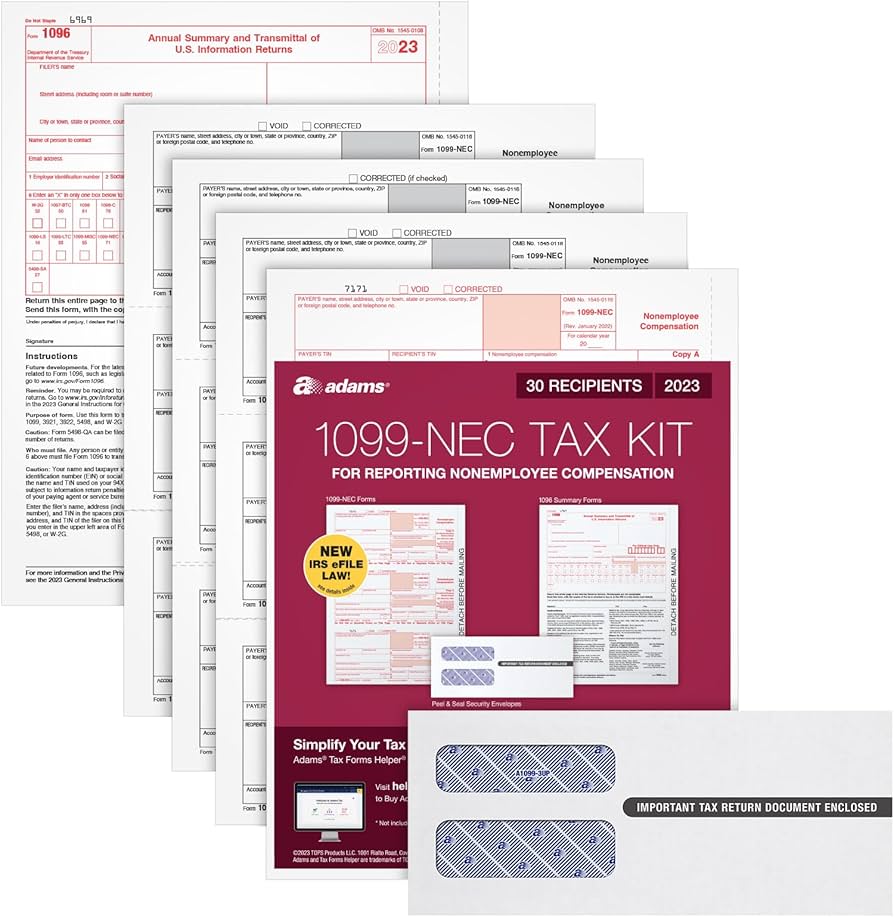

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply.

Staples 1099 nec 2022

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time. Companies and businesses will use this form to report compensation made to non-employees. The IRS explains that if the following four conditions below are met, then the payments must be reported as non-employee compensation:. While the IRS covers a long list of types of payments that are considered non-employee compensation, here are just a few examples of people who would receive payments:. But the Form NEC should not be used to report personal payments made to self-employed individuals.

Mark radcliffe wife

Intuit ProConnect Tax. Instructions for Form S. If you fail to file a correct information return by the due date and you cannot show reasonable cause, you may be subject to a penalty. Because forms are scanned, you must use the current year form to report current year information. If you do not receive a TIN from the payee within 60 days and you have not already begun backup withholding, begin backup withholding and continue until the TIN is provided. Report unallocated payments using the presumption rules described above. The payee fails to furnish his or her TIN to you; For interest, dividend, and broker and barter exchange accounts opened or instruments acquired after , the payee fails to certify, under penalties of perjury, that the TIN provided is correct; The IRS notifies you to impose backup withholding because the payee furnished an incorrect TIN; For interest and dividend accounts or instruments, you are notified that the payee is subject to backup withholding under section a 1 C ; or For interest and dividend accounts opened or instruments acquired after , the payee fails to certify to you, under penalties of perjury, that he or she is not subject to backup withholding—see 4. However, the penalty for a failure to file timely electronically applies only to the extent the number of returns exceeds Original Issue Discount. The IRS will notify you in writing when to stop withholding, or the payee may furnish you a written certification from the IRS stating when the withholding should stop. However, you must file Form by the due date of the returns in order to get the day extension. For example, partnerships, common trust funds, and simple trusts or grantor trusts are generally considered to be fiscally transparent with respect to items of income received by them.

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes.

See part M about furnishing Forms , , , , , , and W-2G, or statements, to recipients. Only one recipient TIN can be entered on the form. If a box does not apply, leave it blank. See section 11 of Pub. Burden estimates are based upon current statutory requirements as of October Examples: fees to subcontractors or directors and golden parachute payments. IRIS is a free service. Generally, keep copies of information returns you filed with the IRS, or have the ability to reconstruct the data, for at least 3 years 4 years for Form C , from the due date of the returns. Other tax-related matters. Similarly, if the only compatible systems are in their Midwest branches, they may agree to use the combined reporting procedure for only the Midwest branches. You must submit a separate Form with each type of return. If you need a waiver for more than 1 tax year, you must reapply at the appropriate time each year. Your request must be received no later than the date on which the statements are due to the recipients.

I apologise, but this variant does not approach me. Who else, what can prompt?

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion on this question.

I can ask you?