Support and resistance indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it.

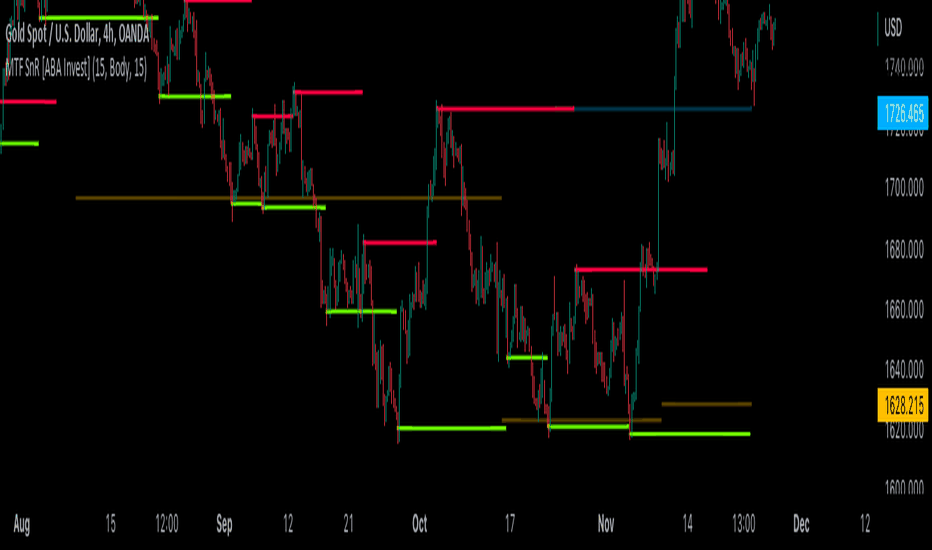

This indicator provides you with 55 levels! Choose from levels as low as the 5 minute time frame all the way up to days. This new indicator can render order blocks with their volumetric information. It's highly customizable with detection, invalidation and style settings. This new indicator can render breaker blocks with their volumetric information. Ability to change amount of pivot points that used to generate trend lines or The VWAP Range indicator is a highly versatile and innovative tool designed with trading signals for trading the supply and demand within consolidation ranges.

Support and resistance indicator tradingview

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. This innovative tool operates across three distinct timeframes, offering a comprehensive view of market dynamics to help you make informed trading decisions. By combining data from three different timeframes, this indicator provides a holistic perspective on market trends and key levels. The adaptive nature of this tool ensures a dynamic assessment of support and resistance zones, empowering traders to adapt to changing market conditions efficiently. You can increase the strength up to 4.

By combining data from three different timeframes, this indicator provides a holistic perspective on market trends and support and resistance indicator tradingview levels. Added user option to select the number of SR zones back to display on the chart for each time frame. These two together can help provide an indication of market sentiment and price trends for the day.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Support and resistance indicator tradingview

The ICT Killzones Toolkit is a comprehensive set of tools designed to assist traders in identifying key trading zones and patterns within the market. In the event of a Liquidity Sweep a Sweep Area is created which may provide further areas of interest. This would now be looked upon for potential support or resistance.

Handsome siblings cast

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Indicators, Strategies and Libraries. Alerts are included for the occurrence of a new target as well as for reached targets. You can favorite it to use it on a chart. This option is going to be especially useful when using the feature described next. Session Sweeps [LuxAlgo]. The indicator offers a large variety of features LuxAlgo Wizard. You may use it for free, but reuse of this code in a publication is governed by House Rules. Users can display a series of two targets, one for crossover events and another one for crossunder event. Revision should be set to 7 in pine editor, then add to chart.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules.

Previous Key Levels [UAlgo]. Catching Trend Reversals by shorting tops and buying bottoms. By doing so, we may hope to achieve an Adaptive Oscillator which can help display when the price is deviating from Added extensions to active SR Zones to extend all the way right. Trading Rules for Sells, Buys are reversed 1. Read more in the Terms of Use. The Targets For Overlay Indicators is a useful utility tool able to display targets during crossings made between the price and external indicators on the user chart. Now it will only draw one zone and one label if chart time frame is same as one selected in settings. Remove from favorite indicators Add to favorite indicators. If you have any suggestions or features you would like to see, just let me know in the comment section. Read more in the Terms of Use.

I think, that you have deceived.