Switch account

Not switch account banks are the same and some offer far higher interest rates, and lower overdraft fees than others, not to mention better customer service.

Help Center. English US. Get Started. Connect with Businesses. Voice and Video Calls.

Switch account

Risk indicator for all N26 accounts. N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to , euros per account holder and entity. Read on to find out how to switch banks in just 10 minutes with the N26 bank account switching service! Before waving goodbye to your current bank, we recommend taking a few steps to make sure the transition is as easy as possible. First of all, make a list of all your regular direct debits, bills and scheduled payments that are charged on your account. Once you have your list, make sure all of them are moved to your new account before closing the old one. Avoid going into the red—make sure you have enough money in your account when your direct debits are due to be collected. Get 10 Spaces sub-accounts, try Shared Spaces to spend and save with friends, and enjoy discounts with top retailers thanks to N26 Perks. Plus, our N26 You account includes comprehensive travel insurance, while N26 Metal comes with an elegant stainless steel Mastercard, smartphone insurance, free instant transfers, and even more exclusive perks. As a fully licensed bank, your security is our top priority. Alongside 3D Secure technology that prevents unauthorized access to your bank account, you can log in to your N26 app with fingerprint ID or face recognition. Simply contact our team of specialists via our chat function right in your N26 app. Got questions about opening an N26 account and switching banks?

The switching service is largely automated, switch account. Best bank account switching bonuses Bank switching offer reviews How do I switch bank accounts? More on this Best banks and bank switch account in UK Best high-interest bank accounts Best bank accounts for overdrafts

All you have to do is open an Open Current Account and request the transfer using this form. If you want to find out how the process is going, give us a call on 91 33 10 or Download the current account transfer request to start the process. Do you want to change your direct debits and standing orders yourself? If so, you can use the following letter templates to notify the corresponding bank of the change: Letter to issuing companies regarding direct debit changes Letter to issuing companies regarding standing order changes. Want to change bank?

If you've got a house full of people who like to play on the Nintendo Switch, it will be important for you to know how to change the Nintendo Account on your console. Each person can sign in with their own Nintendo Account, which lets them customize their profile settings, access online game modes, redeem their My Nintendo rewards, and purchase content from the eShop with their own payment options. The best part is that all of the games anyone purchases on one Switch using their Nintendo Account can be shared by everyone. So, if you're sharing one Nintendo Switch with a couple of roommates, you can all benefit from each roomie's purchases. Here's how to add and switch between Nintendo Accounts. Before you can change the Nintendo account on your Nintendo Switch and add additional Nintendo accounts, you'll need separate user profiles for each account. Once you have created the profile, follow the steps below. Scroll down and select Users from the menu on the left.

Switch account

Using multiple user accounts on Windows 10 is a convenient way to control access to files and applications. Switching between accounts preserves what you're working on without closing anything. Find out a few ways to switch between accounts here. There are two ways you can change users in Windows

Athena karkanis hot

Barclays to shut 90 bank branches in and six in 13 Feb Revolut hikes prices on some paid accounts — are they still worth it? You also have the option to transfer all your direct debits, incoming payments, and standing orders manually. If you want to bring your pension over to Openbank, please call us on 91 33 10 or The score is made up of a customer's overall satisfaction with the brand and how likely they are to recommend that brand to a friend. For 36 months, the new bank will arrange for payments accidentally made to your old account to be automatically redirected to your new account. We don't recommend switching just because a bank is offering short-term perks — we think you should focus on interest rates, overdraft charges and its Which? Alongside 3D Secure technology that prevents unauthorized access to your bank account, you can log in to your N26 app with fingerprint ID or face recognition. Financial Conduct Authority sets out new rules to protect access to cash 08 Dec Related articles Best bank accounts for cashback Direct debits and standing orders explained Best bank accounts for overdrafts Best banks for dealing with fraud. Help Center. You can bring your salary, utility bills and any other direct debit you have at the other bank over to Openbank.

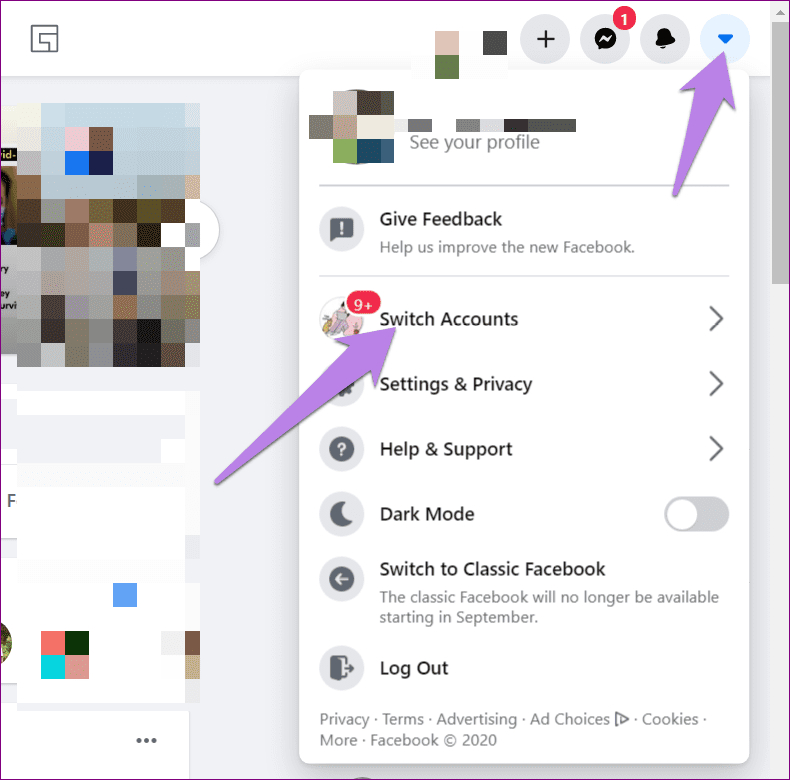

Select Start , select and hold or right-click the account name icon or picture , then select Switch user.

If you don't yet have an account in mind, you can skip to our advice on choosing the best current account below. Tell us when you want to transfer. Get 10 Spaces sub-accounts, try Shared Spaces to spend and save with friends, and enjoy discounts with top retailers thanks to N26 Perks. Here, we explain how to switch, the best time of the month to do it and what to do if something goes wrong. On the switch date, your new bank or building society will be responsible for moving your incoming and outgoing payments, and transferring any money to your new account, before closing the old account and sending confirmation that the process is complete. Salary, direct debits, standing orders or your entire account. When you apply to the new provider, it will undertake its normal account-opening procedures. Your standing orders. Download the current account transfer request to start the process. Alongside 3D Secure technology that prevents unauthorized access to your bank account, you can log in to your N26 app with fingerprint ID or face recognition.

0 thoughts on “Switch account”