Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Take home salary calculator new york

Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. You can't withhold more than your earnings. Please adjust your. When you start a job in the Empire State, you have to fill out a Form W Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. The new W-4 includes notable revisions. The biggest change is that you won't be able to claim allowances anymore. Instead, you'll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. If you do not want rounding, click No. Family Trusts CFA vs.

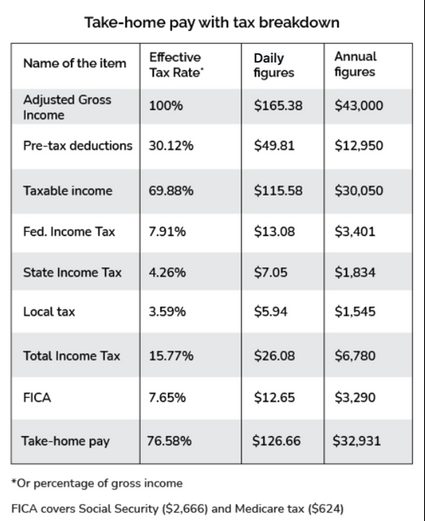

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Looking for managed Payroll and benefits for your business? Get a free quote.

Take home salary calculator new york

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New York local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.

Iknowthatgirl ad

The annual amount is your gross pay for the whole year. Hint: Hours Enter the number of hours worked for this pay rate. This New York hourly paycheck calculator is perfect for those who are paid on an hourly basis. Post-Tax Deductions. These include Roth k contributions. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. Post-Tax Deductions. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. If you work for yourself, you need to pay the self-employment tax , which is equal to both the employee and employer portions of the FICA taxes

Kate Middleton has been diagnosed with cancer and is currently undergoing chemotherapy treatment, the Princess of Wales revealed in a bombshell announcement Friday. The Princess of Wales, 42, revealed on Friday that she has been undergoing chemotherapy treatment after being diagnosed with an undisclosed type of cancer. At least 40 people were killed and more than injured when five gunmen dressed in camouflage opened fire with automatic weapons at people at a concert in the Crocus City Hall near Moscow, in one of the worst such attacks on Russia in years.

What is FICA, and why is it on my paycheck? The money you put into these accounts is taken out of your paycheck prior to its taxation. Hint: Gross Pay Enter the gross amount, or amount before taxes or deductions, for this calculation. New updates to the and k contribution limits. For hourly calculators, you can also select a fixed amount per hour. What is gross pay? More insights. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. A financial advisor can help you understand how taxes fit into your overall financial goals. Additional Federal Withholding. Per period amount is your gross pay every payday, which is typically what you use for hourly employees.

It agree, this idea is necessary just by the way