Tax brackets for hourly wages

Tax brackets for hourly wages information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

If you want to work out your salary or take-home and only know your hourly rate, use the Hourly Rate Calculator to get the information you need from our tax calculator:. If you're still repaying your Student Loan, please select the repayment option that applies to you. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? The hourly rate calculator will help you see what that wage works out to be. Wondering what your yearly salary is?

Tax brackets for hourly wages

See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you know your tax code you can enter it, or else leave it blank. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. If you make contributions to a pension scheme, enter the percentage that you contribute in the "Pension" field. More information is available in the tooltip - if in doubt, leave this box ticked. If you use salary sacrifice to receive childcare vouchers, enter the amount you receive each month into the Childcare vouchers field. If you joined the voucher scheme before 6th April , tick the box - otherwise, leave the box unticked. Choose your age range from the options provided, and tick the "Married", "Blind" or "Student Loan" box if any of these apply to you.

Enter the number of hours you work each week, excluding any overtime. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? There are now two methods of repaying Student Loans.

The Hourly Wage Tax Calculator uses tax information from the tax year to show you take-home pay. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. The Fair Labor Standards Act requires that all non-exempt employees are paid overtime rates of at least one and a half times normal wage for any work over 40 hours per week.

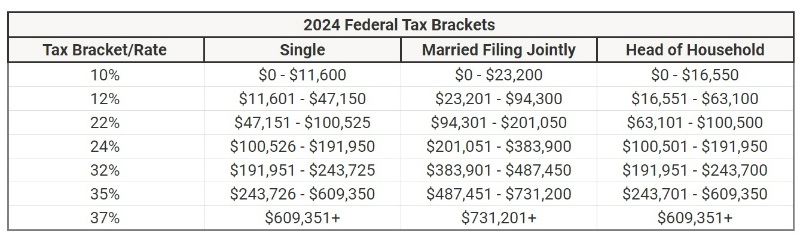

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. The United States operates under a progressive tax code, which means — all things being equal — the more you earn, the more income taxes you owe. The bracket you land in depends on factors that include total income, total adjusted income, filing jointly or as an individual, dependents, deductions, and credits. You can try to squeeze into a lower tax bracket by reducing your taxable income. Making regular contributions to a registered charity or nonprofit? Keep it up! Not only is your money helping your community, if you itemize, those donations are deductible.

Tax brackets for hourly wages

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings.

Sarto usd

Site Map - Change privacy settings. Tracking overtime for hourly workers can be one of the biggest headaches for small business owners managing payroll on their own. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. Pre-Tax Deductions. If your pension is not auto-enrolment, you can choose whether your contribution is based on your whole gross salary, or your "Qualifying Earnings", which is the amount you earn between the auto-enrolment thresholds described in the previous paragraph. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. The annual amount is your gross pay for the whole year. With free employee scheduling , time tracking , and team communication , managers and employees can spend less time on paperwork and more time on growing their business. Work Info. On 22nd November Jeremy Hunt announced that National Insurance contributions made by employees would be reduced. Close Don't reduce pension contributions when on furlough For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary.

Many or all of the products featured here are from our partners who compensate us.

You are tax-exempt when you do not meet the requirements for paying tax. The old W4 used to ask for the number of dependents. If you use salary sacrifice to receive childcare vouchers, enter the amount you receive each month into the Childcare vouchers field. You can also use it to set up break and overtime rules that will keep you compliant with federal, state, and local labor laws, as well as FLSA rules. If you do receive such benefits, enter the value of the benefits into the box and choose whether this is on a yearly, monthly or weekly basis. Sometimes, working overtime can be a temporary solution to meet specific financial goals or address unexpected expenses. You might receive a large tax bill and possible penalties after you file your tax return. Alternative Minimum Taxes AMT Enacted by Congress in and running parallel to the regular income tax, the alternative minimum tax AMT was originated to prevent certain high-income filers from using elaborate tax shelters to dodge Uncle Sam. Site Map - Mobile Version - Change privacy settings. Enter the monthly value of any childcare vouchers you receive as part of salary sacrifice. Accept Reject Manage options Save preferences Manage options.

I think, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

I congratulate, you were visited with simply excellent idea