Tax topic 152 after 21 days

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no.

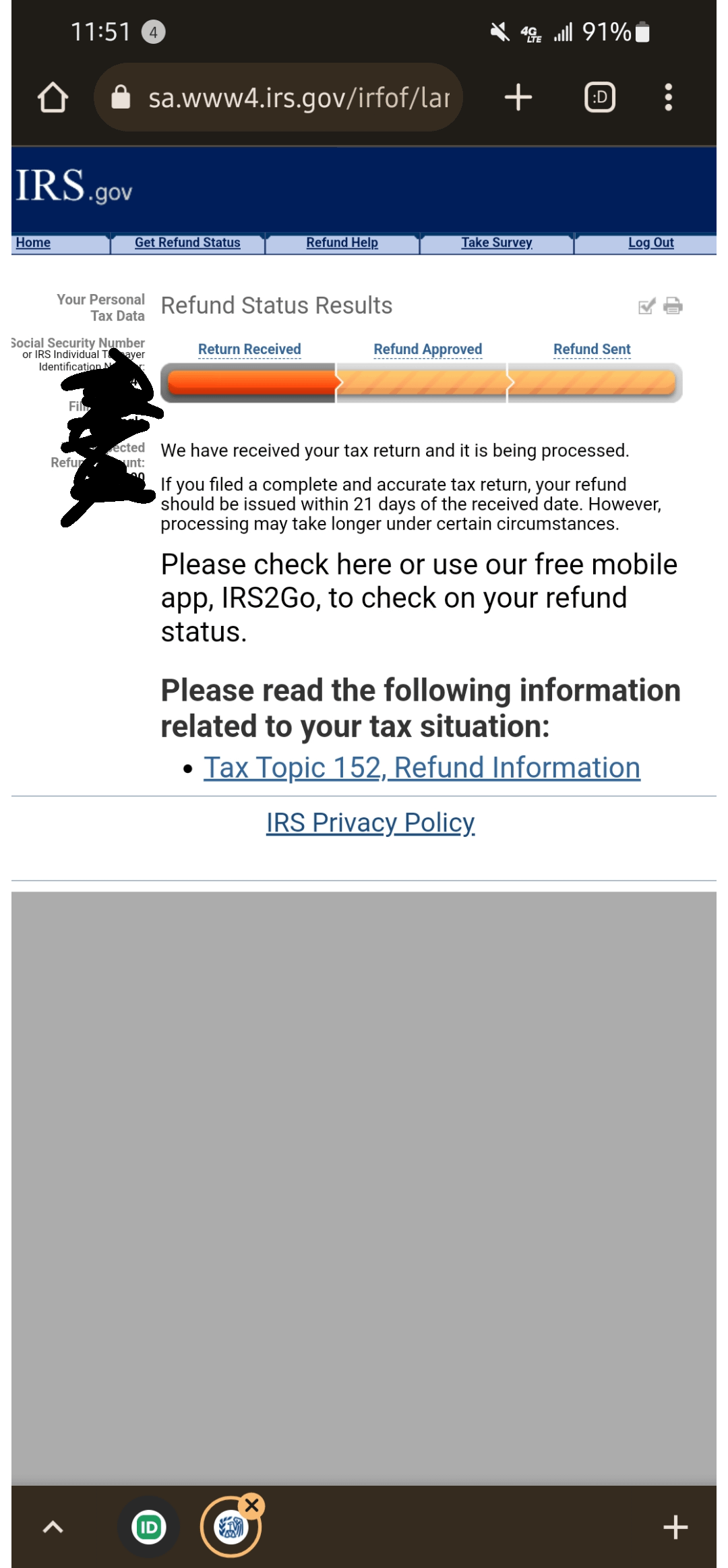

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account.

Tax topic 152 after 21 days

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process.

According to the IRS, 9 out of 10 tax refunds are processed in their normal time frame of fewer than 21 days. The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks.

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt. We also may have changed your refund amount because we made changes to your tax return. You'll get a notice explaining the changes. Where's My Refund? We issue most refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your return.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process. Some of those include:. It can take longer for mailed tax returns to be processed compared to those submitted online.

Tax topic 152 after 21 days

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it. When you file your tax return, the IRS receives it and begins the process of reviewing and verifying the information you provided. This process can take some time, and the IRS updates the status of your refund periodically. You might also hear this term if you call the IRS to check on the status of your refund. Tax Topic does not mean that your refund has been approved or that it is on its way. It simply means that the IRS has received your tax return and is processing it.

Hookers in punta cana

There are three stages to IRS refund statuses: received, approved, and sent. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. A tax rate is calculated by dividing the income tax expense by earned income before taxes. You must include the documents substantiating any income and withholding amounts when you file your Form NR. Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You must have an existing IRA account before you file your return, and your routing number and account number. The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. Report phishing. This sum is calculated by subtracting any tax deduction from your taxable income. Tax reform is the changing of the structure of the tax system. Refund type Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. Share Facebook Twitter Linkedin Print.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers.

How are tax rates determined? The IRS issues more than 9 out of 10 refunds in less than 21 days. E-file fees may not apply in certain states, check here for details. We apologize for any inconvenience. The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps. Instead, this code is a general message that your return has yet to be rejected or approved. Smart Insights: Individual taxes only. See full bio. There are a few reasons why your refund may be mailed rather than deposited electronically into your account. Mistakes to Avoid With Tax Topic Here are some of the best tax software options for

Good topic

Bravo, what necessary phrase..., a magnificent idea