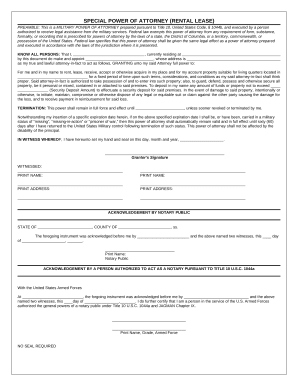

Tc 62s

Show details. Hide details.

Link to official form info: Utah TCS. Tax Reminder works year round to keep official tax form info up-to-date for Utah and the rest of the USA. The IRS and states change their forms often, so we do the hard work for you of figuring out where the official form info is located. Create a free account to see exactly when to file this form, receive email or SMS notification reminders, and to keep a record of filing it in your history. Thanks for taking the time to suggest a form! Please provide as much information as possible, so we can approve and add it ASAP. Create Free Account Now.

Tc 62s

Share your interactive ePaper on all platforms and on your website with our embed function. Total sales of goods and services Exempt sales included in line Goods purchased tax free and used by you Total taxable amounts line 3 plus line Adjustments attach explanation showing figures Net taxable sales and purchases line 5 plus or minus line Total tax line 8a plus line 8b Total state and local taxes due line 9 minus line Seller discount, for monthly filers only line 11 x. Additional grocery food seller discount, for monthly filers only line 8b x. I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return.

Utah has a 6.

.

Sales Utah sales tax guide. All you need to know about sales tax in the Beehive State. Learn about sales tax automation. Introducing our Sales Tax Automation series. The first installment covers the basics of sales tax automation: what it is and how it can help your business. Read Chapter 1. As a business owner selling taxable goods or services, you act as an agent of the state of Utah by collecting tax from purchasers and passing it along to the appropriate tax authority.

Tc 62s

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department. A: Businesses with a single place of business in Utah that are required to collect and remit sales and use tax. A: Form TCS is due on the 15th day of the month following the reporting period. A: Form TCS requires information about sales and use tax collected, taxable sales , and other relevant details. A: Yes, there are penalties for filing Form TCS late, including possible interest charges on unpaid taxes. Please refer to the instructions for more information. Download a fillable version of Form TCS by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.

Amazon paint palette

It's advisable to consult your state's department of revenue or a tax professional for personalized assistance and to ensure compliance with the relevant tax laws. Form MISC. Delete Pages. Search for another form here. A-Z Listing of Forms. IRS Tax Forms. Use the Add New button. Edit scanned PDF. Log in to your account. Compress PDF.

Link to official form info: Utah TCS.

PDF to Excel. If you want to learn more about how the PDF editor works, go to pdfFiller. Reset Password. Use tax is a tax on the storage, use, or consumption of goods or services in a jurisdiction that may or may not already have a sales tax. Flag as Inappropriate Cancel. Utah Sales Tax The state rate is 4. Some states may also impose additional penalties, such as interest charges, for late filing. Thank you, for helping us keep this platform clean. Electronic Signature. Change language.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.