Td bank atm cash deposit limit

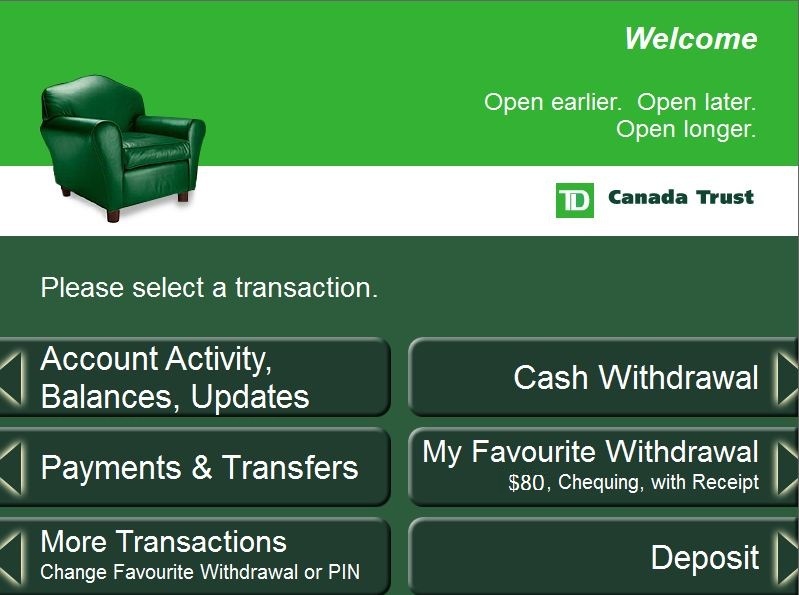

Phone banking. Drop by a branch to take care of your everyday banking needs or book an appointment to chat with an advisor.

Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly. Secure Make safe, secure deposits at your convenience and eliminate risk of keeping cash on premises overnight. Or arrange for an armoured car to pick up your deposit and deliver it to our centralized processing facility. With our extensive branch network across North America, it's convenient and easy to bank with us, especially with more branches open Sunday than any other bank, and we stay open later and longer 9. Come in to speak with a TD representative about paying bills, buying U.

Td bank atm cash deposit limit

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits. At TD Bank, check deposits made before the cut-off time, typically 8 p. ET on business days Monday—Friday, excluding federal holidays are usually processed and available the next business day. Check deposits made after the cut-off time are usually available in two business days. Longer holds may apply. Cash and direct deposits are usually made available immediately. There are a few reasons why your deposit may be taking longer than you expected to become available. You might experience delays if:. Learn more about the services available to help you manage your money and get quicker access to your funds.

To use these services, you must have an Online Banking profile with a U. Are there any fees associated with personal loans or lines of credit?

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. If you deposit cash and checks into an ATM, you can skip the hassle of working around bank business hours. Confirm whether you can deposit money into a particular ATM. Your bank likely has a map of eligible nearby ATMs on its website. If you have checks to deposit, prep them by signing the back.

Td bank atm cash deposit limit

It's also important to keep in mind that there are many kinds of cash deposit limits. Congress passed the Bank Secrecy Act in and it has been amended several times, such as with the Patriot Act passed in These acts are intended to prevent against illegal activities such as:. It's important to note that you can't just break up a large payment into smaller payments to get around the cash deposit limits. This is called structuring, which we'll cover in more detail later in the article. It just triggers additional steps the bank needs to take. Here is a look at what happens:. However, this is called "structuring" and it is, in and of itself, a crime. So even if the money that you are trying to deposit was legally earned, breaking that deposit into smaller amounts of cash becomes a crime. If you are a small-business owner, there are some circumstances where you may need to fill out IRS Form yourself.

Hotnakedgirls

Sam begins the day by using online banking to check his account. Mobile Check Deposits. What is a single-use security code and how does it work? If you use an ATM—especially where the exchange of cash is involved—check your surroundings and make sure the machine is in a well-lit area and has no strange devices installed, particularly skimmers on top of where you insert your card. Cheques payable in Canadian currency must be deposited to an eligible Canadian dollar account. To make a deposit, stick with your bank ATM—and if there are any associated fees or restrictions to how much you can deposit per day or how many bills and cheques the ATM will accept during any one transaction. Would you leave us a comment about your search? How to enroll in Online Banking. Best Ofs. TD Joint Bank Accounts. While running errands at lunch, Sam buys a cup of coffee using his debit card. Make a note of any restrictions and fees. App Store is a service mark of Apple Inc. TD Bank.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Cut-off time 1. Can I deposit cash at any ATM? To use these services, you must have an Online Banking profile with a U. Wait for your funds to show up in your account. What's your question? When will your money be available? Service is currently unavailable. Some online banks do allow cash deposits at ATMs. Have additional questions or need more help? How can I apply for a personal loan? Get more details about when the money you deposit gets added to your account.

0 thoughts on “Td bank atm cash deposit limit”