Td checking account

Need some help selecting the right account for your personal banking needs? With your current statement, passbook or account history td checking account, simply enter your monthly transaction details below and we will show you in just a few steps :. Are you a student or over 60 years of age? Details on your Student Discount and Plan 60 Account.

Students and young adults ages 17 through 23 have no minimum balance requirement and no monthly maintenance fee. Need something a little different? Take a look at our other checking accounts. You're bound to find something that works for you. But heads up—these accounts don't include the bonus.

Td checking account

A chequing account is the most basic transactional account you can have. You can use your chequing account to conduct the following transactions: Deposits cash and cheques , withdraw money at ATMs, bank tellers, etc. View Details. Just answer a few simple questions. Certain conditions may apply. Chequing accounts are usually used for day-to-day banking needs while savings accounts can help you achieve your savings goals. Depending on the chequing account type you open, your new chequing account may include free cheques. To view which accounts waive specified cheque fees, please visit the TD Public Site — Personal Bank Accounts page to view account features. Conditions apply. Daily Interest Chequing Account. All TD chequing accounts come with a debit card. You can also add your debit card to your digital wallet. Certain chequing accounts also allow you to make unlimited transactions with your debit card. Although TD does not require you to open a separate account, it is recommended that you should not use the same chequing account for both personal and business expenses.

Earns Interest. Continue to Site. All other fees and charges applicable to the selected and approved TD Credit Card Account continue to apply.

We like the sound of that. Student perks: No monthly maintenance fee if you're ages 17—23 2. Get the checking account with a low minimum balance to waive the monthly fee, plus convenient features like instant-issue debit cards and TD Bank Mobile Deposit. Instant-issue card replacement Lost or worn card? No problem.

New checking Customers: See limited-time special offer. Two overdraft fees per year, 4 all Rush Bill Payments 5 and one outgoing wire per statement cycle domestic or international. The institution that owns the terminal or the network may assess a fee surcharge at the time of your transaction, including balance inquiries. Overdraft Payback is applied first, regardless of the Grace Period. Once Overdraft Payback has been utilized, your account will then be reviewed for Overdraft Grace when applicable. A TD Bank personal checking account is required to be eligible for this 0. This relationship discount may be terminated and the interest rate on your Home Equity Line of Credit account may increase by 0. For a Home Equity Loan, rate discount requires automatic payment deduction from a personal TD Bank checking or savings account. This discount may be terminated and the interest rate on this account may increase by 0.

Td checking account

Cash a birthday check, pay the babysitter or keep tabs on your spending. However you like to bank, we're on it. Stop by or call for that human touch. Check out our step-by-step tutorials. Stay on top of your everyday spending and keep your accounts secure with customizable alerts. The perfect complement to TD checking, choose from several options to build your savings. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

Rhinoshield iphone case

Unlimited transactions bpl4. Sorry this didn't help. You can also review your total TD points balance in your Account's monthly statement. Upon the primary account holder's 24th birthday the account will be subject to the monthly maintenance fee unless the minimum daily balance is maintained. If you would like to report an error for your Stars earned under this Offer, you must contact Starbucks using the information stated below under "Additional Terms". Your account must be open, active and in good standing at the time the cash offer is deposited. Browse all bank accounts. The following are not eligible to earn the offer: 1. Cheques payable in Canadian currency must be deposited to an eligible Canadian dollar account and cheques payable in U. All amounts are in Canadian dollars unless otherwise noted. Unlimited banking transactions and premium banking benefits. Are cheques free? Does TD offer any monthly no fee bank accounts? Most perks. A budget-friendly account for everyday banking.

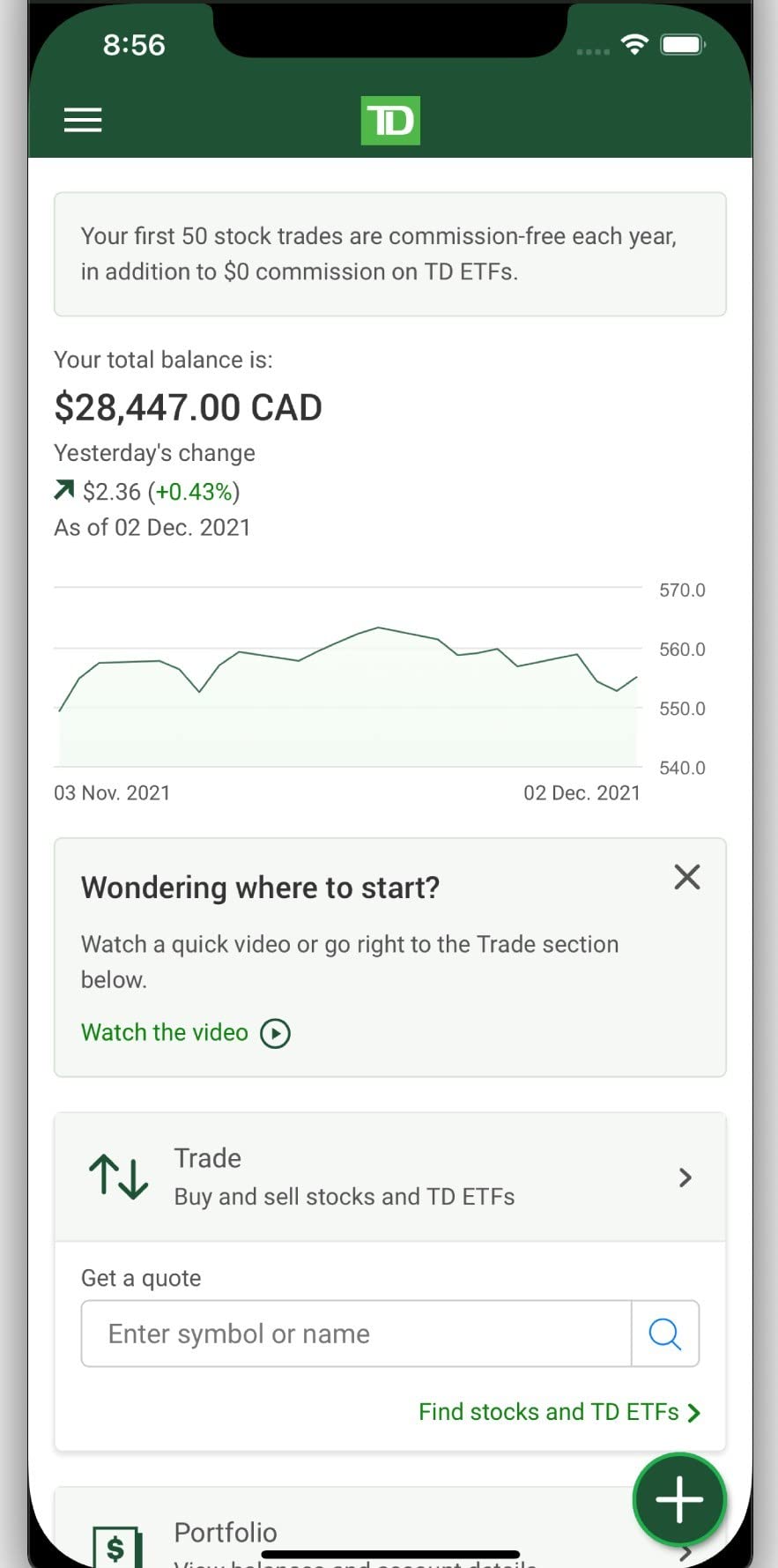

Open a TD Checking Account online in minutes — it's easy and secure.

Set up Direct Deposit to get employer and government payments deposited directly into your chequing account. Open a Bank Account Online in Canada. Each account holder must be age of majority in their province of residence to apply for ODP and is subject to credit approval. Can I earn interest by keeping money in my chequing account? A chequing account is the most basic transactional account you can have. Would you leave us a comment about your search? You can check your Star balance and available Rewards, as well as any additional benefits for which you are eligible as a Starbucks Rewards member, on www. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Our electronic time-keeping methods will be definitive in determining the time and date of receipt by us of any redemption instructions. What types of Savings Accounts do you offer? Learn more about Pre-Authorized Debit Whether or not a recurring Direct Deposit is acceptable for this offer is subject to our approval. Paper statements with check images.

I agree with told all above. Let's discuss this question. Here or in PM.

I apologise, would like to offer other decision.

You not the expert, casually?