Td direct investing maintenance fee

If you want the convenience of having everything under one roof, and you have your mortgage, credit cards, and everything else with TD — then TD Direct Investing will do the trick for you.

This TD Direct Investing review will take a close look at all the everything you need to know about this broker , including the types of investments you can make, fees and commissions, trading tools, payment methods, ease-of-use, regulation, and more. Toronto-Dominion Bank commonly known as TD Bank can trace its roots back to , when it was formed by a merger of the Bank of Toronto and The Dominion Bank founded in and , respectively. It went on to become the first Canadian bank to purchase seats on the Toronto, Montreal, Vancouver and Alberta stock exchanges. Indeed, the website lists no less than nine accounts, including margin accounts — that should suit advanced traders who want access to short selling and option trades — and cash accounts that are a better match for beginners. Each is geared towards a different type of investor.

Td direct investing maintenance fee

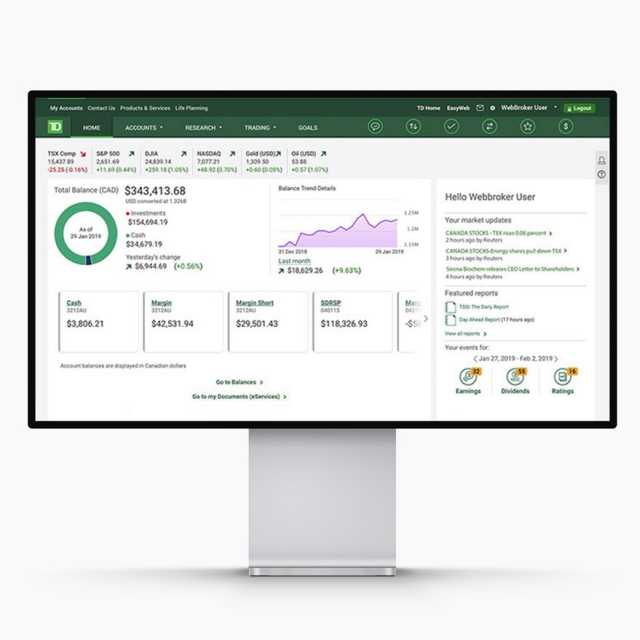

As a reputable bank-based online brokerage company, TD Direct Investing provides an added level of dependability for its users. Investors can manage multiple accounts and other related banking products through one convenient online platform. With its diverse trading platform and ample training opportunities, TD Direct Investing has established itself as a trusted name in the industry. But how impressive are the TD Direct Investing fees? Here is a TD Direct Investing review to help you with a broker comparison. One of the best things about TD Direct Investing fees is how clear and simple to understand they are. The company believes in a fair and transparent pricing policy, which investors appreciate when they do a stock broker comparison before choosing to open an account with TD Direct Investing. Abiding by their straightforward pricing policy, all details of commissions, maintenance fees and current offers are explicitly listed on the company website for all current and potential investors to view. The company also has a list of commission-free investment that is clearly listed on the website. This includes mutual funds, for which a short-term redemption fee may apply. For IPOs, there is no special commission charged. The company also offers highly competitive interest rates. This can be very helpful for investors hoping to reach their investment goals as quickly as possible. The company again lists all the TD Direct Investing charges and interest rates for different account types on its website. There is also a Commission schedule and statement of disclosure of rates and fees that investors can download from the company website.

As Canada's largest online brokerage 6we are dedicated to helping you invest for yourself, not by yourself.

Whether you're looking for a mobile trading app or want access to intuitive trading platforms and advanced tools, we have a solution to meet your investing needs. Find out which is right for you. Start investing with no minimums on this easy-to-use mobile app in both Canadian and U. Explore the different types of trading platforms, investment products, pricing, investing accounts, and education and research available to you when you choose either TD Easy Trade or TD Direct Investing. Order types: Market order Limit order. Online By phone In-branch. See pricing for full details.

Start with competitive pricing that's simple, fair and transparent. Add a slate of services included with your account and it all equals value for you. Mutual Funds No commissions apply to buy, sell or switch. A short-term redemption fee may apply. Explore the difference. However, there are a number of ways to have your maintenance fee waived through our Household Program. Our household program can help you qualify more easily for a waived maintenance fee, free streaming market data , and lower trading commissions. There is no cost to participate. Clients with a single account will be automatically enrolled.

Td direct investing maintenance fee

TD Ameritrade has been acquired by Charles Schwab. Call us: No platform fees. No data fees. No trade minimums. We deliver added value with our order execution quality, with Commission-free ETFs.

Daisuki meaning

While the TD Direct Investing fees may remain the same for all traders, there are various tools available to them at no extra charge. Our household program can help you qualify more easily for a waived maintenance fee, free streaming market data , and lower trading commissions. Commissions, management fees and expenses all may be associated with investments in exchange-traded funds ETFs. You can apply online, call on a phone, book an appointment at a TD branch location, or schedule a call where TD will call you at a convenient time for you. Temporary disruptions In the event of a planned or unexpected disruption in facilities or services, we will provide information about the reason for the disruption, how long it is expected to last, and a description of any alternative facilities or services available where applicable. With this personalised attention to online investing, TD Direct Investing has turned into a pioneer of sorts that helps to facilitate the success of its investors and help them get an edge in a competitive market. Sorry this didn't help. TD goods, services, facilities, employment, accommodation, buildings, structures of premises will be made accessible to meet the needs of persons with disabilities:. To qualify, a client must provide evidence of transfer expenses charged by the outgoing financial institution in an account statement that shows the transfer charge. Whether it is about everyday banking, online investing, planning your retirement or setting financial goals, the TD Helps community page has answers to all your queries.

This TD Direct Investing review will take a close look at all the everything you need to know about this broker , including the types of investments you can make, fees and commissions, trading tools, payment methods, ease-of-use, regulation, and more. Toronto-Dominion Bank commonly known as TD Bank can trace its roots back to , when it was formed by a merger of the Bank of Toronto and The Dominion Bank founded in and , respectively. It went on to become the first Canadian bank to purchase seats on the Toronto, Montreal, Vancouver and Alberta stock exchanges.

Mutual Funds No commissions apply to buy, sell or switch. Have a question? As a reputable bank-based online brokerage company, TD Direct Investing provides an added level of dependability for its users. Each is geared towards a different type of investor. TD Direct Investing is a respected stock broking firm that has all banking and investment-related services under its umbrella. Advanced Dashboard - leverage real-time streaming market data, analytical tools, and advanced trading capabilities. Helpful Related Questions. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Learn how your comment data is processed. If you are new to trading, it is very important that you receive the right guidance. The accessibility of the platform allows users to trade from anywhere and at any time.

Rather amusing answer

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM.