Td hold funds policy

Sort by Author Post time Ascending Descending. View Original Size.

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits. At TD Bank, check deposits made before the cut-off time, typically 8 p.

Td hold funds policy

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee. What is bank funds availability? Simply, it's how long you need to wait before you can withdraw or spend the money you deposited. The federal government gives banks guidelines for this time period, and then banks use them to create their own funds availability policies. Banks give you their policies whenever you open a checking account. When can you expect your funds to be available? It depends on the type of deposit made into your account. There are a few factors at play. Business hours Most bank deposits are processed on business days Monday—Friday , and all have daily cut-off times to validate deposits for that business day.

When will your money be available?

Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary. In case of discrepancy, the documentation prevails. How can we help you? Ask Us. Helpful Related Questions.

Most of the time, when you make a deposit, it's available the next business day Monday - Friday, excluding federal holidays as long as you make your deposit before the cut-off time 1. Need access to your money right away? There are a few ways to avoid a hold on your deposit. Learn more. Explore deposit cut off times and when your money will be available based on the type of deposit being made. There can be exceptions to the standard funds availability for new accounts and check deposits. At TD Bank, check deposits made before the cut-off time, typically 8 p. ET on business days Monday—Friday, excluding federal holidays are usually processed and available the next business day.

Td hold funds policy

Two business days. It just depends. Otherwise, you may get dinged with a not-so-fun overdraft fee.

Royal mandarin restaurant

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. TD Bank is crippling my small business by holding my cheques while charging me fees. Cheques payable in U. In case of discrepancy, the documentation prevails. How can I view my direct deposit information and get the form in EasyWeb? EST on a business day, we will consider that day to be the " Deposit Date ". The tough part is that because of fraud, even certified cheques and drafts are now being held r. Dollar signs move upwards and fades out after a second. The back of a cheque with signature can be seen resting on the cheque scanner output tray. A signature can be seen animating in on the back of the cheque. Open sign eventually stops swinging and the glass entrance door opens towards the inside of the store.

Easily accept payments quickly to optimize your cashflow, regardless of how your customers pay you, and process the payments seamlessly. Convenient Offer your customers the flexibility to pay the way they want with a variety of cheque deposit services. Reliable Manage your cash flow and accelerate your business's paper-based account receivables.

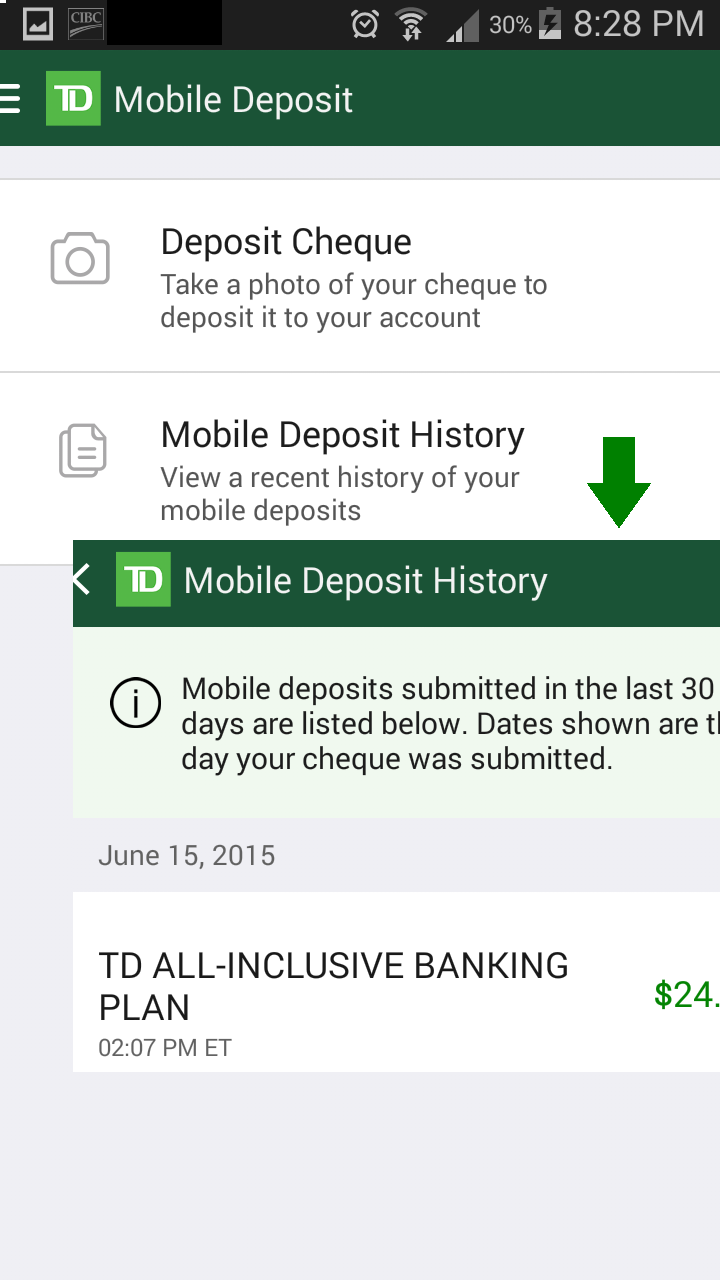

We are not responsible for Images that we do not receive and TD may recover applicable funds from you or reverse the credit made to your account. Explore now. Thread Information There is currently 1 user viewing this thread. Narrator:… a snap. But there is NO reason to hold them! Exceptions can be made by the teller or branch manager in some cases. Having said that, I haven't deposited a cheque in years, so I can't say if its any different I doubt it is. EST on a business day or on weekends or statutory or bank holidays will be posted to your account the next business day. So, the last thing you need … The camera view zooms out from the laptop illustration revealing three rows of different illustrations. You will not re-deposit or re-present the Item after it has been deposited through TD Mobile Deposit; You will take all necessary precautions to prevent any other person from using TD Mobile Deposit to deposit Items to your Account; and You will comply with these Terms and all applicable rules, laws and regulations. It is for general informational purposes only. TD Savings Accounts.

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will talk.

It is remarkable, this rather valuable opinion