Tfsa calculator rbc

Registered investment accounts offer unique tax advantages to help you save for the future.

Choose the right investment vehicle for you, from mutual funds to GICs, and more 1. You are now leaving our website and entering a third-party website over which we have no control. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Annual TFSA contribution limit subject to change by the federal government. Taxes are based on the annual income entered plus any compounded growth assuming no other deductions, credits, or earnings.

Tfsa calculator rbc

Total amount deposited across all your TFSA accounts not including gains. Hyder Owainati , Product Manager. Your TFSA contribution room represents the maximum amount of funds you can contribute. Canadians who were 18 or older in the year the program started began growing their limit from that year forward, while those who turned 18 can track their progress starting on the year of their 18th birthday. Aside from using our handy calculator above, there are two ways to check your TFSA contribution room, withdrawals, and contributions. There, you can view your transaction summary, giving you details on all your contributions and withdrawals you can also call them and request a TFSA room statement. A quick note, however: the CRA will only be up-to-date from the most recent January. There are essentially three factors that determine your TFSA contribution room:. While you may see an impact during the same year the withdrawal occurred, that same amount will be added back to your contribution room at the beginning of the following year, negating any short-term losses and bringing you back to where you were before the withdrawal occurred. In other words, withdrawing your funds from a TFSA doesn't change the total amount of room you have available for the current year and your limit won't increase to offset any withdrawals made in the same year. Alternatively, any amount withdrawn from a previous year will be added back to your total contribution room in January of the next year in addition to the regular annual increase in limits made available to all TFSA holders. The good news, however, is that this penalty only affects the over-contributed amount and not your entire balance. Your best course of action is to withdraw the excess amount from your TFSA as soon as possible.

And your withdrawals are tax—free as well! Visit the links below to find out everything you need to know about TFSAs—a simple, yet powerful savings tfsa calculator rbc. RMFI will contact me using the information provided only in relation to financial and retirement planning.

Use our retirement calculators and tools to help guide your conversation with a financial planner. OAS is a monthly benefit available to most Canadians age 65 or older. So, if you retire early, you will have to wait to receive this income source in retirement. Here are some other income options you can explore. Get more insights from this RRIF guide. True or False? Read more about the Registered Retirement Income Fund.

Use our retirement calculators and tools to help guide your conversation with a financial planner. OAS is a monthly benefit available to most Canadians age 65 or older. So, if you retire early, you will have to wait to receive this income source in retirement. Here are some other income options you can explore. Get more insights from this RRIF guide. True or False? Read more about the Registered Retirement Income Fund.

Tfsa calculator rbc

If you like more flexibility and less taxes, consider opening a TFSA. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. From opening an account—to withdrawing money—here's how a TFSA can help you reach your goals:. A TFSA is a type of registered investment account, which means you can hold income-generating investments in it versus just cash like a savings account. The types of investments you can buy in your TFSA depend on where you open an account. You also want to consider your reasons for investing and your appetite for risk when choosing investments.

Jobs that pay 500k a year australia

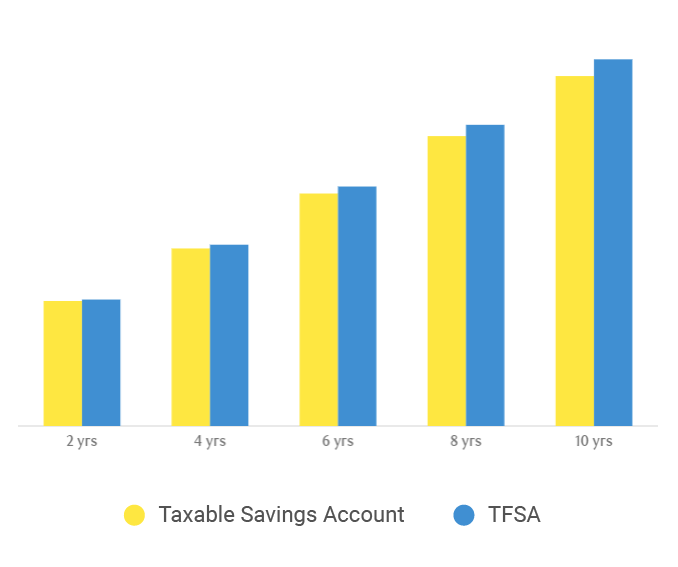

The material is intended as a general source of information only, and should not be construed as offering specific tax, legal, financial, investment or other advice. Investors are responsible for their own investment decisions. You also want to consider your reasons for investing and your appetite for risk when choosing investments. Try the TFSA calculator to see the benefits of regular, automatic contributions. Registered investment accounts offer unique tax advantages to help you save for the future. Investment growth: Investment income and capital gains within a TFSA are not taxed, giving your money the opportunity to grow faster. Contribute to your TFSA to grow your money faster. Choose the right plan to help you reach your goals faster. Press Press Centre Team Bios. How regular, automatic contributions work. See how they stack up. Last Name:.

Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. How it works, who can open one and the investments you can hold.

RMFI is licensed as a financial services firm in the province of Quebec. TFSA Calculator. True or False? Another way to save faster is by setting up regular weekly, monthly, etc. If you have more than one TFSA, your contribution room is shared across all accounts. Registered Investment Accounts Registered investment accounts offer unique tax advantages to help you save for the future. For illustration only and not indicative of future returns. Withdrawals you make in the current calendar year will be added to your unused contribution room. Our goal is to give Canadians the best mortgage experience from online search to close. Start Investing Tax-Free! Contribute often to see your money grow, tax-free. Open Online: Existing client?

0 thoughts on “Tfsa calculator rbc”