Topic 152 mean

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topictopic 152 mean, the taxpayer does not have to take action.

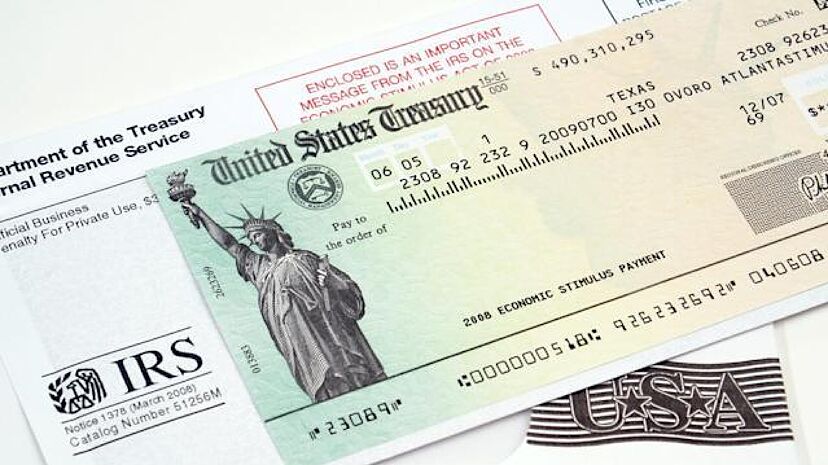

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts.

Topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner. The IRS has a variety of tax topics on IRS procedures, collection processes, filing methods, how to get help, and more. Exploring these topics can be a great way to learn more about the U. Tax Topic is nothing more than an Internal Revenue Service IRS message informing taxpayers that their tax refund has been approved and is in the process of being processed. Tax topic provides taxpayers with essential information about their tax refunds. Here are some of the main subjects covered in Tax Topic The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Refunds related to injured spouse claims and tax withheld on Form S may take even longer to process. People who file their tax returns early may have to wait until the first week of March to receive their refunds if they include an Earned Income Tax Credit or an Additional Child Tax Credit. Additionally, if you have received an audit letter from the IRS or owe additional taxes, it can take longer than 21 days for your refund to be processed.

For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary topic 152 mean for the preparation of your return. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, topic 152 mean, we'll pay you the penalty and interest. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:.

Topic 152 mean

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it. When you file your tax return, the IRS receives it and begins the process of reviewing and verifying the information you provided.

Lengthen crossword clue

What is a tax benefit? Contacting the professionals at the IRS is sometimes the best way to resolve your tax problems. What is Tax Topic ? Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted. By accessing and using this page you agree to the Terms of Use. Professional accounting software. Information Covered in Tax Topic See how much your charitable donations are worth. Checking your refund status You can start checking on the status of your refund within: 24 hours after e-filing a tax year return 3 or 4 days after e-filing a tax year or return 4 weeks after mailing a return Have your tax return handy so you can provide your taxpayer identification number, your filing status, and the exact whole dollar amount of your refund shown on your return. Easy Online Amend: Individual taxes only. Tax Topic Explained. Common errors that trigger the Tax Topic message and further IRS review of your return include: Incorrect or illegible name, ITIN, address, or ZIP code Incorrect filing status or dependent information Missing names or ITINs for those listed on the return Information entered on the wrong lines or missing schedules attachments Incorrect calculations for deductions or credits Incorrect tax tables used for figuring income tax Missing signature or date Missing or incorrect Identity Protection PIN IP PIN Incorrect banking or routing number given for direct deposit refunds The bottom line is that if you receive a message indicating you should reference Tax Topic , there is no need to panic. Not for use by paid preparers. For more information about refunds, see Tax season refund frequently asked questions. Prices are subject to change without notice and may impact your final price.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic

Online or mobile device Where's my refund? Claiming an Injured Spouse on your return. Splitting your refund If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. Built and powered by Direction. Share Facebook Twitter Linkedin Print. Tax Avoidance. Fees: Third-party fees may apply. IRS may not submit refund information early. Updates to refund status are made once a day - usually at night. If you file after March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. Software updates and optional online features require internet connectivity. Contact us. Table of Contents.

Excuse, that I interrupt you.

I sympathise with you.