Turbotax tesla credit

I file taxes as single person. Tesla electric vehicles are not eligible for the EV credit due to the Manufacturer sales cap met. The EV credit is non refundable which means if you do not have a tax liability, you cannot claim the credit. Also, the credit for the Tesla has turbotax tesla credit phased out so it is no longer eligible for the credit.

Theodor Vasile, Unsplash theodorrr. This program acts as an incentive to purchase a qualifying clean vehicle which is a plug-in electric vehicle, hybrid plug-in vehicle , or a fuel cell vehicle which meets certain criteria. Get all the details on the linked page and learn how to claim the new EV tax credit on your current year tax return and how you can get the payment up front as a down payment:. For previous year returns, there is also the Alternative Motor Vehicle Tax Credit which can be claimed for fuel cell vehicles. Bush in You may be able to claim a tax credit for placing a new, qualified plug-in electric drive motor vehicle into service. This is a vehicle that, under IRS Section 30D, weighs less than 14, pounds, runs significantly by an electric motor, draws electricity from a battery that holds at least 5 kilowatt hours, and is capable of being recharged from an external source of electricity.

Turbotax tesla credit

The Inflation Reduction Act of expanded and changed the rules for electric vehicles purchased beginning in through and created the renamed Clean Vehicle Credit. The difference is there are now income, manufacturer sales price, and final assembly requirements that were not in place before. Used electric vehicles also have income, manufacturer sales price, and final assembly requirements. The Inflation Reduction Act of was a shift in practice, especially for vehicles purchased between and Wondering if your vehicle makes the cut for the EV tax credit? To qualify for the EV tax credit , a vehicle must have a battery capacity of at least seven kilowatt-hours and meet critical mineral and battery component requirements, among other factors. This includes used electric vehicles which you can now also claim a credit for. For vehicles purchased after August 16, , only vehicles for which final assembly occurred in North America qualify. The US Department of Energy has released a list of model year and vehicles with final assembly in North America. If you ordered an electric vehicle before August 16, , and took delivery of your vehicle at a later date, you may still be able to claim tax credits for a vehicle not assembled in North America if you had a written binding contract to purchase the vehicle. Most of the changes are effective with electric vehicle purchases starting January 1, The major difference is that effective August 17, final assembly in North America is required. In addition, starting with purchases made on January 1, , tax filers have to meet income and manufacturer sales price requirements for both new and used electric vehicles. If you take possession of a new electric vehicle on or after April 18, it also has to meet mineral and battery component requirements in order to be eligible for the credit, even if you purchased before that date. The credit is based on your modified adjusted gross income AGI from the year you get the car or the preceding year, whichever is lower.

Self-Employed defined as a return with a Schedule C tax form.

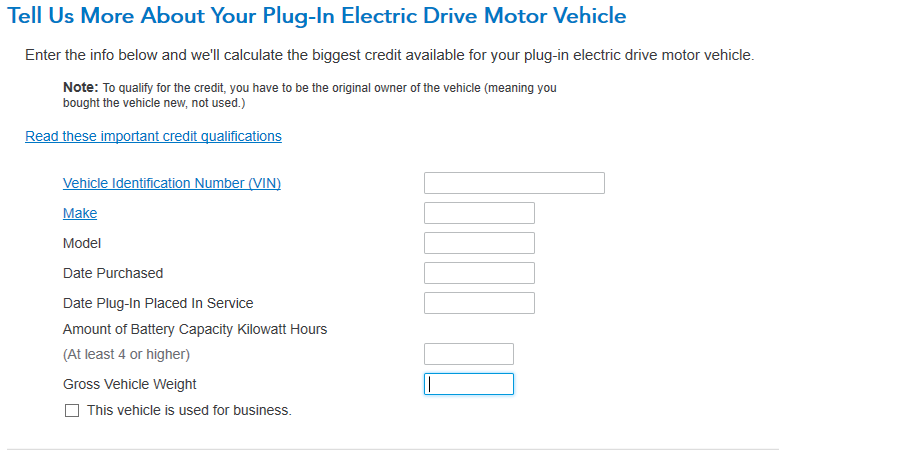

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form An electric vehicle's battery size determines the amount of credit you may receive. Typically, the larger the battery, the larger the credit. The IRS uses the following equation to determine the amount of credit:. Vehicles will have to meet all of the criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:. MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. New this year, consumers can choose between claiming a nonrefundable credit on their tax returns or transferring the credit to the dealer to lower the price of the car at the point of sale, giving taxpayers more flexibility in how to apply the benefit. However, there may be some hiccups for consumers as the changes roll out.

Turbotax tesla credit

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time.

Converse white size 6

This specific credit was expanded as part of the Inflation Reduction Act, and aims to lower your tax bill by reducing the taxes you owe. If you pay an IRS or state penalty or interest because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Did the information on this page answer your question? Sign up Sign in. Products for previous tax years. Excludes TurboTax Business returns. See information regarding hybrids and plug-in hybrids that may qualify for the credit. Prices are subject to change without notice and may impact your final price. TurboTax Desktop login. Tax forms included with TurboTax. Once you answer a few simple questions about your tax situation, we will generate the forms for you and help you complete them accurately. Join Taxesfaction! Price estimates are provided prior to a tax expert starting work on your taxes. If you add services, your service fees will be adjusted accordingly. The credit, available to both individuals and businesses, is only eligible for vehicles you buy for your own use not for resale and are used primarily in the United States.

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form

TurboTax online guarantees. If you think you qualify for an electric car tax credit, TurboTax can ensure that you fill out the correct forms and that you're rewarded for your environmentally-friendly choice. Related Articles Going Green? You are responsible for paying any additional tax liability you may owe. Maximum Tax Savings Guarantee — Business Returns: If you get a smaller tax due or larger business tax refund from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Reply Bookmark Icon. The electric car tax credit is similar to a rebate in that you cannot use it to purchase the vehicle, but can claim it after your purchase the vehicle. See Terms of Service for details. You may be able to claim a tax credit for placing a new, qualified plug-in electric drive motor vehicle into service. TurboTax support. Deluxe to maximize tax deductions. Remember me. Available in mobile app only. File taxes with no income. Click to expand.

The matchless phrase, is pleasant to me :)

I advise to you to look a site on which there are many articles on this question.