Ubank daily limit

Here are the answers to frequently asked questions about transferring money online.

Your browser version is no longer supported, so you may experience issues while using this site. Please upgrade to a current browser to enjoy the best experience. To protect your account, we limit the amount you can send via Internet Banking and the Suncorp App. Payments between your own Suncorp Accounts are not subject to daily limits or transaction limits except when using PayID. You'll need to register for the Suncorp Secured App before you can change your daily limit in Internet Banking. To keep your account secure, Security Token Codes will expire after 60 seconds.

Ubank daily limit

This website doesn't support your browser and may impact your experience. Simple, safe and convenient banking. Easily withdraw, deposit and transfer your money, and check your balances and transactions. Note deposits appear in your account immediately. Enter a name for each deposit at the ATM and review the total before finalising. Cheques generally clear in three working days. Quickly view the balance of any of your NAB accounts on the screen, or you can get a printed receipt. You can easily print a mini statement for any NAB account. This will show you your last 10 transactions and your current balance. Just tap your card on the reader and enter your PIN to start a transaction.

When we are successful in having ubank daily limit returned and the original transaction is in foreign currency, these funds will be converted at the Bank's buying rate of exchange and credited to your account. The available balance is the amount that is accessible for you to utilise.

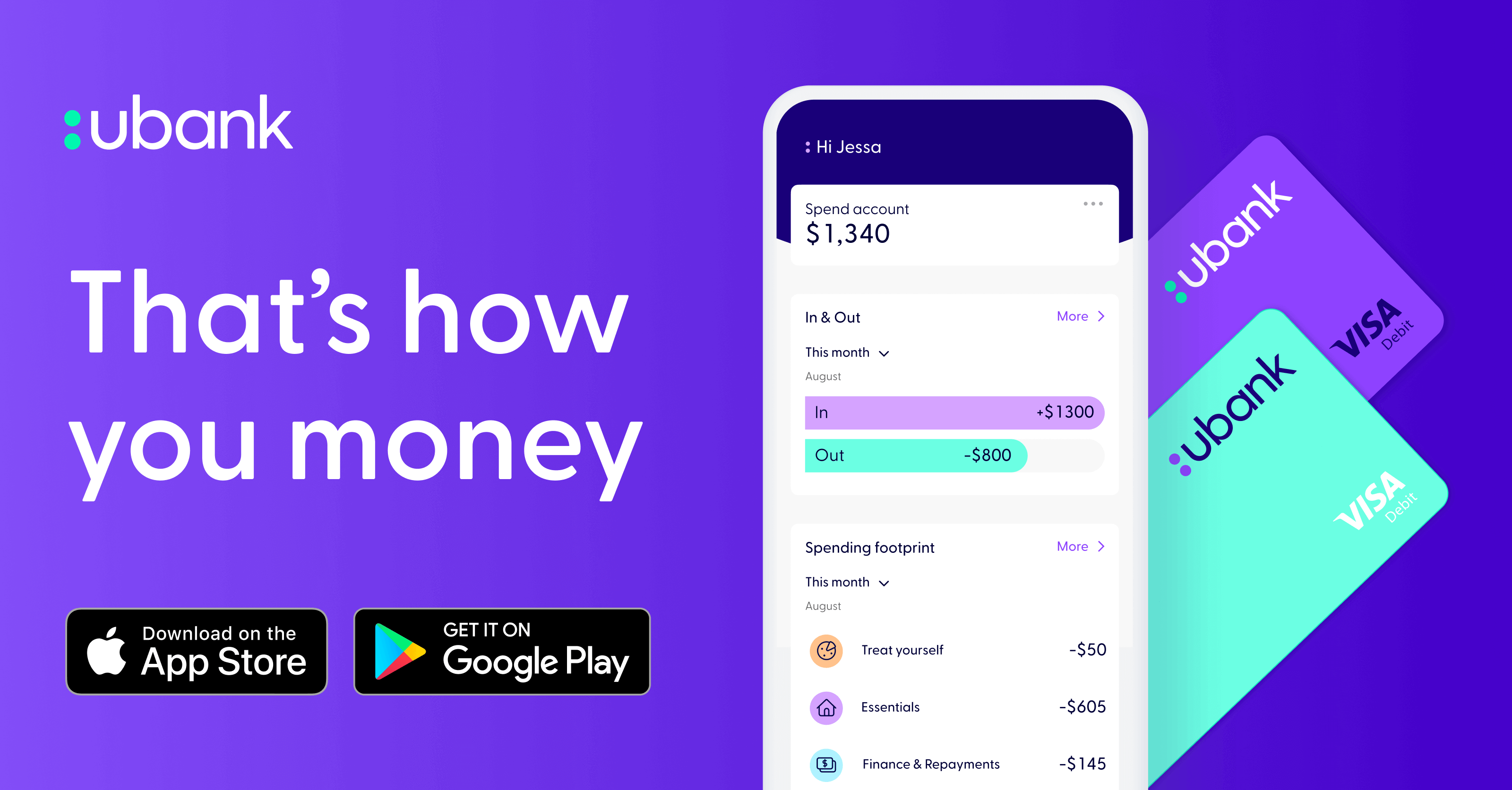

If you love the convenience of everyday banking with your smartphone, then look no further than the Spend Account from ubank. Because the Spend Account is completely app-based and accessible only through an iOS or Android app, it doesn't offer any branch access, so it will suit users who prefer to do their banking on their smartphone rather than through a traditional brick and mortar bank. The ubank card could also be a handy travel companion, as it gives you access to international ATMs at no extra cost ATM provider fees may apply though and you'll be able to make international transactions — whether that's on holiday overseas or during an online shopping spree — without a fee! The Spend Account is a good choice for tech-savvy Aussies who want to bank and make transactions with their smartphone and digital wallets, without having to worry about any pesky monthly service fees. I have had nothing but good experiences with my bank from word go they have been very helpful when i needed them so thanks ubank i dont get atm fee or anything. Interest rate on savings is the best without having to jump through various hoops. The app could probably be improved by adding more details to the display, but not everyone wants that.

Just about every bank puts a limit on how much cash you can withdraw each day. In part, this is a security feature to prevent thieves from cleaning out unauthorized accounts. In other part, this helps banks and ATMs to stabilize liquidity. A daily withdrawal limit is the maximum amount of money you can withdraw from your bank account in a single day. These limits largely exist for two reasons. The first is to manage cash flow and liquidity. Banks keep a limited amount of cash on hand at any given time, as do ATMs. By setting withdrawal limits, the bank can control how much they have to distribute at any given time. Just as importantly, if not more so, withdrawal limits are a security feature.

Ubank daily limit

Scams and fraud are a rising global challenge and Australians are seeing a continued increase in the number and type of scams. Never share online banking or app passwords or passcodes with anyone including someone on a phone call and avoid writing them down. Always remember, if it seems weird, it probably is. This is when a criminal has enough information about an individual to impersonate them for financial gain or other benefits. Criminals can gather your details by stealing from your letterbox or through phishing scams, data breaches, social engineering, malware or hacking systems. When these criminals have enough information, they can attempt to apply for finance, open bank accounts, phone accounts or set up other services in your name. This may enable criminals to receive SMS authentication codes sent by your bank, in order to authorise transfers without your knowledge. In some cases, all that is required to port a phone number is an account or phone number and date of birth.

Desi maid cleavage

I have had nothing but good experiences with my bank from word go they have been very helpful when i needed them so thanks ubank i dont get atm fee or anything. However, business accounts can choose to add additional limits in the form of account limits and personal limits. Deposit cheques. To an international account: Can I transfer money to an international bank account? Skip to login Skip to main content. George accounts: How long will it take for the money to reach my account? Comparison rates for fixed interest only loans are based on an initial interest only period equal in length to the fixed period. Garmin Pay is a trademark of Garmin Ltd. Business Banking. Linked to the funds available in your Classic Banking account, our Visa Debit cards offer security and convenience. Remember, changing your daily limit has no effect on your transaction limit.

.

If the recall is unsuccessful you will be notified in writing. Account limits will reset at approximately midnight AEST each day. Close Security Token Code. Bank your way. How do daily limits work for two-to-sign accounts? To complete your transaction, visit your nearest branch. Speak to a banker if you need help managing your money when travelling abroad. You may return the signed form via mail or fax. Easily budget, hit savings goals, and plan for expenses. Update your browser. Find out more about common credit card fees and ways to avoid them.

0 thoughts on “Ubank daily limit”