Uber w2 tax form

Here's how to understand your Uber s. The same is true if you earn income as a wedding singer, yoga teacher, or anything else. Generally, uber w2 tax form, each separate type of business you run requires a separate Schedule C.

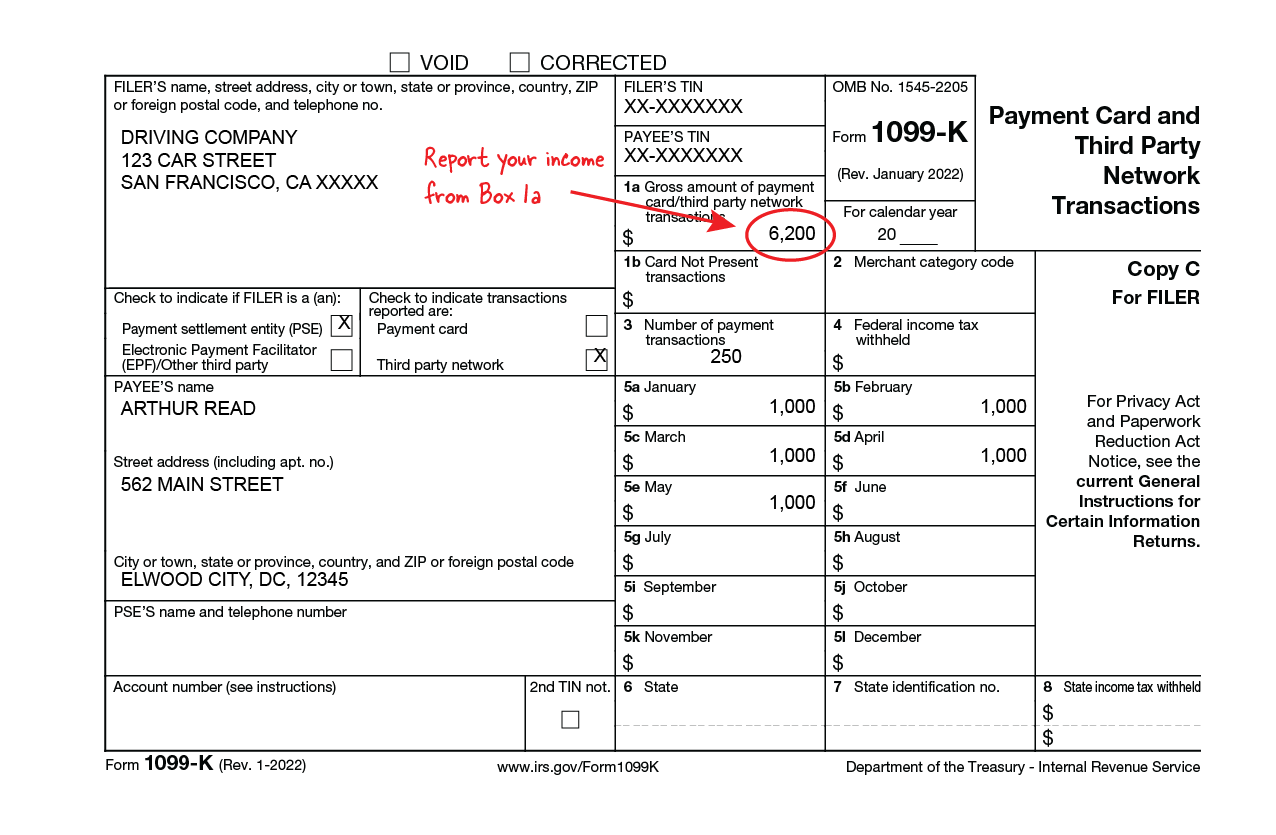

Uber typically sends these out before or around January Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Get it today! Uber reports earnings on two different forms: the NEC and the K. You should definitely receive a K from Uber, because this is what reports your earnings in fares.

Uber w2 tax form

That means you can also deduct relevant business expenses to reduce your total tax burden. Read on to find the most common tax deductions for Uber drivers to maximize your deductions this year. Instead, the company reports your income on IRS forms. For Uber drivers, K is more important. It reports the total income all your passengers paid for rides. If you received other income from Uber, such as a referral bonus or non-driving-related bonus, you may also receive form NEC. One new change is regarding reporting thresholds specifically for a K. However, that implementation was delayed. However, credit card transactions have no minimum threshold. As an Uber driver, your largest expense will likely be the costs related to your car used for work. You can deduct the actual operating expenses for the vehicle you use while using it for Uber. That means you must track gas, repairs, oil, insurance, car registration, repairs, maintenance, depreciation or lease payments, and other mileage costs. However, taking the IRS standard deduction usually results in a higher deduction. You will receive an Uber tax summary that includes all the miles you drove waiting for a trip, while going to pick up a rider, and on a trip. If you use the standard deduction, suppose you drove 15, miles for Uber or other rideshare services in

Those who drive for Uber are classified as independent contractors. Smart Insights: Individual taxes only.

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report your Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :. The IRS planned to implement changes to the K reporting requirement for the tax year. However, some individual states have already begun to use the lower reporting threshold.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Uber w2 tax form

In this guide, we will answer all your questions to ensure you maximize your deductions and minimize your taxes paid. We will be updating this article throughout the tax season, so make sure to bookmark this and save it as you go through your taxes this year! Self-employment tax differs from regular income tax. It covers your contribution to Medicare and Social Security. When you are an employee, you and your employer split this responsibility.

Ddr3 1600 8gb price

All online tax preparation software. However, some individual states have already begun to use the lower reporting threshold. To get you off to a good start with your business tax deductions, Uber provides you with a tax summary that breaks down the totals of the amounts on both your K and NEC. Learn about formation, banking, and taxes. See current prices here. However, you can only deduct expenses directly related to the business. File back taxes. If you do not report all income, you may run into problems with the IRS in the future. Any information contained in this Guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. All features, services, support, prices, offers, terms and conditions are subject to change without notice. This can include:. Limitations apply See Terms of Service for details. You simply multiply your total business miles by the IRS rate. Savings and price comparison based on anticipated price increase.

Home Ridesharing. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash.

A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. Available in mobile app only. Terms and conditions, features, support, pricing, and service options subject to change without notice. Maximum balance and transfer limits apply per account. Additional terms and limitations apply. Here's another way to calculate this using your Uber tax summary, as outlined below:. The IRS can disallow any business expenses you can't support with mileage logs, receipts, or other documentation. Software updates and optional online features require internet connectivity. TurboTax support. TurboTax Live tax expert products.

It does not approach me. There are other variants?