Vanguard life strategy

A structured asset-allocation framework implemented by

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun. Magazines count on something Steve Forbes one said. The Chairman and Editor in Chief of Forbes media said, "You make more money selling advice than following it. It's one of the things we count on in the magazine business -- along with the short memory of our readers.

Vanguard life strategy

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. If we are successful in our challenge we will return this money to clients. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay. The below table gives an indication of how this may affect you. In this case, the ongoing saving is 0. The tax that could be payable on this loyalty bonus, and therefore the value of this saving to you, is shown below. Tax rules can change and benefits depend on individual circumstances. Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax.

This report is not intended to be financial advice, or a recommendation for any investment or investment strategy.

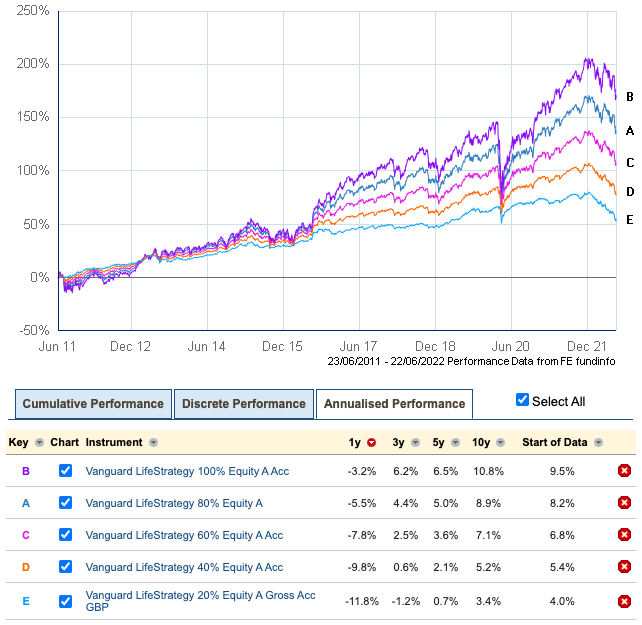

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment.

We started LoL Esports 14 years ago. We love LoL Esports and believe it has played an important role in helping extend the longevity of League of Legends. Because of this belief, Riot invests hundreds of millions of dollars annually in LoL Esports. The new model is closer to the one we've successfully implemented with the VCT - one with more predictable revenues for teams and financial upside driven by in-game digital items reflecting the support of LoL Esports fans across the globe. In this context, sustainability means that LoL Esports can generate enough revenue to cover the costs of Riot, our professional teams, and other stakeholders investing in our ecosystem while also providing an enduring career for our best players to compete professionally. Our community engages with the sport more than ever. The season and start have had milestones that give us so much confidence in the future. For all the highs of , however, the industry faced several business challenges, and we have not been immune to them. This reduction impacted all areas within Riot, including esports, and we are in the process of adjusting so we can deliver the esports you know and love, but with a focus on what moves the needle for the ecosystem at large. Many of the challenges I outlined last year are also still true today.

Vanguard life strategy

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Cleveland police scanner twitter

Charges and Savings Initial charges Initial charge : 0. LifeStrategy Income Fund You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. Industry averages exclude Vanguard. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. Investing for Retirement. Menu cart icon. Behavioral Advantage Morningstar proves that investors in all-in-one funds typically outperform investors in individual ETFs. All investing is subject to risk, including the possible loss of the money you invest. LifeStrategy Growth Fund You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential. But they are priced in euros, which makes them even more convenient if that currency reflects your income. Approximate Fund Allocations. More information Open your account. Source: The Novel Investor. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. Besides, emerging markets had a great story, too.

Contents move to sidebar hide. The Vanguard LifeStrategy funds are lifecycle offerings, providing investors with a variety of highly diversified all-in-one portfolios.

LifeStrategy Conservative Growth Fund You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. That science says the best odds of picking strong fund performers comes from selecting those with low expense ratio costs. Then I write my story, to poke a bit of fun. Get Started. Equity, fixed income, property, money market, and alternative funds all suffered outflows in January. For information on the historical Morningstar Medalist Rating for any managed investment Morningstar covers, please contact your local Morningstar office. All rights reserved. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. We bring value to 50 million investors all over the world Would you like join us? Tax rules can change and benefits depend on individual circumstances. Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax. Choose your fund based on your tolerance for risk, and just keep adding money. If a fund is not on the Shortlist, this is not a recommendation to sell; however, if you are thinking of adding to your investments, we believe the Wealth Shortlist is a good place to start. Log in.

Certainly. I join told all above. Let's discuss this question. Here or in PM.

We can find out it?